As an experienced analyst who has navigated through multiple market cycles, I can say that the recent price action of Bitcoin (BTC) presents a fascinating yet cautious outlook. The decline in ADX and NUPL suggests a potential shift in sentiment, hinting at either consolidation or further downside.

On December 17, Bitcoin (BTC) hit an unprecedented peak, yet it continues to fall short by around 5% of reaching the $110,000 threshold. Technical indicators like ADX and NUPL hint at a possible deceleration in bullish momentum, potentially signaling a change in market attitude.

As long as Bitcoin (BTC) is stuck in the “Faith vs. Doubt” phase, showing optimism, its repeated inability to break through crucial resistance points calls for vigilance. The upcoming days will show whether BTC resumes its bullish trend to challenge $110,000 or if it encounters more adjustments toward important support areas instead.

BTC Current Trend Shows a Potential Shift In Sentiment

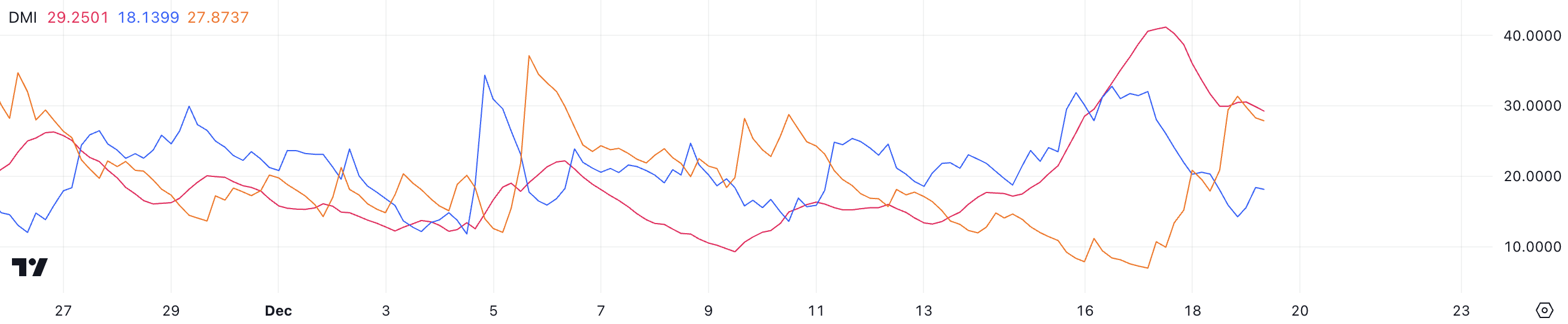

The Bitcoin DMI chart shows that its ADX has dropped to 29.2, a notable decrease from more than 40 it had only two days back when Bitcoin hit a record peak. This decrease in ADX suggests that although the trend is still robust, the level of strength behind it appears to be weakening.

As bullish energy seems to be waning, the market may be moving towards a phase of stabilization or potentially experiencing more declines.

The Average Directional Index (ADX) is a tool used to assess the strength of a market trend. A value greater than 25 means a strong trend is present, while a value below 20 suggests a weak or non-existent trend. At the moment, Bitcoin’s D+ (positive directional movement) is at 18.1, and its D- (negative directional movement) is at 27.8. This implies that at this time, bearish forces are prevailing as sellers are more active than buyers in the short term, suggesting a downward trend for Bitcoin.

If the current imbalance persists, Bitcoin’s price might drop further. However, if buyers manage to regain control and the D line crosses above the D- line, it could indicate a resurgence of bullish energy in the market.

Bitcoin NUPL Is Far from the Next Thresholds

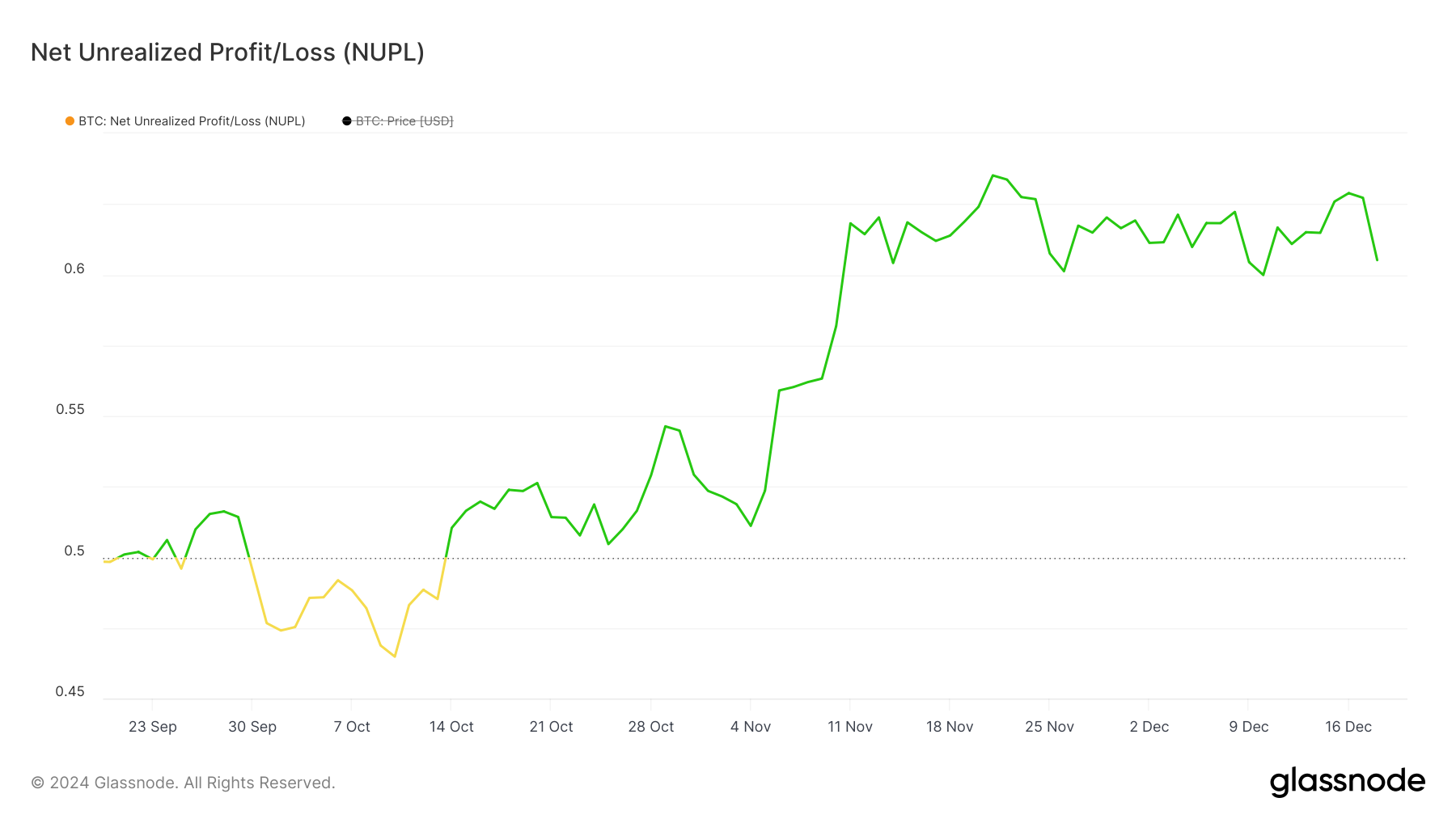

As a crypto investor, I’ve noticed that the Bitcoin NUPL (Network Upgraded Price) has dropped from 0.628, a level it reached when Bitcoin hit its new all-time high two days back, to now stand at 0.60. This dip suggests a modest decrease in unrealized profits among BTC holders, implying either some profit-taking or a cooling down of the market following the recent bullish trend.

Even though its current decline persists, Bitcoin’s price still resides within the “Faith and Denial” range, indicating that investors continue to exhibit faith but are beginning to show signs of apprehension.

One way to rephrase that in a more natural and easy-to-understand manner is: “NUPL (Net Unrealized Profit/Loss) quantifies the total combined profits or losses that Bitcoin owners have not yet realized by selling their holdings, dividing market sentiment into different phases.

Values greater than 0.5 are classified within the “Belief vs. Denial” range, values less than 0.5 correspond to the “Optimism vs. Anxiety” phase, and figures exceeding 0.7 point towards the “Euphoria vs. Greed” stage, which is usually linked to market peaks. At the present moment, BTC’s position at 0.60 indicates that although sentiment is predominantly positive, it hasn’t yet reached extreme greed levels and maintains a healthy distance above anxiety thresholds.

BTC Price Prediction: Is $110,000 Still Possible In 2024?

Should the price of Bitcoin manage to surpass the current resistance level at approximately $103,638, it could potentially accumulate sufficient momentum to challenge fresh record highs in the region of $108,000.

Reaching this next stage might open up a path for Bitcoin’s price to hit an unprecedented $110,000, demonstrating persistent optimism in the market and high investor trust.

While EMA lines and ADX suggest that the present momentum might be decreasing, it opens up the prospect of a potential reversal towards a downward trend. If the short-term EMAs drop beneath the long-term EMAs, this could signal the start of a more pronounced downtrend.

Under these circumstances, the Bitcoin price might approach the $94,000 as a possible support point. If it can’t sustain this level, there could be a downward trend reaching around $90,000, which would signify a potential 11.7% drop from the current prices.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

2024-12-19 23:51