As a seasoned crypto investor with a keen eye for market trends, I find MicroStrategy’s inclusion in the Nasdaq-100 Index nothing short of revolutionary. Having witnessed the meteoric rise of Bitcoin and its impact on various sectors, this move signifies a major leap forward for institutional acceptance of cryptocurrencies.

The biggest publicly traded company owning Bitcoin, MicroStrategy, is now included in the Nasdaq-100 Index for the first time.

Reaching this landmark underscores the increasing importance of our company, driven by a substantial increase in its share price, mirroring Bitcoin’s dramatic rise in value during 2021.

MicroStrategy’s Nasdaq-100 Debut Marks a Crypto Milestone

MicroStrategy has been added to the index after the departure of Illumina, Super Micro Computer, and Moderna. Additionally, Palantir Technologies and Axon Enterprise will also be part of the index. The implementation of these changes is scheduled to occur prior to the market opening on December 23rd.

The Nasdaq-100 tracks the top 100 non-financial firms listed on the Nasdaq exchange, featuring giants like Apple, Microsoft, Tesla, and Nvidia. The addition of MicroStrategy to this elite group signals a growing institutional acknowledgment of crypto-related companies.

Starting today, investment funds that mirror the Nasdaq-100, like Invesco QQQ, are adding MicroStrategy to their holdings. This decision might boost MicroStrategy’s presence in passive investment schemes and further tie its performance to that of Bitcoin.

Financial analysts consider this development crucial. Rajat Soni pointed out that MicroStrategy’s stock gains from Bitcoin’s rising trend, establishing a loop where growing passive investments might strengthen its capacity to raise funds. This additional capital empowers the company to buy more Bitcoin, which could potentially cause further increases in the cryptocurrency’s price.

When Bitcoin’s value increases, so does MicroStrategy’s stock price, along with its position within the NASDAQ. This implies that there is an increase in investment towards its stock, resulting in a greater influx of passive capital into MSTR. With this increased allocation, MicroStrategy can potentially issue more debt and purchase additional Bitcoin. (Soni’s statement paraphrased)

Nevertheless, it’s important to exercise caution since MicroStrategy could potentially be reclassified as a financial entity by March. This reclassification, suggested by Bloomberg ETF analyst James Seyffart, might lead to the company being taken out of the index. The reason for this risk is that MicroStrategy heavily relies on Bitcoin for its valuation instead of its primary business activities.

MicroStrategy’s focus has shifted significantly towards Bitcoin, with it now accounting for a large portion of their treasury assets. At present, they hold more than 423,650 Bitcoins, which translates to an estimated value of around $43.18 billion. Strikingly, about 40% of this total was purchased just last month, underscoring their determined approach towards amassing cryptocurrency.

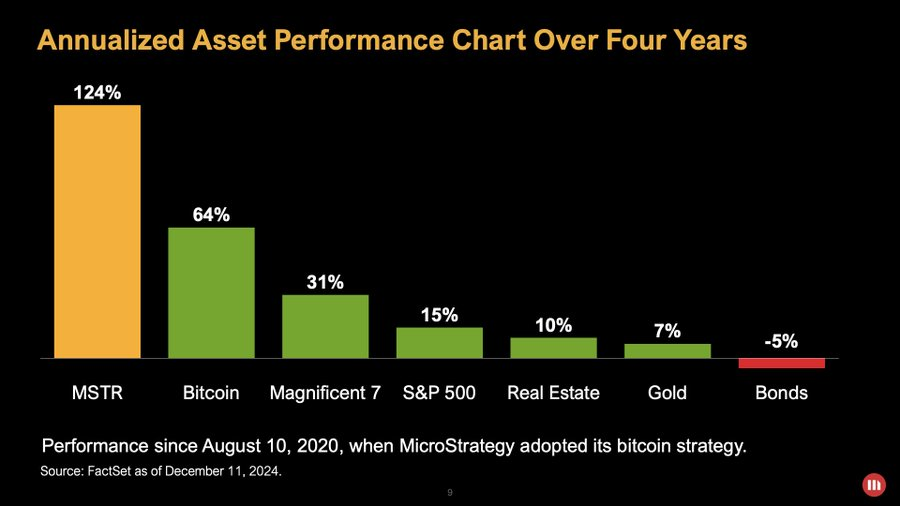

Currently, Executive Chair Michael Saylor credits MicroStrategy’s prosperity to its strategic emphasis on Bitcoin. Over the last four years, MicroStrategy’s shares have skyrocketed by 124%, exceeding the performance of significant indices such as the S&P 500.

Saylor underscores that Bitcoin integration has fortified their competitive advantage, thereby consolidating their status as a pioneer within the rapidly changing financial landscape.

Read More

- VVAIFU PREDICTION. VVAIFU cryptocurrency

- QANX PREDICTION. QANX cryptocurrency

- Taylor Swift vs. Ariana Grande: What is The Fan War Surrounding Sabrina Carpenter All About, Let’s Find Out

- Taylor Swift Announces Official Eras Tour Book And THIS Version Of TTPD On Good Morning America

- NPC PREDICTION. NPC cryptocurrency

- Get Paid to Expose Fraud: : A Simple Guide to SEC Whistleblower Payouts

- DanMachi Season 5 Episode 1: Release Date, Where To Stream, Expected Plot And More

- Sebastian Stan Remembers the STAR TREK and GREEN LANTERN Roles He Really Wanted

- 28 Years Later Trailer Reveals Evolved Zombies and THIS Actor’s Return; Watch

- Holiday Calm to Ignite Bitcoin Rally? Traders Signal Bullish Breakout

2024-12-14 14:42