As a seasoned researcher who has navigated through multiple crypto market cycles, I’ve learned to read between the lines of technical indicators and market sentiment. The surging Ethereum buy orders and positive funding rate are clear signs that the bulls are strengthening their grip on the market.

The value of Ethereum has been finding it tough to surpass the symbolic $4,000 mark since it reached its peak for the year so far ($4,093) on December 6th.

However, market participants continue to accumulate the leading altcoin despite broader market consolidation. This increases the likelihood of a break above the $4,000 price level in the near term. This analysis details why.

Ethereum Buy Orders Surge

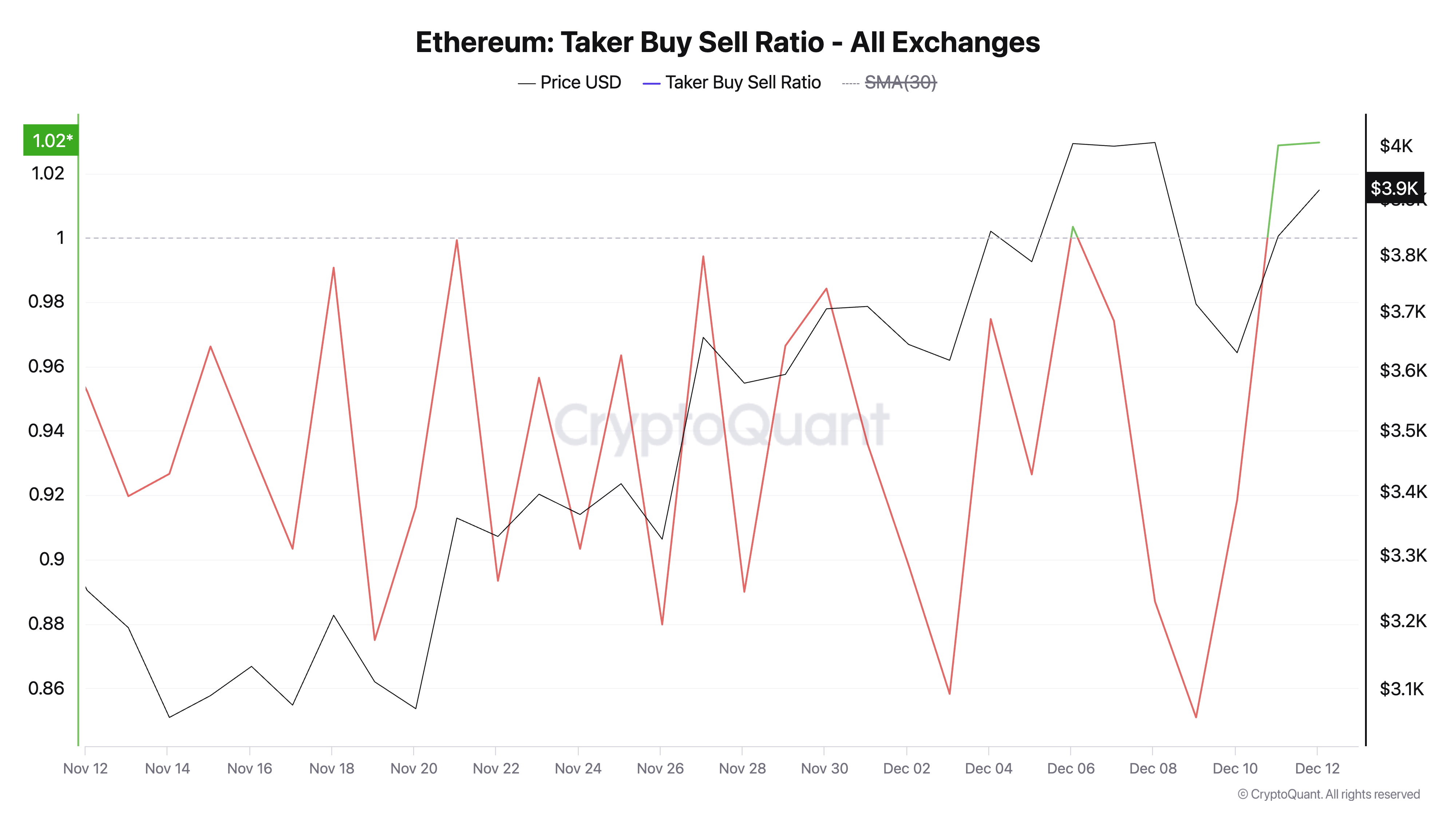

As an analyst, I’ve noticed a significant uptick in the Taker Buy-Sell Ratio for Ethereum, reaching a monthly peak of 1.033. This surge suggests a notable increase in buy orders within the coin’s derivatives market, indicating potential bullish sentiment among traders.

This measure provides understanding about an asset’s market mood and possible price movement by examining how often market makers fill buy orders compared to the frequency they fill sell orders.

Expressing it in a more conversational style: When the ratio exceeds 1, it indicates a positive or ‘bullish’ outlook on the market. This is because buyers are ready to pay the asking price, showing a rise in demand for the asset. Essentially, this higher demand creates stronger buying pressure, which might suggest that the underlying asset’s price could increase, potentially leading to an upward trend.

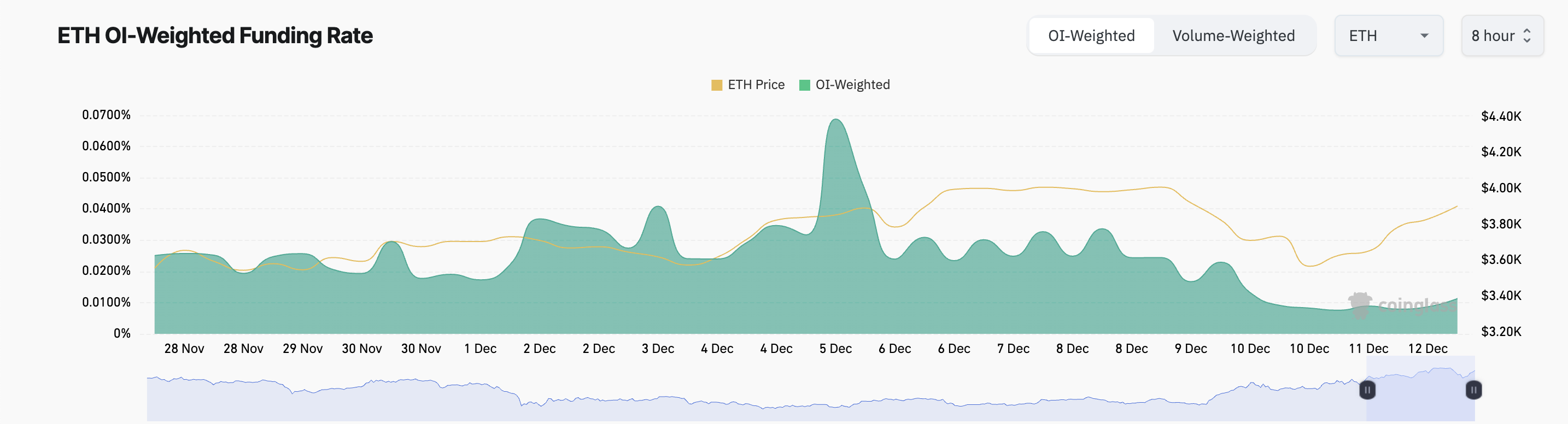

Significantly, the coin’s favorable funding rate reinforces its optimistic trajectory. Currently, Ethereum’s combined funding rate across various crypto platforms is approximately 0.011%.

The funding rate is a regular payment made among traders in ongoing futures contracts, aimed at adjusting the contract price to match the current market value of the underlying asset. When the funding rate is positive, long traders (those who bet on the asset increasing in value) are paying short traders (those who bet against it), suggesting that more traders want to hold long positions. This often reflects a bullish outlook in the market, as investors are prepared to pay extra to maintain their long positions.

ETH Price Prediction: The Bulls Strengthen Their Control

On a day-to-day graph, Ethereum’s increasing On-Balance Volume indicates its consistent buying activity. At present, the reading on the momentum indicator is 26.06 million.

This tool relies on the measurement of volume flow to forecast price adjustments for an asset. An increasing OBV (On-Balance Volume) indicates robust buying interest, which implies that the majority of the trading activity is fueled by buyers, frequently signaling a possible increase in the asset’s price due to strong bullish sentiment.

If Ethereum buyers continue to hold their ground, they could potentially drive up the value beyond $4,000 towards its year-to-date peak at $4,093. Conversely, if the current trend shifts, there’s a possibility that the price of Ethereum might drop significantly to $3,673, which would challenge the bullish outlook for the cryptocurrency.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Franklin Templeton’s 2025 Crypto Predictions: BTC Reserves, Crypto ETFs, and More

- ANDOR Recasts a Major STAR WARS Character for Season 2

- USD CAD PREDICTION

2024-12-13 03:36