As a seasoned crypto investor with a decade of experience under my belt, I find Riot Platforms’ recent acquisition of 5,117 BTC for $510 million nothing short of impressive. This strategic move aligns perfectly with the trend of viewing Bitcoin as a valuable corporate reserve asset, and it mirrors the bold steps taken by companies like MicroStrategy and Marathon Digital.

Bitcoin miner Riot Platforms has significantly expanded its BTC holdings. As of December 12, it acquired 5,117 BTC for $510 million. This purchase, at an average price of $99,669 per Bitcoin, brings Riot’s total holdings to 16,728 BTC.

The purchase was financed using funds generated from the company’s 0.75% convertible senior notes maturing in 2030, as well as money from its current savings.

Riot’s Bitcoin Holdings Reach 16,728 BTC

Riot’s latest purchase of Bitcoin underscores a wider pattern whereby Bitcoin is increasingly being viewed as a vital strategic reserve. Many businesses and even governments have been adopting this approach in their recent financial strategies.

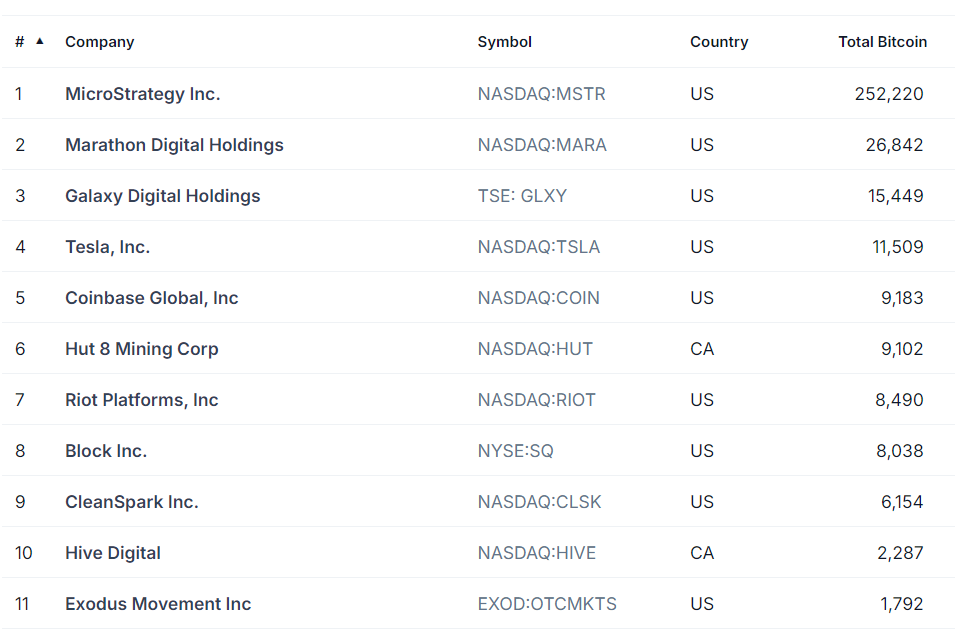

MicroStrategy, a trailblazer in adopting Bitcoin for corporate treasury reserves, currently possesses more than 423,650 Bitcoins. Over the past few months, from November onwards, this company has invested significantly in Bitcoin, accumulating a total worth of approximately $15 billion.

In a similar vein, Marathon Digital now holds approximately 40,435 Bitcoins, making it a significant player in the field of digital asset mining and storage.

Governments are considering Bitcoin as a potential form of reserve currency. In fact, Pennsylvania has proposed a bill called the Bitcoin Strategic Reserve Act, which suggests setting aside up to 10% of its $7 billion in state funds as an investment in Bitcoin.

Texas is contemplating laws that could enable tax payments using Bitcoin. Meanwhile, Bhutan has been covertly mining Bitcoin since 2019, accumulating approximately 12,000 Bitcoins. In recent news, the city of Vancouver has approved a proposal to establish a Bitcoin reserve, and a Russian legislator has submitted a similar proposition in Moscow.

These instances demonstrate a rising belief in Bitcoin’s potential as both a depository for wealth and a means to counteract inflation. A 2024 analysis indicates that there is factual data backing up this idea; however, as more people adopt it, its role as a store of value could potentially decrease over time.

As a crypto investor, I’ve come across some fascinating findings by researcher Harold Rodriguez. His study, based on data spanning from August 2010 to January 2023, suggests that Bitcoin’s returns surge notably following a positive inflationary event, supporting the idea that Bitcoin could function as an inflation hedge.

Nonetheless, Riot Platforms’ decision to dedicate substantial resources to Bitcoin holdings signals confidence in the cryptocurrency’s future and its strategic alignment with a global shift toward digital reserve assets.

In a similar turn of events, the active shareholder Starboard Value has gained a substantial portion of shares in Riot Platforms. Now, Starboard is urging Riot to transform certain Bitcoin mining sites into massive data centers, catering to demanding computing clients.

Riot has confirmed that they are having continuous talks with Starboard, highlighting their efforts aimed at increasing the company’s value for its shareholders.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

2024-12-13 22:01