As a seasoned economist with over two decades of experience in the financial industry, I find Arthur Hayes’ suggestion intriguing but somewhat far-fetched. While it’s true that Bitcoin and other cryptocurrencies have shown remarkable growth potential, suggesting such a drastic move as devaluing gold to build a strategic Bitcoin reserve is a bold step, one that could potentially destabilize the global economy if not executed carefully.

Arthur Hayes, BitMEX’s CEO, proposes that the Trump administration might consider shifting away from the gold standard and instead create a strategic Bitcoin reserve as an alternative approach.

Hayes proposes an unconventional approach to US economic growth, which involves the Treasury Department increasing the money supply by lowering the value of gold as a means to establish a Bitcoin reserve.

Hayes Suggests Trump to Shift from the Gold Standard

As per Hayes’ recent Substack post, this depreciation could result in the Federal Reserve’s Treasury General Account (TGA) being credited with a dollar.

This credit serves as a means to immediately introduce funds into the economic system, bypassing the necessity of international negotiations to weaken foreign currencies relative to the U.S. dollar. The more substantial the decrease in gold’s value, the greater the size of this credit.

At present, the treasury assigns a value of approximately $42.22 per ounce to gold. However, according to Hayes, this current valuation seems too high. He argues that if the incoming Treasury Secretary, Scott Bessent, were to reconsider a significant increase in the price of gold, say between $10,000 and $20,000 per ounce, then the TGA’s assets would instantly surge in value.

“Hayes wrote that reducing the strength of the dollar swiftly and significantly could be the initial move for Trump and Bessent to reach their economic objectives. This action can be executed immediately, without requiring approval from domestic lawmakers or foreign financial authorities. Since Trump has a year to demonstrate progress towards some of his goals to secure Republican control in the House and Senate, Hayes predicts that the dollar’s value compared to gold will decrease during the first half of 2025.

What Would a Bitcoin Reserve Mean for the US Economy?

As a crypto investor, I’m excited about Arthur Hayes’ perspective: If the U.S. Treasury were to use dollars they’ve credited themselves to buy Bitcoin and other cryptos, it could potentially drive up their prices.

If the United States currently holds the most gold among all nations, they might also consider establishing a Bitcoin reserve. This action would underscore the nation’s dominance in the financial sphere, particularly in terms of control over the world’s leading digital currency.

Given that Bitcoin is generally viewed as a form of hard currency because of its limited supply, Hayes posits that the most powerful government-issued currency would likely be the one backed by the largest hoard of Bitcoins held by its central bank.

If a government possesses a substantial quantity of Bitcoin, it’s only logical for them to enact policies that foster the expansion of the cryptocurrency sector.

Hayes explains in his article that if the U.S. government increases the number of dollars by devaluing gold and uses some of those new dollars to buy Bitcoin, the price of Bitcoin will increase dramatically. This is because other countries may feel compelled to purchase Bitcoin as well, to keep up with the U.S., leading to a rise in the price of Bitcoin. As the U.S. government continues to devalue its own currency by increasing the money supply, people will be less inclined to sell Bitcoin and accept devalued fiat currency in return, causing the price of Bitcoin to continue climbing at an exponential rate.

It’s also important to consider that the US is not the only country considering a strategic Bitcoin Reserve. As BeInCrypto reported earlier, Russian lawmakers are also suggesting the same.

It appears that lawmakers in Japan have previously proposed comparable ideas this month, while Vancouver, Canada, has already endorsed a Bitcoin Reserve scheme for their city council. Therefore, it seems plausible that if the U.S. does not act swiftly, other countries may take advantage of the opportunity first.

In reality, Hayes isn’t anticipating that the Treasury will invest in Bitcoin. Nevertheless, a devaluation of gold could indirectly generate dollars, either by being circulated as commodities and services or utilized as financial resources.

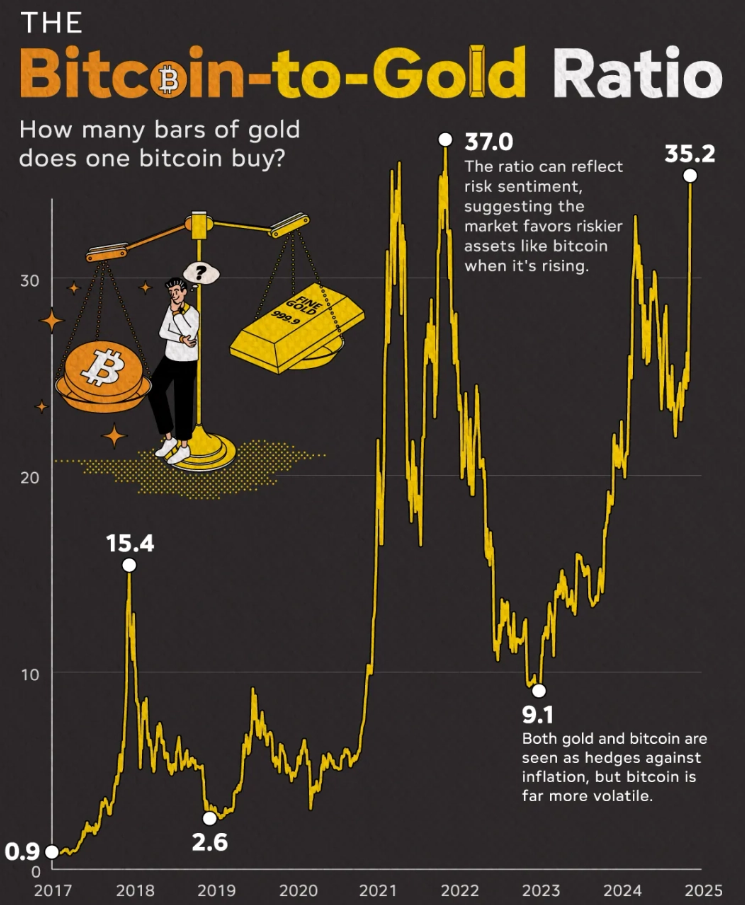

According to Hayes, it seems that his views correspond with the current market trends since Bitcoin ETFs currently manage more assets than those of Gold ETFs. Notably, these Bitcoin ETFs have only been in operation for roughly a year.

How Much Time Does Trump Have?

As a researcher, I express some apprehension regarding the exuberant anticipation among crypto investors, who are banking on swift regulatory adjustments from the incoming Trump administration to favor the cryptocurrency market.

He forecasted that Trump would require approximately a year to tackle the root causes of both domestic and foreign problems.

Simultaneously, the newly elected president will be under pressure to produce quick outcomes, as many legislators will soon shift their focus towards campaigning for the mid-term elections, which are due just one year after Trump’s inauguration.

If patience is worn thin and feelings turn sour rapidly, Hayes anticipates that some investors may regret their investment decisions.

“Starting from around January 20th, investors will come to understand that President Trump has only about a year left to make any policy changes. This awareness could trigger a sharp decline in the prices of cryptocurrencies and other stocks associated with Trump’s second term, as investors choose to sell off their holdings.

Given the limited time Trump has to instigate change, Hayes underscores the fact that devaluing gold offers the swiftest method for producing money and invigorating the economy.

People are growing increasingly restless due to their desperation. Trump, being an astute politician with a keen understanding of his supporters, likely will take bold actions right from the start. In my opinion, this could lead to a significant weakening of the U.S. dollar in relation to gold within his first 100 days in office. This move would make American production costs globally competitive almost immediately. That’s his predicted strategy, he concluded.

As a researcher, I’m not alone in holding this viewpoint. Just last month, Republican Senator Lummis suggested an intriguing idea: the Federal Reserve could consider selling a fraction of its gold reserves to purchase approximately 1 million Bitcoins, thereby establishing a Bitcoin Reserve.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-19 01:32