As a seasoned crypto investor with battle-tested nerves and a portfolio that has weathered numerous market cycles, I find myself cautiously optimistic about XRP‘s current standing. The recent 6% dip is nothing new to me – the crypto markets are known for their rollercoaster rides.

The price of XRP has dropped approximately 6% over the past day, as it follows a significant increase in value earlier this December that established its place among the top four cryptocurrencies by market capitalization. Although technical indicators like RSI and CMF present a mixed picture, with the RSI at 45 suggesting neutral conditions and the CMF at 0.01 hinting at slight positive movement of capital.

The price of XRP is currently fluctuating between approximately $2.28 and $2.53. If the support level gives way, we might see a substantial drop down to around $1.89. But if buyers take charge again, XRP could challenge resistance levels at $2.53 and $2.90, potentially reviving its recent bullish trend.

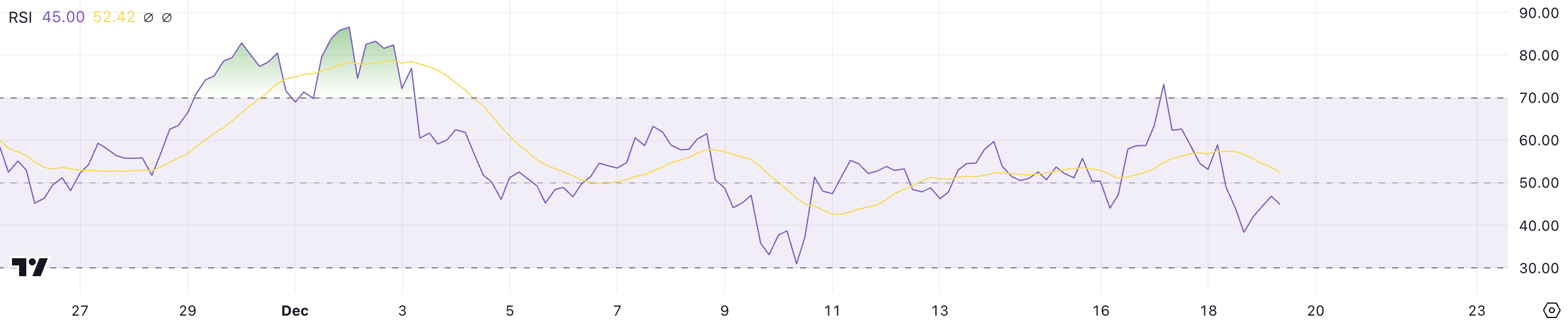

XRP RSI Stays Neutral

The Relative Strength Index (RSI) for XRP has decreased significantly from 60 yesterday to 45 now. This significant drop suggests a lessening of the bullish trend and a move towards a more neutral state, as the RSI is now moving away from overbought regions.

A significant decrease indicates a growing trend of sellers, potentially leading to more pricing stabilization or even a decline in the near future if there’s no increase in buyers.

The Relative Strength Index (RSI) evaluates how fast and significantly an asset’s price is changing to determine if it’s too expensive (overbought) or too cheap (oversold). When the RSI exceeds 70, it usually signals that the asset might experience a drop in value (a potential pullback), whereas values below 30 may indicate that the asset is undervalued (oversold), potentially leading to an increase (a rebound).

In simple terms, when the Relative Strength Index (RSI) of XRP is around 45, it indicates that the market is neither strongly bullish nor bearish, but leaning slightly towards a downtrend. This trend makes the XRP price susceptible to additional decreases unless positive market momentum resurfaces.

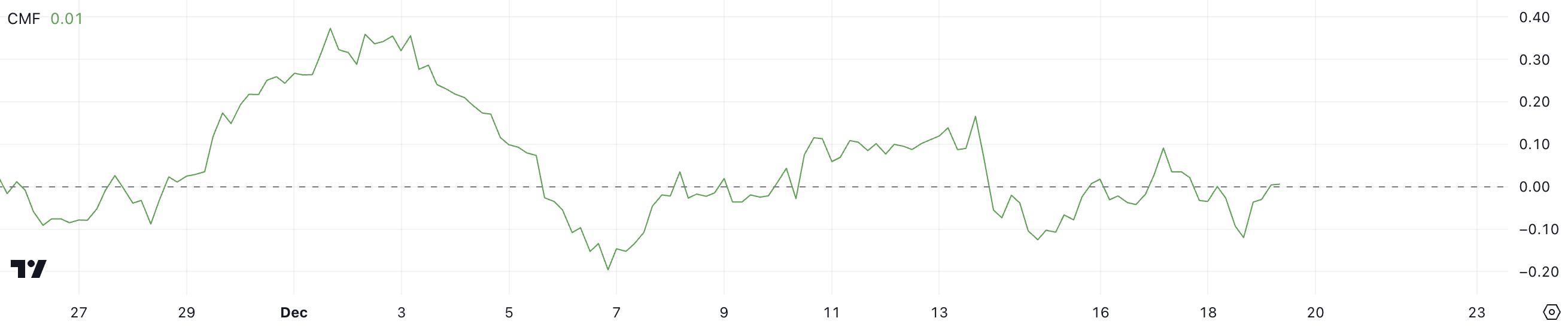

XRP CMF Is Nearing 0

As a researcher, I’m observing an upward trend in the XRP Crossed Moving Finder (CMF) which stands at 0.01 today, marking a substantial rise from -0.12 yesterday. This uptick suggests a growing influx of capital into this asset. However, despite the CMF slightly veering above neutral, it’s yet to signal robust bullish energy.

This adjustment indicates that the demand to sell has lessened, yet the desire to buy is still subdued, suggesting a possible price leveling instead of an undeniable upward trend.

The CMF (Chaikin Money Flow) measures the strength of capital inflows and outflows over a given period. Values above 0 indicate net positive inflows, signaling buying pressure, while values below 0 suggest net outflows and selling pressure.

In simple terms, when the Cumulative Moving Average (CMF) of XRP is at 0.01, it seems that the market is moving into a period of balance, neither buyers nor sellers are strongly in control. Unless there’s a significant change in money flow, we might see price fluctuations within a specific range for the upcoming days.

XRP Price Prediction: A Death Cross Could Send the Coin Below $2

At the moment, XRP’s trading range is approximately between 2.28 dollars and 2.53 dollars. The significant level of 2.28 dollars serves as crucial support. If this support weakens, there’s a possibility that the price could drop lower, reaching a potential test point at 2.17 dollars, and even going down to 1.89 dollars, indicating a more substantial correction might be underway.

As the gap between the Exponential Moving Averages (EMA) decreases, it indicates a potential softening or weakening in the trend. Moreover, when the short-term EMAs drop below the long-term ones, creating what’s known as a “Death Cross,” this situation might lead to an escalation of bearish pressure.

If XRP’s price manages to regain its upward trajectory, it might initially face a resistance at approximately $2.53. Overcoming this barrier could pave the way for further increases, with potential targets at around $2.64 and potentially even reaching as high as $2.90 if the uptrend becomes quite strong.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

2024-12-19 19:45