As a seasoned crypto investor with a decade of experience under my belt, I find the Texas proposal to establish a strategic Bitcoin reserve as an exciting and promising development. My journey into cryptocurrencies began during the early days of Bitcoin’s inception, when it was still considered a fringe investment by many. Seeing such a forward-thinking state like Texas embrace digital assets is not only a testament to their innovative spirit but also a powerful step towards mainstream adoption.

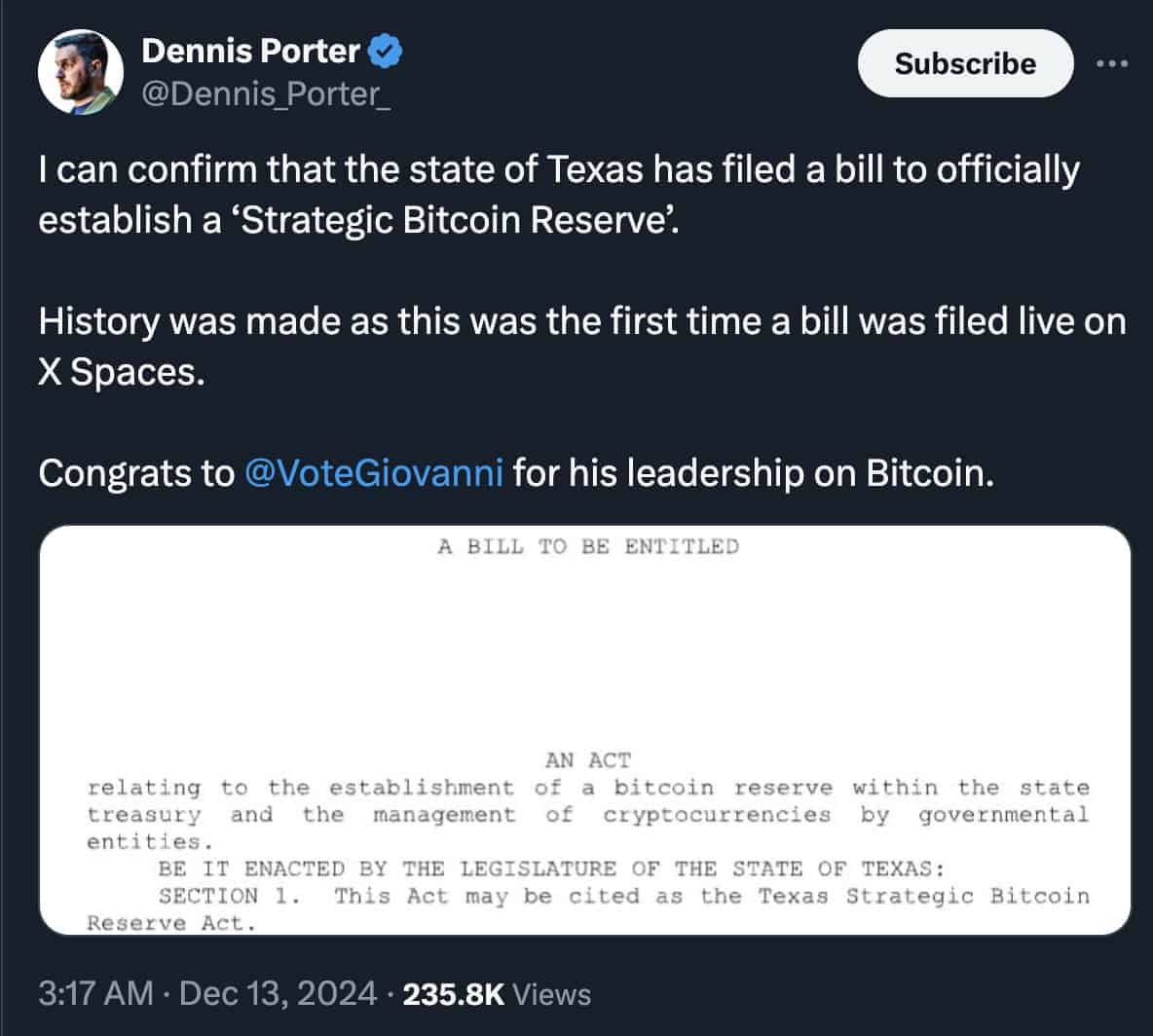

A fresh bill put forth in the Texas legislature intends to create a tactical Bitcoin reserve, making the state a pioneer in adopting digital currencies. Representative Giovanni Capriglione presented this proposal, H.B. No. 1598, on Thursday, mirroring increasing enthusiasm for Bitcoin not just within the state but also at a national level.

What’s in the Bill?

The law suggests that Texas should create a Bitcoin savings account kept in an offline vault, known as cold storage, for enhanced security against cyber attacks. This reserve would be left untouched for at least five years as part of a long-term investment strategy. Additionally, the bill permits Texas residents to make optional contributions to this fund, thus increasing the integration of Bitcoin into state financial planning.

The bill asserts that a strategic Bitcoin reserve supports Texas’s goal of promoting innovation in digital currencies and improving the financial safety of its residents.

The reserve is intended solely for domestic transactions, avoiding dealings with international entities or individuals engaged in unlawful activities, demonstrating a commitment to local advantages and adherence to regulatory standards.

Addressing Inflation and Financial Security

At a live broadcast on Spaces, Capriglione clarified the reasons behind the bill, highlighting Bitcoin’s possible role as a safeguard against inflation. “Inflation might just be the greatest threat to our investments,” he remarked, also mentioning that the concept of a Bitcoin reserve has been under development for quite some time.

Originally introduced as a decentralized payment system in 2009, Bitcoin has since transformed into a highly valued asset for storage. Its supporters claim it offers protection against inflation, much like gold. The incoming President, Donald Trump, has suggested Americans should hold onto their Bitcoins, aligning with a growing trend to incorporate cryptocurrency into financial reserves.

Bitcoin’s Momentum in Texas and Beyond

Texas is now a significant center for Bitcoin-related activities, luring miners due to its low-cost energy and government initiatives aimed at strengthening the power grid’s stability. By creating a Bitcoin reserve, Texas could reinforce its status as a pioneer in blockchain technological advancements.

Across the nation, the concept of a centralized Bitcoin storage system, known as a “Bitcoin reserve,” is becoming increasingly popular. This year, Senator Cynthia Lummis from Wyoming, who is commonly referred to as the “Bitcoin Senator,” put forth a proposal for a federal Bitcoin reserve. It’s worth noting that the U.S. government currently owns over 198,000 Bitcoins, which equates to more than $20 billion, and these were seized from criminal activities, according to information provided by Arkham Intelligence.

After Trump’s election victory, Capriglione observed a significant rise in curiosity towards Bitcoin and blockchain technology. The president-elect had been vocal about his support for cryptocurrency, leading to this surge of interest. “Ever since November,” he said, “there has been a growing enthusiasm and understanding not only about the Bitcoin reserve, but also about blockchain and related technologies among lawmakers. This is beneficial because it reflects the concern of constituents on these matters.

The Future of Bitcoin Reserves

As a crypto investor, I’m excited about the potential impact of the Texas bill. If it gets passed, other states might follow suit, and Texas could lead the way as a pioneer in financial innovation. Embracing Bitcoin as part of our financial strategy would reinforce our progressive image and show courage in navigating changing economic terrains. This move could be another significant stride towards mainstream Bitcoin acceptance, possibly paving the way for broader national adoption.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

2024-12-14 17:40