As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market volatility and options expirations. Today, we have nearly $3 billion in Bitcoin (BTC) and Ethereum (ETH) contracts set to settle or renew, which undeniably calls for close attention.

Today marks the day for settlement or renewal of approximately $3 billion worth of Bitcoin (BTC) and Ethereum (ETH) contracts in the crypto options market. The crypto markets have experienced a surge in recent weeks, often referred to as the “Trump rally”. However, will this momentum continue?

As an analyst, I find myself keenly watching the current market trends, for the expiration of cryptocurrency options can frequently trigger significant price fluctuations that demand close attention from traders and investors alike.

$2.72 Billion Bitcoin and Ethereum Options Expiring

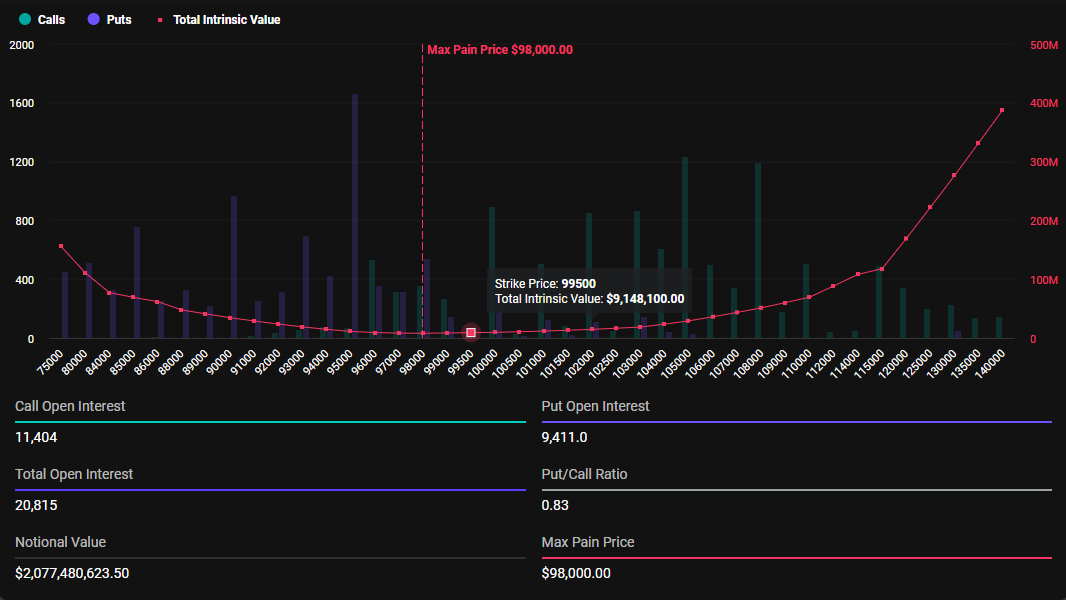

Today marks the expiration of about 20,815 Bitcoin derivative contracts, collectively worth approximately $2.077 billion. This suggests that traders have been preferring to purchase more long contracts (calls) compared to short ones (puts), as the put-to-call ratio currently stands at 0.83.

The price that triggers the most losses for the majority of asset holders is approximately $98,000. It’s worth mentioning that this figure is slightly below the present market price, which stands at $99,758.

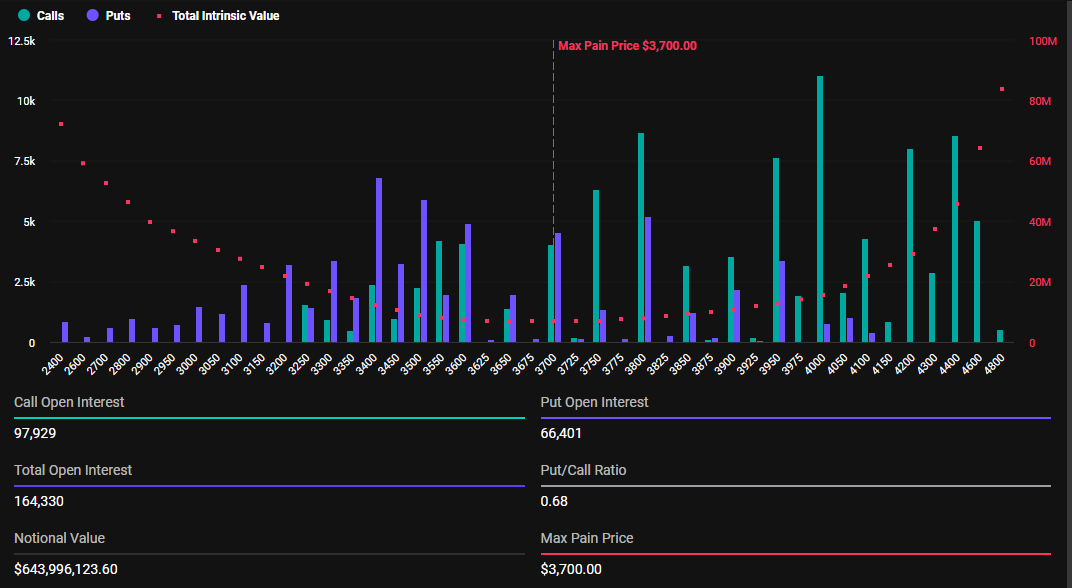

Today marks the expiration of approximately 164,330 Ethereum options contracts, equating to a total value of about $644 million. The ratio of put options to call options stands at 0.68, suggesting that traders are preferring to buy more long contracts than short ones, much like the trend observed with Bitcoin.

Greek’s analysis suggests that this current market week has seen significant corrections, contrasting last week’s milder adjustments for Bitcoin and steeper adjustments for alternative cryptocurrencies. As we get closer to Christmas and the end of the year, market players seem to be shifting their positions.

Greece Live stated that a larger portion of recent Block call options trading exceeded 30% on a daily average. In contrast to past years, the trading activity during the Christmas season in Europe and the U.S. has noticeably decreased. However, this year, there’s been an increasing impact of US stocks on cryptocurrencies, which seems more prominent.

This brings up the query: Will we see a surge in prices associated with Christmas this month, given that the market shows signs of further divergence again? At present, Bitcoin hovers below the $100,000 mark, while Ethereum fluctuates slightly below $4,000.

Over the past fortnight, the behavior of options market data suggests that market participants are adopting a more conservative approach. This is due to an uptick in the primary term implied volatility (IV), which has been observed amid significant market swings. In light of these conditions, analysts at Greeks.live propose that options are particularly advantageous for short-term trading strategies.

“…the cost-effective way to buy options is still very high,” they added.

During this period, the expiring options follow a turbulent week from an economic standpoint in the United States. Inflation increased to 2.7% in November, while the core Consumer Price Index (CPI) stayed high at 0.3%. Although a Federal Reserve rate cut is expected, persistent inflation makes it difficult for continued monetary loosening.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 30 Best Couple/Wife Swap Movies You Need to See

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-12-13 08:49