As a seasoned investor with a penchant for technology and a keen eye for market trends, I found BlackRock’s report on Bitcoin both enlightening and cautionary. Having witnessed the tech boom of the late ’90s and the dot-com bubble burst, I can appreciate the unique opportunities that Bitcoin presents while also understanding the risks associated with it.

In the December 12th report titled “Bitcoin Allocation in Portfolios: An Analysis,” BlackRock pointed out that investing this percentage amount in Bitcoin could potentially carry a risk level equivalent to investing in top technology companies such as Amazon, Microsoft, and Nvidia. These firms are part of what the report terms as the “Notable 7,” a collection of prominent tech titans.

The report warns against exceeding this suggested range, stating that larger allocations could drastically increase Bitcoin’s risk contribution to a diversified portfolio. While Bitcoin offers unique opportunities, investors must tread carefully when deciding how much of their portfolio to commit.

Bitcoin’s Value Hinges on Adoption, Not Cash Flows

As a researcher, I’ve recently found myself delving into the world of Bitcoin. Contrary to conventional valuation methods that rely on cash flows to estimate future returns, my focus has shifted towards Bitcoin. This is because, unlike traditional assets, Bitcoin doesn’t produce cash flows.

The report suggests that investing in Bitcoin could offer an additional, varied source of profit,” the company notes. Over prolonged periods, they suggest, Bitcoin’s connection with significant risk assets might lessen because of its unique factors influencing value. This unusual setup could make Bitcoin an attractive safeguard against specific risks, much like gold.

On the other hand, BlackRock warns that as Bitcoin’s adoption expands, its risk characteristics may lessen, resulting in fewer significant factors influencing its price. Over time, it could transition from being a source of high returns to a more strategic investment choice.

2024 saw a notable increase in institutional interest towards Bitcoin, primarily fueled by the rising trend of Bitcoin Spot Exchange Traded Funds (ETFs). Launched in January, these ETFs amassed over $100 billion in total assets by November, symbolizing a significant achievement.

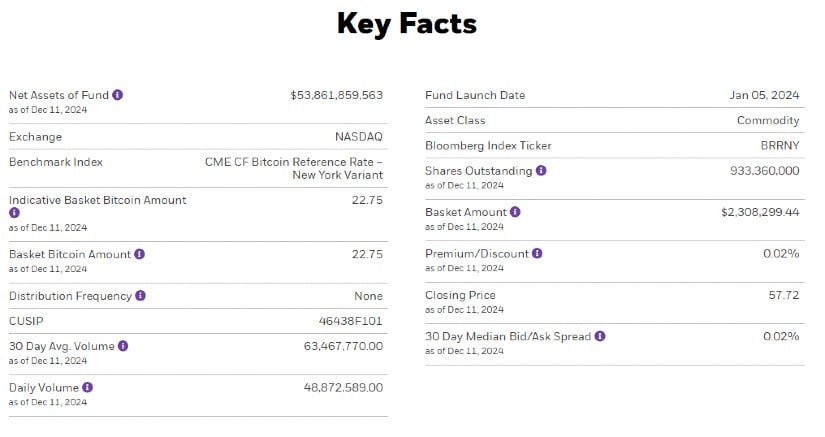

The largest Bitcoin exchange-traded fund (ETF) offered by BlackRock’s iShares Bitcoin Trust (IBIT), with a net asset value of around $54 billion, holds almost 1.104 million Bitcoins collectively. All spot Bitcoin ETFs combined now oversee more than the amount of Bitcoin owned by the mysterious creator of Bitcoin, Satoshi Nakamoto. Specifically, BlackRock’s ETF controls approximately 529,000 Bitcoins that are kept safe by Coinbase Custody.

Institutional involvement is significantly altering the crypto market terrain. According to Sygnum Bank’s forecast, even minor institutional investments could trigger “demand surges” by 2025, possibly pushing Bitcoin prices up. These trends suggest a dynamic environment in which institutional entities hold considerable power and influence.

Trump’s Crypto-Friendly Stance Adds Momentum

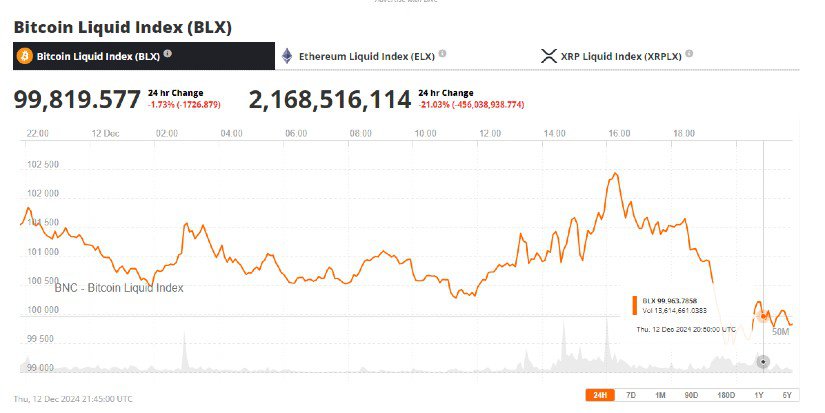

The increase in Bitcoin’s value (reaching over $100,000 for the first time) occurs concurrently with a significant political change. Donald Trump, known for his favorable stance towards cryptocurrency, was elected as U.S. president last month. At this moment, Bitcoin is being traded at $99,819, representing a 1.71% rise in the past day, as per Brave New Coin’s Bitcoin Liquid Index.

Under the current pro-crypto government, the broader cryptocurrency market is experiencing renewed credibility. Institutions such as Goldman Sachs, which currently hold approximately $1 billion in Bitcoin ETF shares, have shown a desire to increase their involvement. This interest stems from anticipation of regulatory clarity.

On a local scale, states such as Alabama and Pennsylvania are investigating legislation to set up Bitcoins as part of their official reserves. On a global level, various nations including the United States, Brazil, and Canada are said to be contemplating similar legislative actions to incorporate Bitcoin within their national strategic reserves.

Still, the report underscores the importance of moderation. A 1-2% allocation, while modest, reflects Bitcoin’s volatility and the uncertainty surrounding its adoption trajectory. Going beyond this range might expose portfolios to disproportionate risk.

Is it possible that Bitcoin will maintain its rising trend while preserving its distinctive character, given the increasing interest from institutions and a more favorable stance towards cryptocurrencies by governments? The circumstances appear to be conducive for Bitcoin to establish itself as a significant player within traditional finance.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Summer Game Fest 2025 schedule and streams: all event start times

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

2024-12-15 15:18