As a seasoned analyst with years of experience navigating the volatile and unpredictable crypto market, I have seen it all – from meteoric rises to devastating crashes. The recent surge of VIRTUAL has caught my attention, and its impressive 536.03% increase in just 30 days is nothing short of astonishing. While I am always wary of overbought conditions, especially when RSIs are as high as VIRTUAL’s current 83, the bullish momentum behind this coin is undeniable.

The price of Virtual has soared significantly, placing it at the forefront of AI crypto agents and now ranking it as the 4th largest AI coin in the market, surpassing WLD. In just the last month, it has seen a remarkable increase of 536.03%, also earning a spot among the Top 50 largest cryptocurrencies by market capitalization.

The steady rise of the coin is being driven by robust momentum, propelling it to unprecedented peaks and testing more resistance points. Yet, since its Relative Strength Index (RSI) indicates oversold conditions, traders are vigilantly watching for possible adjustments that might disrupt its ongoing bullish trend.

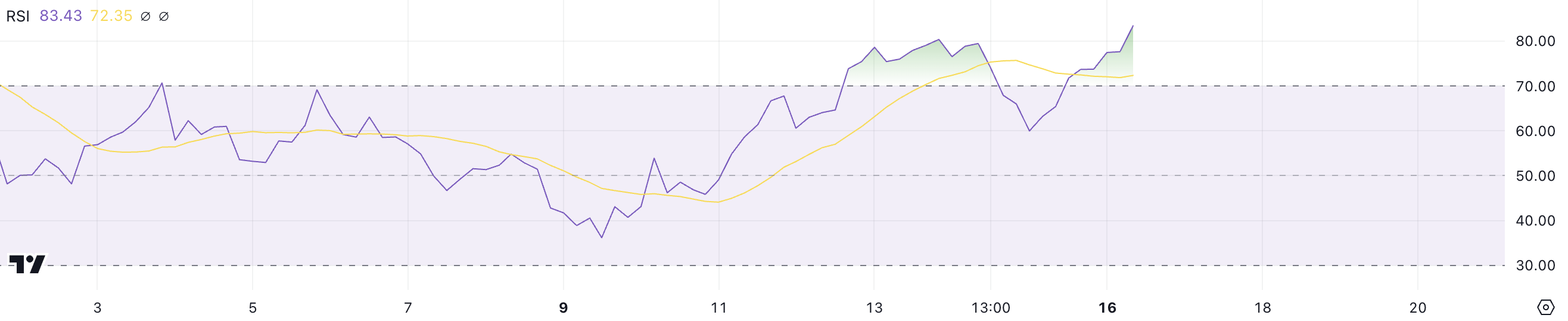

VIRTUAL RSI Is Showing an Overbought Zone

As a researcher, I’ve noticed an upward trend in the Virtual Relative Strength Index (RSI), which has jumped from 60 yesterday to 83 today. The RSI is a crucial momentum indicator that gauges the pace and intensity of price fluctuations, ranging from 0 to 100.

In simpler terms, when a financial indicator like RSI exceeds 70, it suggests that the market is experiencing overbought conditions, meaning there’s strong upward momentum or a bullish trend. Conversely, if the RSI falls below 30, it points to oversold conditions, which could mean the asset might be undervalued. In the case of VIRTUAL, its RSI is currently quite high, suggesting that there’s substantial buying pressure as it moves closer to new record highs.

From December 12th through December 14th, the Relative Strength Index (RSI) of VIRTUAL remained persistently above 70, indicating a robust momentum during that span. Maintaining this level in the near future as VIRTUAL aims to set new milestones is possible, but it’s typically difficult and often short-lived.

A significantly high RSI might indicate an upcoming adjustment or correction, since sellers could potentially step in to realize their gains. This could alleviate the continuous rise in price. Therefore, traders need to exercise caution and be prepared for a possible short-term reversal.

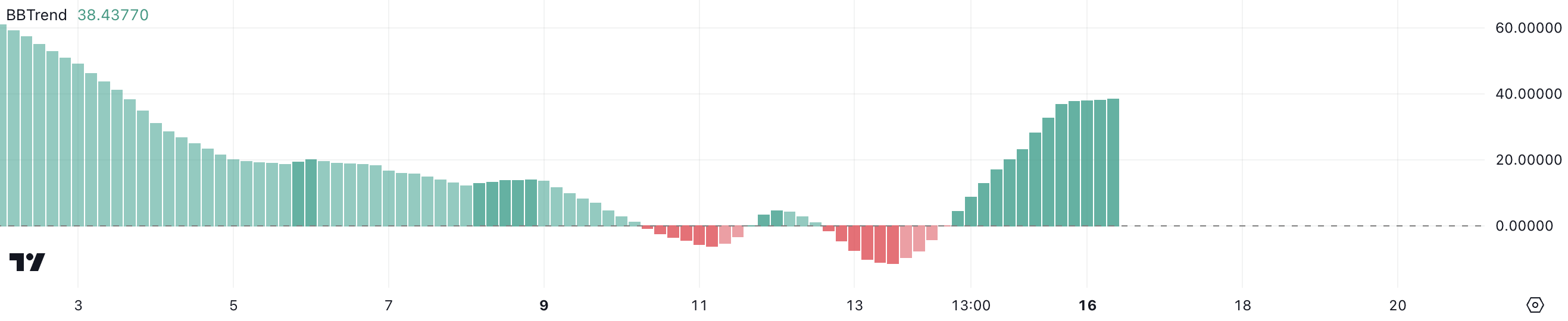

VIRTUAL BBTrend Is Still High

Currently, the BBTrend of VIRTUAL stands at 38.4, which is a considerable jump compared to the -0.01 recorded on December 14. This notable rise suggests a major change in direction, pointing towards robust bullish movements.

The indicator known as BBTrend, which is based on Bollinger Bands, assesses price movement and trend orientation. A positive value indicates a bullish trend, while a negative one signals bearish pressure. The fact that it has moved solidly into positive territory demonstrates the robustness of VIRTUAL’s ongoing uptrend.

Following December 15, VIRTUAL’s BBTrend leveled off at approximately 38.4, indicating persistent bullish energy. This high BBTrend figure implies that VIRTUAL is experiencing a robust uptrend, as the upward price movement may be fueled by ongoing buying interest. The growing buzz around AI crypto agents seems to be contributing to this narrative.

On the other hand, the stability suggests a potential pause in the growth rate, which investors ought to keep an eye on for hints of either increased speed or possible price trend consolidation in VIRTUAL’s case.

VIRTUAL Price Prediction: Will It Fall Below $2?

At this moment, the Virtual coin is hitting unprecedented peaks, indicating robust bullish energy, despite its elevated RSI values. If the upward trend persists, there’s a possibility for Virtual to breach significant resistance points, potentially reaching $3.5 or even $3.75 in the short term. This could further strengthen its status as the leading artificial intelligence coin in terms of performance over the past month.

If the upward trend weakens, there might be a correction taking place. In such a scenario, the Virtual currency’s price might test its support levels at $2.28 and $1.99. If these support levels cannot prevent a downward movement, the price could fall to $1.34, indicating a substantial drop.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- In Conversation With The Weeknd and Jenna Ortega

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- USD ILS PREDICTION

2024-12-17 00:47