As a seasoned researcher with over two decades of experience in financial markets and technology, I find myself intrigued by the speculation surrounding MicroStrategy (MSTR) and its Bitcoin (BTC) purchases. The rumor of a blackout period for Executive Chairman Michael Saylor could indeed slow down MSTR’s aggressive Bitcoin acquisition strategy, but the exact details remain unclear.

There’s increasing talk that MicroStrategy (MSTR) might temporarily stop buying Bitcoin (BTC) in January, possibly because of a supposed prohibition on emitting new shares or convertible bonds.

For publicly traded companies, there’s a specified duration called a “blackout period” where certain actions related to their stocks or shares are temporarily prohibited. These limitations are often self-enforced by the company itself.

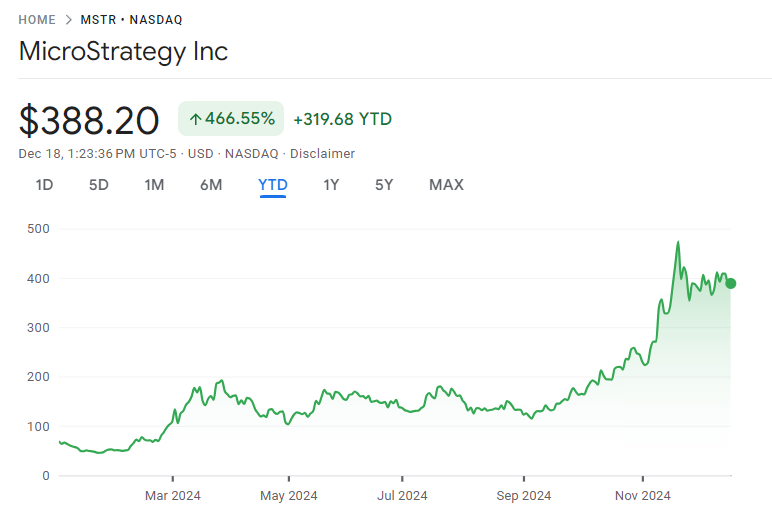

MicroStrategy’s Bitcoin Purchase Could Slow Down in Q1 2025

As a crypto investor, I recently learned from a renowned venture capitalist that Michael Saylor, the Executive Chairman of my preferred company, may encounter limitations in January that could potentially hinder the release of new convertible debt. This debt is crucial for continuing to purchase more Bitcoin.

Conversely, such a move might displease numerous Mastercard investors who are keen on the company’s bold approach towards Bitcoin investments.

As a crypto investor, I found out that Saylor is in a holding period throughout January, meaning they can’t issue any new convertible notes to buy Bitcoin. So, I decided to capitalize on this opportunity before the end of December, and then prepare for an anticipated altcoin season, as Vance Spencer suggested on platform X (previously known as Twitter).

Some people speculate that the alleged ban could originate from insider trading laws. Although the Securities and Exchange Commission (SEC) doesn’t stop insiders from trading after a financial quarter has ended, numerous corporations establish ‘blackout periods’ to prevent any suspicion of unethical behavior.

These durations usually span from two weeks up to a month, and they usually conclude a few days following the announcement of quarterly earnings reports. Some believe that this limitation might pertain exclusively to “at-market” (ATM) stock sales, rather than convertible debt offerings.

The analyst believes that the blackout periods for MicroStrategy are excessively emphasized in terms of length and potential effect. He’s not certain that MicroStrategy will cease purchasing Bitcoin or halt the ATM during the period from the end of the quarter until the release of the quarterly report (approximately 40 days). He recognizes that regular 8K filings and press releases meet all Fair Disclosure requirements, and they have established a pattern for doing so in their market activity up to this point.

An alternate explanation connects the possible blackout to MicroStrategy’s addition to the NASDAQ 100 index on December 23. This theory implies that internal committee suggestions might have caused the temporary halt.

microstrategy’s upcoming earnings statement might be released anytime from February 3rd to February 5th, 2025. Some analysts speculate that a potential quiet period could last all through January or start halfway into the month on January 14th.

So far this period, MicroStrategy’s treasury operations have generated a Bitcoin Yield of approximately 46.4%, which translates to roughly 116,940 Bitcoins. Given that each Bitcoin is currently worth around $105,000, this equates to an impressive quarterly profit of about $12.28 billion, as stated by Michael Saylor on his social media platform X (previously known as Twitter).

At present, Microstrategy owns approximately $46 billion in Bitcoin, with an unrealized gain of more than $18.9 billion. In December alone, they purchased around $3 billion worth of Bitcoin at prices exceeding $100,000, demonstrating their strong belief in the largest cryptocurrency. This bullish stance on Bitcoin is clearly evident in Michael Saylor’s company.

This surge in performance has propelled the company onto the roster of the leading 100 publicly traded U.S. corporations. More recently, its stock became part of the exclusive Nasdaq-100 index, and it’s possible that it could be under consideration for inclusion in the S&P 500 next year.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Persona 5: The Phantom X Navigator Tier List

2024-12-18 22:04