As a seasoned crypto investor with a knack for navigating the turbulent waters of this exciting market, I must say that yesterday’s Federal Reserve decision and Powell’s subsequent comments sent shockwaves through both traditional finance and the crypto realm. The rollercoaster ride we witnessed was a stark reminder of the adrenaline-pumping nature of our chosen investment terrain.

Yesterday, the Federal Reserve lowered interest rates by 0.25% as anticipated, but market indices fell following remarks from Chairman Jerome Powell indicating a possible slowdown in the reduction of interest rates next year.

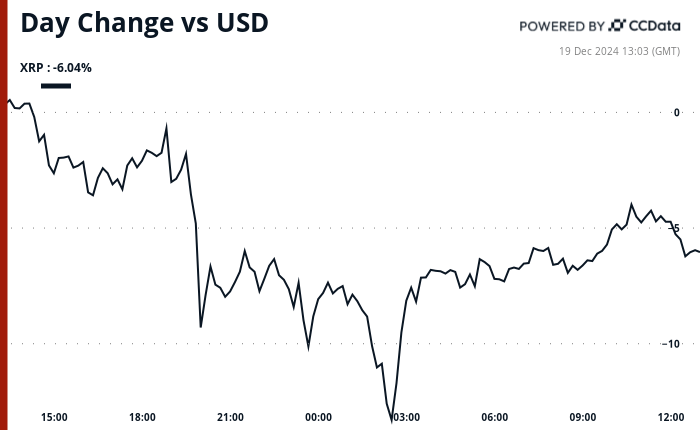

Powell’s remarks triggered a broad selling spree in high-risk investments, affecting both the cryptocurrency sector and conventional finance. This selling wave caused Bitcoin to dip temporarily below $100,000 before rebounding, while Ethereum remains under $3,700. The sell-off also impacted XRP, causing it to lose 6% of its value today, currently trading at $2.37.

Even with recent declines, XRP has managed to rise by over 360% from its starting point in early November. Back then, it was priced at approximately $0.513.

Behind its significant rise were several contributing factors: The victory of Republican nominee Donald Trump in the U.S. Presidential election, numerous applications for XRP-based exchange-traded funds, and the introduction of Ripple‘s RLUSD stablecoin by the company itself.

In simpler terms, the recent drop in stock prices caused a huge increase in the expected volatility of the market, as indicated by the CBOE Volatility Index (VIX), which is often referred to as the “fear gauge.” This increase was one of the second-largest ever recorded in its history.

Since the sharp increase in XRP’s price in early November, it has shown considerable fluctuation. This volatility is due to normal adjustments as investors cash out their gains and rebalance their portfolios.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Elder Scrolls Oblivion: Best Battlemage Build

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-19 16:18