As a seasoned researcher with years of experience observing and analyzing financial markets, I must admit that the recent surge in crypto inflows has left me both intrigued and slightly bewildered. The sheer volume of money pouring into Bitcoin and Ethereum is undeniably impressive, but it also raises questions about the future of altcoins and smaller blockchain ecosystems.

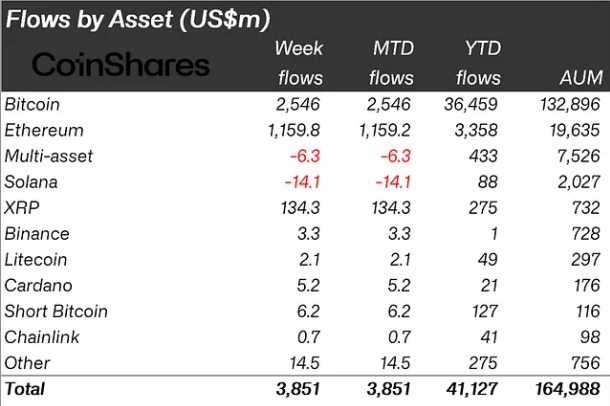

Last week saw an unprecedented spike in crypto inflows, totaling an impressive $3.85 billion. This figure exceeds the prior record that was established merely weeks before.

This monumental activity has propelled the total year-to-date (YTD) inflows to $41 billion.

Bitcoin Leads the Charge As Crypto Inflows Approach $4 Billion

Last week, Bitcoin (BTC) spearheaded the inflows, contributing approximately $2.5 billion. This adds up to an astounding $36.5 billion year-to-date. The continuous bullish trend has investors anticipating additional growth, with some experts even speculating a potential reach of $100,000 during this cycle.

Recently, there has been an inflow of approximately $6.2 million into short-term Bitcoin investment products. This is a pattern that typically follows significant price surges in Bitcoin. As stated by James Butterfill in the latest CoinShares report, this trend indicates a careful approach from investors, as many are reluctant to wager against Bitcoin’s present robustness.

Recently, Ethereum garnered attention by receiving its highest weekly investment of $1.2 billion ever. This surpasses the enthusiasm during the introduction of Ethereum ETFs (exchange-traded funds) in July. These substantial investments indicate a growing belief in Ethereum’s future prospects, especially as it solidifies its position within decentralized finance (DeFi) and non-fungible token (NFT) environments.

Meanwhile, it seems that Ethereum’s growth is causing a setback for rivals such as Solana (SOL). Last week alone, Solana experienced $14 million in withdrawals, making it the second consecutive week of losses. This trend suggests that investors are becoming less interested in altcoins.

Institutions such as BlackRock, who have postponed plans for altcoin ETFs and instead chosen to focus on products based around Bitcoin and Ethereum, have solidified the market’s inclination towards these assets. The substantial inflows indicate a wider pattern of institutional fascination with digital currencies.

Companies such as MicroStrategy and BlackRock are leading the charge in this trend. BlackRock’s ongoing provision of a Bitcoin spot ETF is significantly boosting market enthusiasm.

In a market that’s becoming more competitive by the day, it’s Bitcoin and Ethereum that are attracting most of the investment dollars. However, doubts linger about the future of lesser-known cryptocurrencies. The recent outflow from Solana might indicate tougher times ahead for smaller blockchain networks, especially since institutional investors seem to be flocking towards the market leaders.

Investor Sentiment: Profits and Strategies

In other studies, ResearchExchanges’ latest findings highlight the effects that Bitcoin reaching $100,000 had on American cryptocurrency investors. The survey of 719 participants showed a range of feelings, tactics, and predictions after this significant achievement.

Approximately half (48%) of the survey participants acknowledged that they missed out on significant profits during Bitcoin’s price increase and expressed remorse for not acting sooner. Nearly one-third (31%) felt it was still possible to invest, while a smaller group (15%) claimed success in correctly timing their investments to meet their financial objectives. A minority (6%) shared that they were indifferent towards Bitcoin during its growth period.

The survey revealed that a vast majority (83%) of investors garnered less than $10,000 during the bull run, whereas merely 2% managed to amass more than $1 million. This data underscores the scarcity of significant profits and emphasizes the significance of precise timing and strategic planning in investing.

The survey additionally revealed that a significant majority of 72% of respondents consider cryptocurrency as a significant investment for the future. Furthermore, about 43% of participants showed more trust in the market, whereas 29% maintained a guarded optimism due to underlying risks. At the same time, 7% displayed low confidence, indicating apprehension over its volatile nature.

Approximately two-thirds (67%) of the survey participants stated they’re keeping their investments for long-term benefits, while around one-fifth (18%) are opting to spread their wealth across various investment options. A small portion (10%) decided to liquidate all their assets, and a relatively smaller group (5%) used their earnings to invest in alternative cryptocurrencies, demonstrating a growing curiosity about blockchain technology beyond Bitcoin.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2024-12-16 18:17