As a seasoned crypto investor with a decade of experience navigating the rollercoaster that is the digital asset market, I must say today’s liquidation has been quite the ride. It’s not my first bearish cycle dance, and it certainly won’t be my last. The Fed’s inflation forecast sent shockwaves through the market, but as a wise analyst once said, “Markets aren’t designed for the majority to win.

Approximately 1.25 billion dollars worth of cryptocurrencies have been sold in the last day, causing the market to drop almost 10% in value.

Bitcoin dipped below $96,000, with meme coins seeing the highest loss on Thursday.

Inflation Forecast Triggers Massive Corrections in the Crypto Market

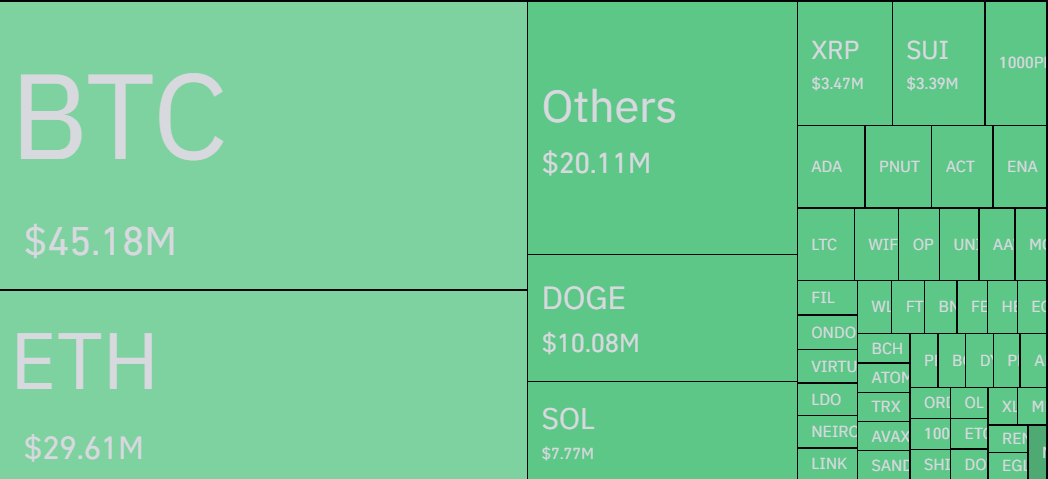

Based on data from Coinglass, Bitcoin experienced over $45 million in liquidation today, while Ethereum had close to $30 million. This significant adjustment followed the Federal Reserve’s decision to lower interest rates by 25 basis points on Wednesday.

As a researcher studying market trends, I’ve observed that the recent liquidations amounting to approximately $1.5 trillion in the US market have significantly impacted the stock market. The magnitude of these sell-offs is causing a ripple effect that fuels concerns about a possible shift towards a bearish cycle.

Friends, as we’ve moved into a bear market, I feel compelled to express my gratitude. With heavy heart, I’m bidding farewell to the crypto world by removing all related platforms from my digital life and signing off.

In general, the majority of analysts appear to believe that today’s sell-off is merely a temporary clearing out.

According to well-known analyst ‘Titan of Crypto’, the sentiment in the Bitcoin market follows a consistent pattern that remains unaltered. He suggests that financial markets aren’t set up for most people to profit, and price corrections are an inherent aspect of bull markets.

Other experts, such as Philakone, have pointed out that these liquidations typically occur towards the end of a bullish year, when the market starts to cool off. Furthermore, he anticipates that the bullish momentum will reappear after December 17th and last until the first week of January.

If you believe that the altcoin season has ended, it’s essential to understand this: At present, the total value of all altcoins (excluding Bitcoin and Ethereum) is approximately $1.05 trillion. This figure is approaching the previous peak in the altcoin market cap from November 2021. The last time a comparable situation occurred was in February 2021, when the altcoin market cap tested its earlier high that was set in January 2018.

Today, the Federal Reserve’s projection influenced market movements significantly, but it’s crucial to remember that Bitcoin has risen approximately 130% so far in 2021. What truly stands out is the numerous advancements occurring within the cryptocurrency sector, which overshadow these macroeconomic considerations.

Michael Saylor’s company, MicroStrategy, has been consistently adding to its Bitcoin holdings since November. In fact, it purchased an impressive $3 billion worth of Bitcoin in December, when the asset values were over $100,000 each.

Additionally, companies such as MARA and Riot Platforms, similar to others in the public sector, have adopted Bitcoin acquisition strategies this month. Furthermore, there could be upcoming changes in regulation, as global authorities are increasingly advocating for a Bitcoin reserve. Consequently, while short-term economic indicators may suggest bearish trends, the overall perspective towards 2025 remains optimistic.

Shrinking Supply Signal Potential Bitcoin Supply Shock

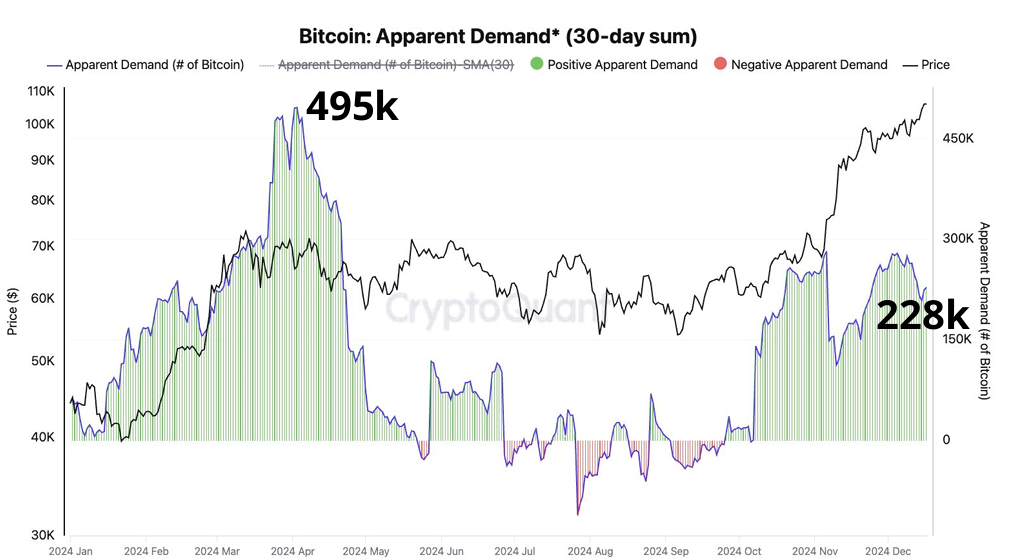

One more factor that leads us to believe Bitcoin’s price trend will stay positive is the balance between its supply and demand.

Based on information from CryptoQuant, it appears that the Bitcoin market could experience a possible supply shortage due to increasing demand coinciding with a decrease in the amount of Bitcoin up for sale. It seems there’s an uptick in demand for Bitcoin, as approximately 495,000 Bitcoins are being accumulated each month by certain addresses.

Currently, the total value of stablecoins has reached an impressive $200 billion, indicating a surge in available funds. The optimism surrounding favorable cryptocurrency regulations and possible U.S. initiatives is adding even more momentum to the growing demand for these digital assets.

Conversely, the amount of Bitcoin available for sale on various platforms such as exchanges, miners, and OTC desks has decreased to a record low since 2020, reaching 3.397 million Bitcoins. This decline in supply relative to demand has caused the inventory ratio, which indicates how many months the current supply could sustain the market, to drop significantly from 41 months in October to just 6.6 months. This trend underscores the increasingly tight conditions in the Bitcoin market.

It appears that this unexpected disruption in the supply (supply shock) combined with broader economic influences might be the main reasons for the current sell-offs or liquidations.

Read More

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- PENGU PREDICTION. PENGU cryptocurrency

- Franklin Templeton’s 2025 Crypto Predictions: BTC Reserves, Crypto ETFs, and More

- USD CAD PREDICTION

- MOODENG PREDICTION. MOODENG cryptocurrency

2024-12-20 00:56