As a seasoned analyst with over two decades of market experience under my belt, I’ve seen my fair share of market euphoria and despair. The recent surge in Travala (AVA) has caught my attention, but it’s essential to approach such situations with caution.

Recently, the price of Travala (AVA) has skyrocketed approximately 300% due to Binance CEO CZ’s disclosure about Binance’s initial investment in the platform. Additionally, the company announcing an annual revenue of $100 million has sparked substantial market curiosity towards AVA.

Yet, since momentum indicators suggest a cooling trend, this asset finds itself at a crucial juncture, poised between possible advancements and potential adjustments.

AVA Is Now In The Neutral Zone

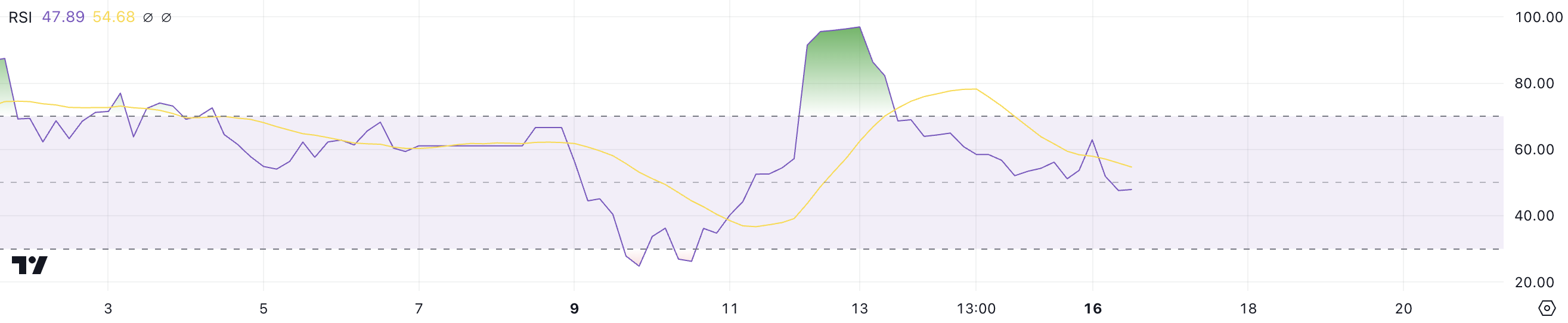

Over the past two days, AVA’s Relative Strength Index (RSI) has significantly decreased from a very high level of 96, which was above the 70 threshold since December 12, indicating extremely overbought conditions due to intense bullish momentum. Now, the RSI stands at 47.8, suggesting a substantial reduction in buying pressure.

The Relative Strength Index (RSI), which gauges the speed and direction of price movement on a scale between 0 and 100, signals overbought conditions when it exceeds 70 and oversold conditions below 30. The fact that AVA has moved from an overbought state into a more neutral zone suggests a change in market sentiment or perception.

Currently, the Relative Strength Index (RSI) stands at 47.8 for AVA, placing it in a neutral zone. In simple terms, this means that AVA’s recent upward trend has slowed down, and the asset is neither showing signs of being overbought nor oversold. The decrease from 96 indicates a loss of momentum, which could lead to price stabilization or potential further consolidation.

In simpler terms, even though there’s still a possibility for a new rise in AVA’s price, traders need to be mindful of possible drops because the strong upward push for AVA seems to be slowing down.

Travala Current Trend Is Losing Its Strength

The Travela Average Directional Index (ADX) has dropped to 39.5, from its previous level of 57 three days back. This index gauges the strength of a trend’s direction, with numbers above 25 pointing towards a robust trend, while values below 20 hint at a market that is either weak or lacks clear direction.

Although an ADX of 39.5 indicates a robust trend, the significant drop from its peak suggests a decrease in momentum, implying there might be a potential change in the market direction soon.

Although the Average Directional Index (ADX) has decreased, the Ascending Volume Accumulation (AVA) lines continue to point upward, suggesting that the bullish momentum remains in place at this time. Yet, the falling ADX indicates it might be difficult for a powerful new uptrend to materialize, as the trend’s strength seems to be weakening gradually.

Investors need to exercise caution since a lessening of the Average Directional Index (ADX) might suggest an upcoming period of price stabilization or even a possible price change, given that buying momentum seems to be waning.

AVA Price Prediction: Will It Reach $3.5 Before Christmas?

As a crypto investor, I’ve been closely monitoring the AVA price analysis chart, and it appears that in the short term, my Exponential Moving Averages (EMA) lines are hovering above their long-term counterparts, indicating a bullish setup. Yet, the shortest EMA line seems to be trending downward, hinting that the current uptrend might be weakening.

Should the downward trend persist, the AVA’s price may encounter a robust resistance at approximately $1.56. If this barrier doesn’t hold, there’s a possibility of a further drop, potentially reaching around 48% to $0.81 or even dipping as low as $0.62.

Conversely, should the upward trend regain its strength, the AVA price may bounce back and challenge the $3.38 resistance point once more. There’s a chance it could even climb to $3.50, maintaining its position as one of the top-performing coins over the past week.

In simpler terms, the EMA lines indicate a crucial juncture for AVA. Whether the upcoming actions lean towards a bullish rebound overpowering the present weak trend indications will significantly influence the next steps.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- In Conversation With The Weeknd and Jenna Ortega

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- USD ILS PREDICTION

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2024-12-17 01:52