As a seasoned crypto enthusiast with years of experience under my belt, I find myself constantly intrigued by the ever-evolving landscape of digital assets. This week’s news is a veritable smorgasbord of developments that have caught my attention.

This week is shaping up to have significant developments in the world of cryptocurrency. Notable occurrences include advancements within the Fantom system, the anticipated launch of the Stacks network, new project releases and airdrops, as well as crucial token release events.

As an analyst, I would advise that one should contemplate tweaking their investment approach, taking into account recent events, to seize potential opportunities arising from market volatility.

Sonic Layer-1 Mainnet Launch

In simple terms, Sonic Labs (previously known as Fantom) recently achieved an important milestone by creating the initial block for its new blockchain system, which is a significant stride towards the launch of its primary network. The team has consistently stated that they aim to release their Layer-1 mainnet in December.

On this Sonic-named EVM platform, developers can anticipate appealing rewards and robust facilities. The enthusiasm for Sonic’s airdrop, along with these expectations, fuels the growing curiosity surrounding the network.

Specifically, their initial blockchain will be made publicly accessible shortly following the distribution of the s-tokens (airdrop). As the mainnet launch is imminent, the Sonic community is abuzz with anticipation.

Avalanche9000 Upgrade

On Monday, December 16th, the Avalanche ecosystem is scheduled to undergo an update known as Avalanche9000. This update aims to significantly decrease the cost of deploying the Avalanche L1 blockchain by a staggering 99.9%. Additionally, it will lower transaction costs on the existing C-Chain by a massive 25 times.

The Avalanche9000 testnet also introduces Retro9000, a $40 million retroactive grant program, including $2 million in referral rewards. This is intended to support developers building on Avalanche.

The recent growth of Avalanche is a clear sign of investor confidence in its technology, as demonstrated by a $250 million investment from Galaxy Digital, Dragonfly, ParaFi Capital, and others. The complete rollout of Avalanche9000 is scheduled for Monday, December 16th, with the upcoming mainnet upgrade expected to improve scalability, simplify development processes, and provide developers with advanced tools for creating decentralized applications – a point emphasized in a recent project blog post.

Stacks sBTC Release

This coming Tuesday, December 17th, an important crypto event takes place with the launch of sBTC by the Stacks (STX) network. sBTC is a Bitcoin-backed asset that operates on the Stacks platform in a trust-minimized manner, providing a 1:1 equivalent to Bitcoin. Its release will allow for BTC liquidity within DeFi protocols on Stacks and offer new possibilities for generating Bitcoin returns.

Additionally, sBTC (wrapped Bitcoin) could potentially speed up the Bitcoin network’s progress towards matching Ethereum‘s DeFi Total Value Locked (TVL), currently exceeding $120 billion.

As a forward-thinking crypto investor, I’m excited about the upcoming launch that allows me to deposit Bitcoins for yield generation and contribute to DeFi within the Stacks ecosystem. This integration not only boosts liquidity but also unlocks fresh financial possibilities, similar to those offered by Zest Protocol.

Gain additional Zest points! By simply holding sBTC, users receive a 5% return, courtesy of the Stacks Rewards Program. On top of that, users can boost their earnings even further using sBTC through the Zest Protocol.

DEAI Listing, Airdrop, and Partnerships

Zero1 Labs is blazing a trail towards the future of decentralized artificial intelligence by utilizing an innovative platform that employs fully homomorphic encryption (FHE). This groundbreaking technology guarantees data confidentiality and security, enabling AI applications to work with encrypted data without disclosing sensitive details. The native token, DEAI, streamlines transactions within this environment, establishing a smooth economic foundation for AI systems.

As a crypto investor, I’m excited about the upcoming listing of the DEAI token on OKX, a tier-one centralized exchange. Not only that, but the network has plans for its first airdrop for token stakers. Furthermore, there’s buzz around potential new partnerships, with rumors swirling about three collaborations, including one with the Sei ecosystem to foster advancements in decentralized AI innovation.

This month, Zero1Labs is thrilled to announce the addition of two prominent partners who will be working with up-and-coming AI teams at an early stage. These well-known entities hail from both the Web 2 and Web 3 AI sectors,” says Zero1Labs.

Cosmos (ATOM) Announcement

As a researcher focusing on the Cosmos ecosystem, I’m keeping a close eye on upcoming developments this week. The Cosmos team has announced three significant updates scheduled between December 17 and 19. One of these announcements is anticipated to shed light on the function of their native token, ATOM, within their system.

The process of cosmic expansion is now underway, driven by a shared vision, empowered leadership, and a revitalized emphasis on progress. Keep an eye out for our upcoming ‘3 Spaces’ in the coming week, as well as more detailed explorations.

The upcoming developments are based on the significant transformations that occurred on the Cosmos network in the past week. One of the key occurrences was Skip becoming part of the Interchain Foundation, now known as Interchain Inc. This partnership combines the strategic planning and implementation efforts of both the Interchain Stack and Hub, aiming to accelerate growth for Cosmos.

LayerZero’s Fee Switch Proposal

In other locations, the LayerZero fee switching proposition is set to become active this coming Friday, December 20. This provides community participants with an opportunity to cast their votes regarding the protocol’s fee structure.

On December 20, 2024, at midnight UTC (Coordinated Universal Time), ZRO holders will cast their votes on whether to activate or keep inactive the LayerZero protocol fee. If they vote “Yes,” it means they agree to activate the fee. If they vote “No,” it indicates they prefer to keep the fee inactive. The voting period ends on December 27, 2024, at midnight UTC, as announced by the LayerZero Foundation.

For the very first time, we’re facing a referendum about transitioning to a fee system for transactions. The outcome of this vote will decide if LayerZero implements a charge for each message sent through its protocol. Notably, this decision is made on-chain every half year, empowering ZRO holders to choose whether or not to activate the transaction fee.

In simpler terms, the fee charged for every LayerZero message verification and execution is referred to as the protocol fee. This fee comprises both DVN and Executor fees. The network collects these fees and uses them to buy back and destroy ZRO tokens, thereby lowering the amount of ZRO in circulation. This information was shared in a Medium post by the network.

Based on the statement, if the required number of attendees (quorum) isn’t met, the percentage of the total circulating supply needed for each subsequent vote will be reduced by 5%. This reduction continues until it reaches a minimum of 20%.

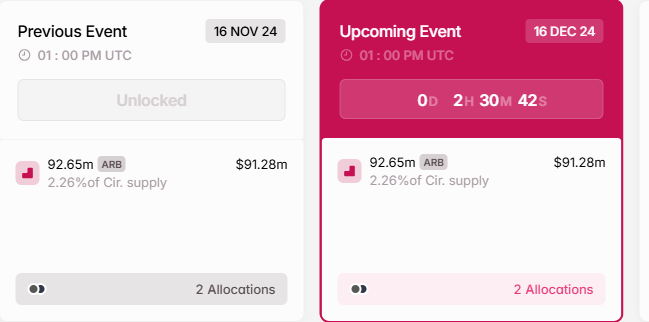

Arbitrum Token Unlock

This week, there could be some fluctuations in the Arbitrum network, as approximately 92.65 million ARB tokens are set to be released on Monday at 1:00 PM UTC. These tokens, worth around $91.15 million, make up over 2% of ARB’s current supply and will be distributed among investors, the team, and advisors associated with the project.

Prepare for potential market turbulence since token releases tend to be followed by negative price movements for traders and investors. A recent report from BeInCrypto shares insights from KeyRock Research about this impact on cryptocurrency prices.

Coinbase WBTC Delisting

In November, Coinbase disclosed their intention to halt the trading of WBTC as of December 19. This decision was based on a thorough examination, with the expectation that their primary Bitcoin packaging service, cbBTC, might soon become more prominent.

On December 19, 2024, Coinbase plans to temporarily halt trading for Wrapped Bitcoin (WBTC) around midday Eastern Time. Don’t worry, your WBTC funds will still be accessible to you and you can withdraw them whenever you want. We have shifted our WBTC trading platform to a mode where only limit orders are allowed. This means you can place or cancel limit orders, and matches may occur.

Prior to the delisting, Bit Global filed a lawsuit against Coinbase last Friday over Coinbase’s suspension of the Wrapped Bitcoin token. The lawsuit alleges that Coinbase’s action constitutes a violation of antitrust laws, leading to Bit Global seeking $1 billion in damages.

“cbBTC already up to 8.7% of the collateralized BTC market since launching 3 months ago The $1b lawsuit post the wBTC Coinbase delisting tells you everything you need to know. cbBTC will flip wBTC, just a matter of when not if,” a DragonFly XYZ investor quipped.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

2024-12-16 16:25