As a seasoned crypto investor who has witnessed the rollercoaster ride of the cryptocurrency market since its inception, I find myself intrigued by the recent movements of XRP. The surge in November was reminiscent of the exhilarating rides we used to have on those old wooden roller coasters at the county fair. However, the slight dip over the past week feels like the sudden drop after reaching the peak – a bit disappointing but also a reality check that we always need to brace for.

The price of Ripple (XRP) has experienced substantial fluctuations lately, reaching its highest point since 2018 in November due to a robust increase. Currently, it ranks as the fourth largest cryptocurrency by market capitalization, and it is just 3% away from overtaking Tether for the third position.

After exhibiting robust growth during the previous month, XRP is now experiencing a brief period of stabilization, dropping by about 2% in the last seven days. At present, technical signs point towards an equilibrium between optimistic and pessimistic forces.

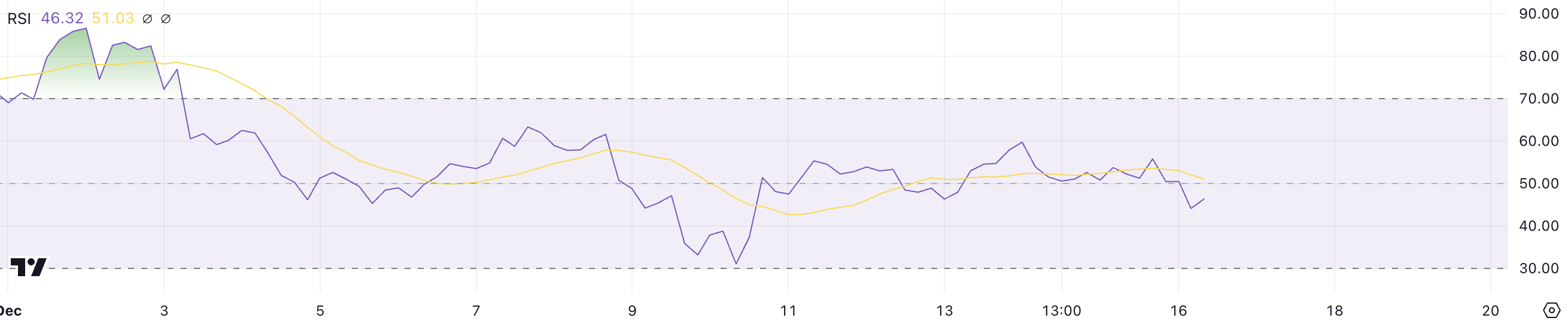

XRP RSI Is Currently Neutral

Ripple price recently reached its highest price level since 2018 but has dipped 2% over the past week. During its December surge, the Relative Strength Index (RSI) stayed above 70 for several days, signaling overbought conditions driven by strong bullish momentum.

At present, the Relative Strength Index (RSI) for XRP is at 46.3, suggesting neither overbought nor oversold conditions as the RSI, an essential technical analysis tool, calculates the rate and size of price fluctuations between 0 and 100.

In simpler terms, a reading higher than 70 indicates the market might be overbought (too many buyers), while readings below 30 suggest it’s oversold (too many sellers). With Ripple’s Relative Strength Index (RSI) close to the middle point, its status is neither extremely bullish nor bearish. This means there’s potential for price fluctuations in either direction based on future market conditions.

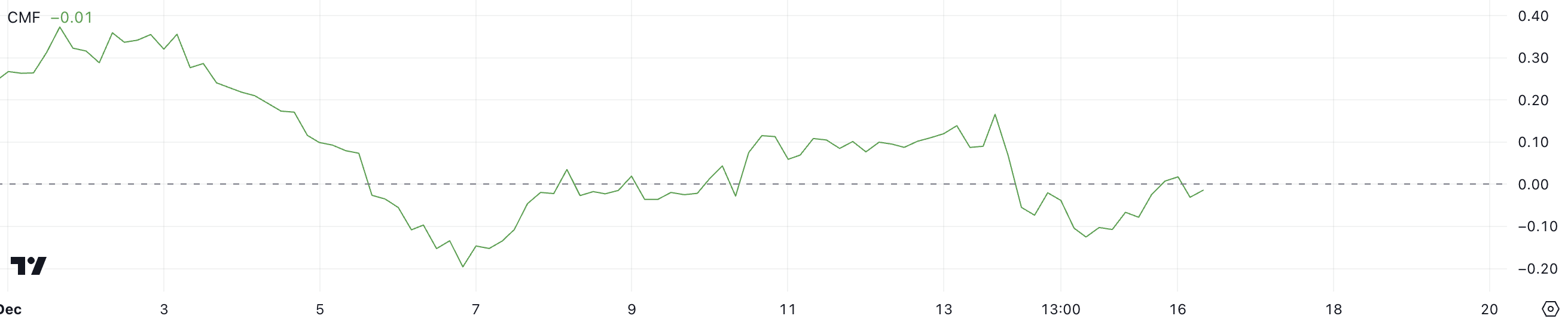

Ripple CMF Is Still Negative, But Recovering

The current Chaikin Money Flow (CMF) for XRP is now at 0.01, up from -0.13 two days prior. This upward trend indicates less intense selling activity and a shift towards a more even distribution of funds flowing into XRP, following a spell where outflows were dominant.

While still slightly negative, the shift indicates stabilizing sentiment in the market.

The CMF (Commodity Movement Index) is a technical tool that gauges the balance of buying and selling activity by merging price and volume statistics. Readings greater than zero showcase robust buying activity, whereas negative figures point to prevalent selling activity. From November 28 through December 5, Ripple’s CMF displayed exceptionally high positivity, reaching a maximum of 0.37 on December 1, which underscores considerable bullish momentum during that period.

In simpler terms, since the Cryptocurrency Fear & Greed Index (CMF) is almost at a neutral level (-0.01), it’s likely that the XRP price will have minimal short-term fluctuations unless there’s a clear trend from increased buying or selling activity in the near future.

XRP Price Prediction: Will the $2.17 Support Hold?

The moving average lines for XRP suggest that the price is stabilizing, as the brief averages are still higher than the long-term ones, yet the difference is shrinking. This implies a decrease in bullish strength, and if selling pressure intensifies, it might lead to a downward trend.

If the current situation continues, the value of XRP could approach the support level of $2.17. If this initial support doesn’t hold, there’s a chance it might drop even lower to around $1.89.

Conversely, an upswing in the trend might push Ripple’s price to test the resistance at $2.64. If it manages to surpass this barrier, it could pave the way for a possible advance toward $2.90, strengthening the bullish outlook.

The tightening Emas (Exponential Moving Averages) suggest a crucial juncture for XRP, as its future actions hinge on whether buyers or sellers take control.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

2024-12-16 18:43