As a seasoned researcher with over two decades of experience under my belt, I must admit that the meteoric rise of Bitcoin has left me both awestruck and somewhat envious. Having spent most of my career analyzing traditional financial markets, I’ve grown accustomed to the slow and steady growth of blue-chip stocks – a far cry from the breathtaking returns offered by Bitcoin.

Bitcoin (BTC) surpassing the $100,000 mark underscores crypto’s unique potential for wealth creation once more. A study reveals a stark contrast in the rate of affluence growth between Bitcoin investors and stock investors.

This significant instance, delved into by NFTEvening and Storible along with others, underscores Bitcoin’s potential for generating wealth as opposed to conventional investment options such as stocks.

Report Shows Bitcoin’s Meteoric Wealth Creation

As a researcher delving into the world of cryptocurrencies, my latest findings reveal an astonishing surge in wealth creation as Bitcoin soared past the $100,000 mark. In a recent study conducted by NFTEvening and Storible, we traced over 17,000 Bitcoin wallets that held balances exceeding $1 million, according to Dune Analytics. This discovery underscores the transformative impact of this digital currency on individuals’ financial landscapes.

The study primarily explored wallets that gradually accumulated funds, disregarding any with opening balances above a million dollars or transactions surpassing $100,000. This approach prioritized the examination of individual investors (retail) instead of large institutions. The results demonstrated:

- 14,211 New BTC Millionaires: Over 14,000 individuals saw their investments balloon to millionaire status as Bitcoin crossed the $100,000 milestone.

- 4 New BTC Billionaires: Four fortunate investors joined the billionaire ranks, highlighting Bitcoin’s potential for exponential financial growth.

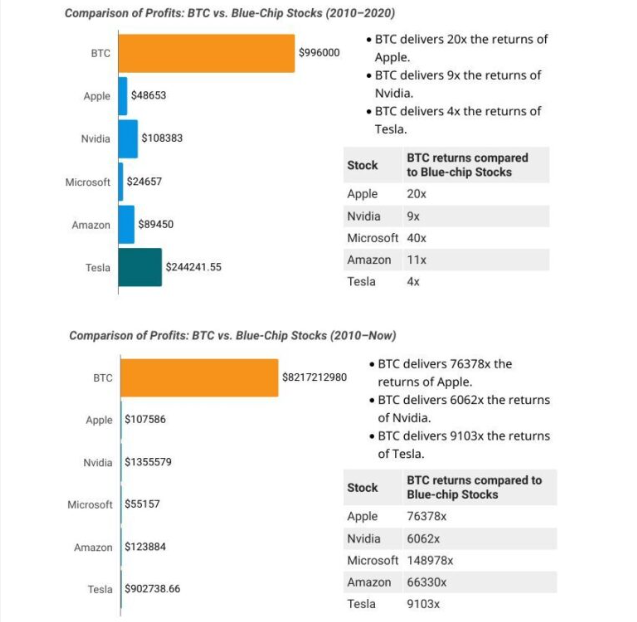

In order to better understand Bitcoin’s performance, the analysts chose to examine investments similar to top companies by market value during the same timeframe. The data was quite compelling as they compared Bitcoin’s rate of wealth creation to that of established blue-chip stocks. According to the findings in the report:

- Millionaire Creation: With a $4,000 investment, Bitcoin investors typically take 10.3 years (or 3,775 days) to reach millionaire status. This represents a 250X return on investment (ROI) since 2010. Conversely, the same investment in blue-chip stocks during the same period would grow to just $45,000—barely a fraction of Bitcoin’s potential.

- Billionaire Creation: A $30,500 investment in Bitcoin has historically required 12.7 years (or 4,645 days) to achieve billionaire status, yielding a jaw-dropping 32,787x ROI. In stark contrast, a similar investment in stocks would reach just $950,000 in value over the same timeframe.

These findings further highlight the stark contrast between Bitcoin and traditional investment vehicles. Nevertheless, the research did not stop there. It proceeded to compare Bitcoin to market leaders.

Bitcoin Returns Dwarf Apple, Nvidia, and Tesla Since 2010

Compared to the leading 10 corporations based on market value, Bitcoin’s growth outperforms the best-performing businesses remarkably. In other words, Bitcoin has shown an exceptional growth rate that surpasses the top performers in the corporate world.

- 2010-2020 Returns: Bitcoin delivered 20X the returns of Apple, 9X those of Nvidia, and 4X Tesla’s gains.

- 2010-Present Returns: Bitcoin’s ROI surged to 76,378X Apple’s, 6,062X Nvidia’s, and 9,103X Tesla’s returns.

The results of this study match a recent poll by ReviewExchanges about how American investors reacted to Bitcoin reaching $100,000, as BeInCrypto shared. In summary, approximately 72% of the respondents consider cryptocurrency as a significant future investment, attributing their optimism to factors like the possibility of Bitcoin ETFs, potential political changes, and increasing mainstream adoption.

Contrarily, around 83% of investors disclosed they made less than $10,000. Meanwhile, an astounding 79% of cryptocurrency owners confessed to missing significant profits during the recent bull run. This underscores the significance of timing in crypto investments, demonstrating how delaying market entries or smaller initial investments could potentially deny investors substantial returns.

Contrarily, it’s crucial that investors don’t rely exclusively on polls for their decision-making process but instead delve deeply into research. As Bitcoin and cryptocurrencies gain momentum and become more widespread, they seem poised to significantly alter the distribution of wealth.

Currently, Bitcoin is being exchanged for around $102,496. Compared to when trading began on Thursday, this is nearly a 2% decrease. The drop in price could be attributed to the impact of the Federal Reserve’s latest interest rate announcement on the crypto markets.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2024-12-19 20:49