As a seasoned researcher with over a decade of experience in the financial markets, I have witnessed firsthand the ebb and flow of various asset classes. However, nothing quite compares to the meteoric rise of Bitcoin (BTC) and its relentless pursuit of new records.

Today, Bitcoin (BTC) made a notable advance, soaring past the $106,000 level during early trading in Asia. With this price increase, the value of one Bitcoin compared to an ounce of gold has also hit a fresh high.

Although Bitcoin’s price dropped by 2% from its latest peak, there’s still a strong positive momentum in the market.

Bitcoin Outperforms Gold

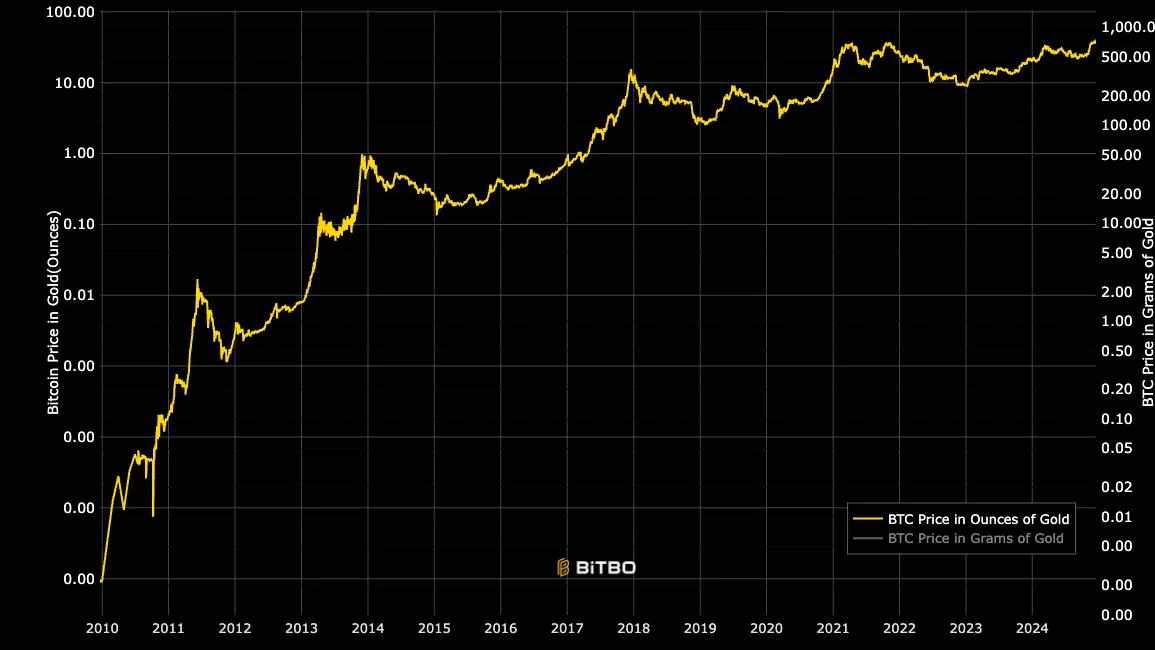

On Monday morning during the Asian trading period, the price of Bitcoin hit an unprecedented record high of $106,533 due to increased trading action. This surge in value pushed the Bitcoin-to-gold exchange rate to its maximum at approximately 40 gold ounces per Bitcoin.

The BTC-to-gold ratio compares the price of one Bitcoin to the price of gold, expressed in ounces. It measures how much BTC is worth in relation to a specific amount of gold, offering insight into Bitcoin’s relative value against the traditional store of value, gold.

As the comparison between Bitcoin’s value and gold’s value increases, it suggests that investors are growing more confident in Bitcoin as a valuable investment asset.

As an analyst, I recently came across a prediction by the well-respected trader, Peter Brandt, in a post dated December 16th. He suggested that the ideal ratio for the value of one Bitcoin compared to one ounce of gold could potentially reach 89:1, implying that it might require 89 ounces of gold to acquire one Bitcoin.

Speaking about factors contributing to Bitcoin’s surge, the on-chain analysis platform Santiment pointed out in a recent post that the continuous accumulation of Bitcoin by large investors, or “whales,” is primarily responsible for driving its price increase.

For the first time ever in its over sixteen-year lifespan, Bitcoin has surged to $106,500. Since the bullish trend started on October 10th, there’s been a notable rise of 1,582 additional wallets containing at least 100 Bitcoins, which represents an increase of approximately 9.9% in a short span. This information was shared by the data provider.

BTC Price Prediction: A New High Could Be In Sight

Currently, Bitcoin is being traded for approximately $104,567, slightly lower than its latest resistance level set at the recent peak price of $106,533. If large Bitcoin holders (often referred to as “whales”) intensify their buying activities, it’s likely that the price will surpass this high and head towards a new record high.

Conversely, should Bitcoin’s profit-driven activity intensify, its current advance could reverse and plummet to approximately $94,344. If this support level becomes fragile, the coin might dip even lower, trading around $84,776.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2024-12-16 16:45