As a seasoned investor with a keen eye for market trends and a portfolio spanning decades of financial evolution, this latest development is nothing short of groundbreaking.

In the ETF market, Bitcoin has surpassed gold as the primary financial investment choice, signifying a significant change in investor preferences, which is an unprecedented event.

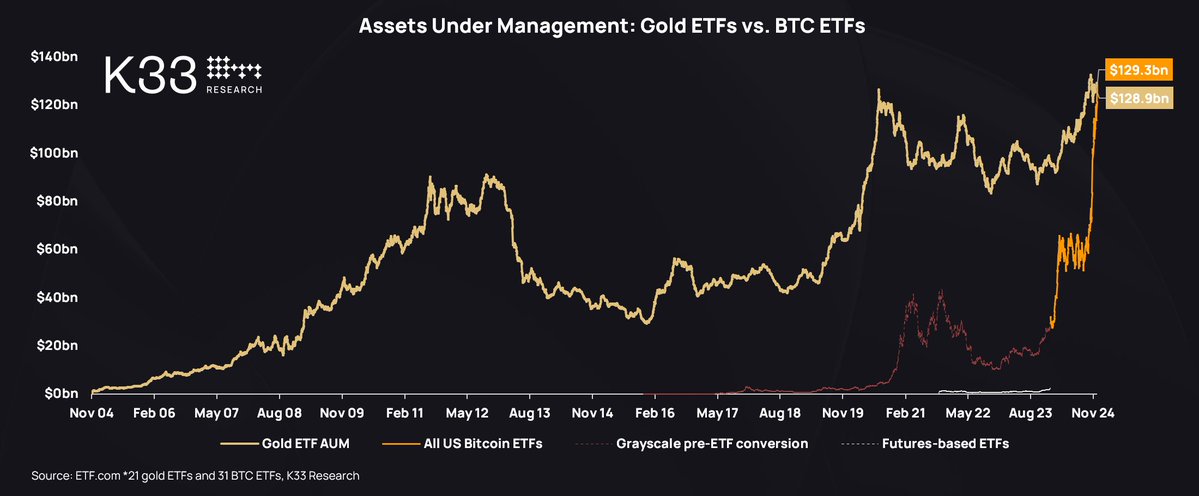

As reported by Vetle Lunde, an analyst at K33 Research – a firm specializing in crypto market research, the value of Bitcoin spot exchange-traded funds (ETFs) listed in the U.S. has now exceeded that of gold ETFs in terms of assets under management (AUM). This significant achievement was announced by Lunde on December 17 via X, emphasizing the historical nature of this event.

The Surge of Bitcoin Spot ETFs

Gold Exchange-Traded Funds (ETFs) made their debut in 2003, providing gold with a substantial early advantage. On the other hand, US Bitcoin spot ETFs didn’t come into existence until January 2024, following numerous years of regulatory hold-ups. However, despite this time difference, Bitcoin ETFs have surpassed gold ETFs in terms of Assets Under Management (AUM), demonstrating an increasing institutional and retail trust in the digital currency.

In the U.S., the total assets of Bitcoin ETFs have exceeded those of gold ETFs, according to Lunde’s statement. Despite gold having a 20-year advantage, its position has now been reversed.

The green light given to Bitcoin spot ETFs signified a significant shift in how cryptocurrencies are embraced by conventional financial systems. With these investment vehicles, individuals can indirectly invest in Bitcoin without physically owning it, thereby connecting the worlds of digital currency and traditional finance.

This significant achievement signifies a growing interest among investors in legally endorsed and convenient Bitcoin investment options, especially considering Bitcoin’s impressive price growth during the year 2024.

The escalating number of Bitcoin ETFs reflects a growing institutional appetite for them. Major financial entities such as BlackRock, Fidelity, and Ark Invest have introduced Bitcoin ETFs, lending credibility and making it accessible to more investors. Their entrance has ignited competition, resulting in substantial investments into these offerings.

Gold has traditionally been viewed as a protective asset during economic turbulence and rising prices. For many years, individuals have looked to gold exchange-traded funds (ETFs) as a secure place for their investments. Yet, Bitcoin is increasingly being perceived as a digital equivalent of gold, providing a more contemporary, decentralized option with comparable qualities for preserving value. The fixed supply of Bitcoin, which maxes out at 21 million coins, makes it especially appealing in situations where inflation is high.

What This Means for Investors

The fact that Bitcoin exceeds gold in ETF Assets Under Management (AUM) signifies much more than just a significant achievement; it symbolizes a seismic shift in investor attitudes across generations. With younger investors, who are more accustomed to digital assets, embracing Bitcoin as both a technological and financial breakthrough, this trend underscores their growing interest in the cryptocurrency. Simultaneously, traditional investors, drawn by the prospect of higher returns, are progressively incorporating Bitcoin into their diversified investment strategies.

As an analyst, I observe that the increasing demand for Bitcoin Exchange-Traded Funds (ETFs) underscores a growing regulatory acceptance of the cryptocurrency market. After years of obstacles, US regulators finally approved Bitcoin spot ETFs in early 2024, establishing a significant precedent for other regions and facilitating the development of future crypto investment vehicles.

As a crypto investor, I ponder about the rise of gold ETFs and what it means for Bitcoin’s future course and role within the broader financial landscape. While Bitcoin’s volatility is a persistent issue, its increasing institutional adoption and progress towards regulatory clarity could fuel sustained growth. Experts predict that as Bitcoin matures, it might attract even more investments from traditional markets, potentially widening its advantage over gold in terms of assets under management (AUM).

From my perspective as an analyst, the soaring success of Bitcoin ETFs underscores a significant shift in investor perception towards digital assets. I used to regard Bitcoin as an unconventional investment; now, it has firmly stepped into the mainstream, even challenging gold’s traditional role as the ultimate store of value.

At the moment, Bitcoin’s increase indicates a shift happening in financial markets, as they are being restructured by innovation and decentralization that are shaping investors’ choices rapidly.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-18 13:01