As a seasoned researcher who has been closely tracking the digital asset landscape for over a decade, I find myself both amazed and intrigued by the steady growth of the stablecoin market. The recent milestone of surpassing $200 billion in total market capitalization is indeed a testament to the resilience and adaptability of these digital assets.

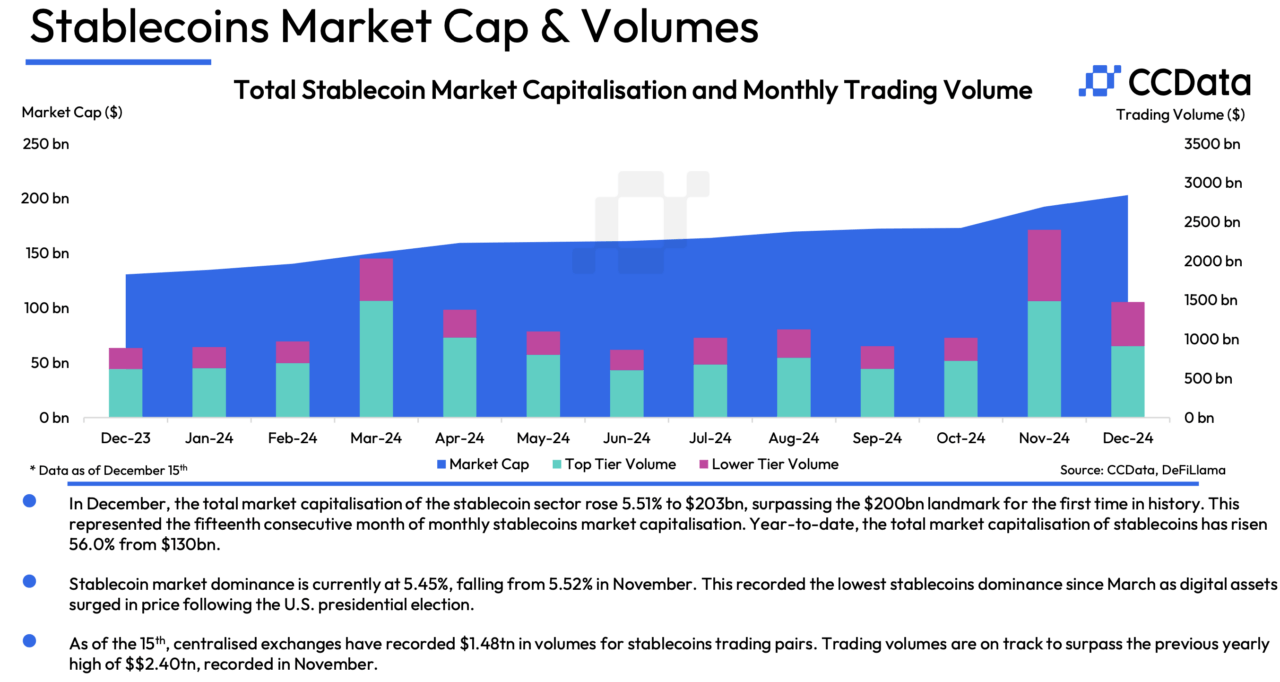

In December 2024, the stablecoin market set a record high, surpassing $200 billion in total market value for the very first time, as reported in the December 2024 edition of the CCData’s Stablecoins & Central Bank Digital Currencies (CBDCs) Report.

The increasing size of this sector indicates the growing influence of stablecoins within the digital assets market, even as regulations become stricter, notably in Europe. For more information on these trends and others, refer to CCData’s thorough examination of the sector presented in their monthly reports.

In December, CCData, a well-known player in the field of digital asset data and an authorized administrator for benchmarks by the Financial Conduct Authority (FCA), pointed out that the overall market value of stablecoins increased by approximately 5.51% to reach a staggering $203 billion.

This milestone signified the fifteenth straight monthly growth for the sector. Stablecoins have become a common tool for trading and transferring value, serving as an intermediary between traditional currencies and digital assets. Although they have grown in popularity, their influence within the overall cryptocurrency market dropped to 5.45%, which is its lowest point since March 2024.

According to CCData’s report, one significant development was Tether deciding to halt support for Euro Tether (EURT). Tether mentioned that the strict compliance obligations under Europe’s new Markets in Crypto-Assets (MiCA) regulations and dwindling demand were behind their decision. As noted by CCData, EURT’s market capitalization dipped by 0.47% to $26.9 million in December, marking its thirteenth straight month of decrease. This suggests the difficulties that stablecoin issuers encounter when adjusting to more stringent regulatory environments.

CCData’s report also spotlighted a substantial alliance between Circle, the creator of USD Coin (USDC), and Binance, the global exchange leader by trade volume. This alliance between Circle and Binance is designed to boost USDC usage through adding more trading options and launching special promotions centered around the stablecoin. As per CCData, this strategic partnership led to a 6.7% rise in USDC’s market cap in December, reaching $42.4 billion—its peak since December 2022. CCData underscored that such collaborations demonstrate the significance of teamwork in fostering stablecoin expansion within a changing regulatory landscape.

In my analysis as a data analyst, one noteworthy regulatory development I observed was Coinbase’s choice to limit access to six stablecoins for its European users on December 13th, before the full enforcement of MiCA. The restricted stablecoins were USDT (issued by Tether), DAI, PYUSD, GUSD, GYEN, and PAX. This action, according to CCData, highlights the increasing emphasis on compliance within the stablecoin sector. As platforms like Coinbase strive to adhere to MiCA’s rigorous standards, it demonstrates their commitment to maintaining a strong presence in the European market.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- ATH PREDICTION. ATH cryptocurrency

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2024-12-19 21:17