As a seasoned cryptocurrency analyst with over a decade of experience navigating the ever-evolving digital asset landscape, I find myself intrigued by Miles Deutscher’s latest predictions. With my own journey starting from mining Bitcoin in my college dorm room, I can attest to the power of retail interest in driving market momentum.

Notable cryptocurrency expert, Miles Deutscher, has highlighted a group of alternative coins he predicts will excel significantly due to a resurgence in retail investor engagement within the market.

As per Deutscher’s analysis, individual investors tend to choose the most convenient investment options, which often include cryptocurrencies that are readily available on well-known centralized trading platforms such as Binance, Coinbase, Upbit, and Robinhood.

Retail Interest Fuels the Crypto Market

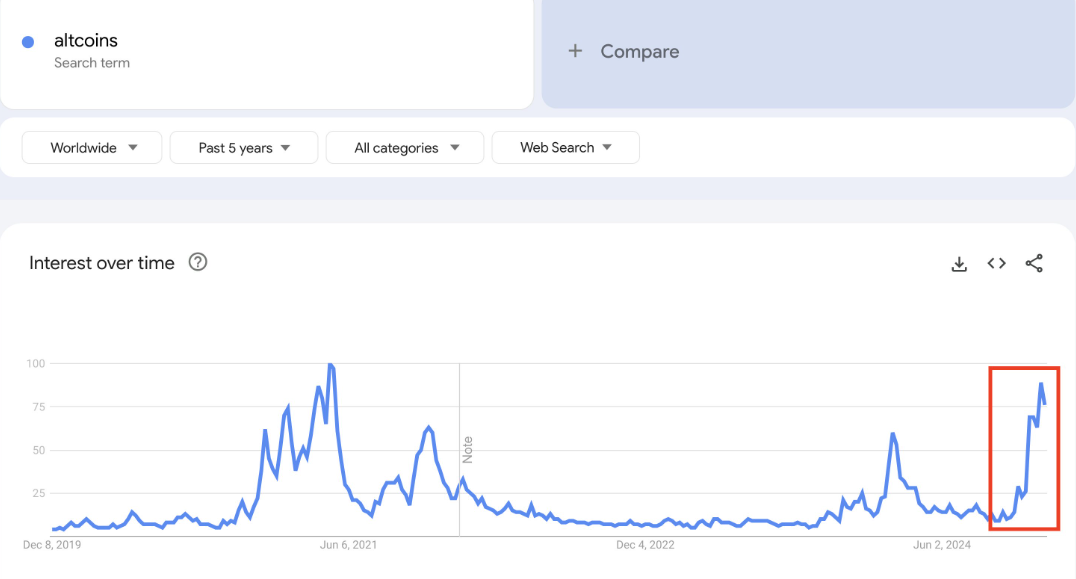

German highlights a surge in Google searches about cryptocurrencies as proof of growing retail curiosity. With an influx of novice investors entering the market, they typically lean towards popular platforms and simple investment choices.

These digital currencies such as Ripple (XRP), Cardano (ADA), and Algorand (ALGO) are currently attracting more interest because they can be easily traded on significant platforms. Interestingly, these alternative coins haven’t been doing well recently, showing less-than-ideal performance in the past few months.

“It’s obvious which altcoins are going to outperform this cycle…There are 16,057 cryptos listed on CoinGecko, but I’ve narrowed it down to just 90. These are the alts with the BEST chance of catching a huge retail bid,” Deutscher stated.

To spot the altcoins most likely to thrive, Deutscher utilized data from APIs of leading cryptocurrency exchanges. He subsequently constructed a personalized spreadsheet featuring 90 different tokens. Among the notable choices are Aptos (APT), Dogecoin (DOGE), Chainlink (LINK), and Near Protocol (NEAR). Some additional recommendations include Solana (SOL), Ripple (XRP), Ondo Finance (ONDO), Pepe (PEPE), Sei (SEI), and Stacks (STX).

The coins we’re discussing are highly accessible worldwide since they are featured on all significant trading platforms. In the world of altcoins, those that offer the smoothest entry will likely thrive the most. Coins such as APT, DOGE, and SOL meet all requirements for ease of access, high volume, and retail appeal, according to Deutscher.

Why Accessibility Matters: Risk and Opportunity

German maintains that accessibility plays a pivotal role in stimulating retail investment. On the global stage, exchanges such as Binance and Coinbase hold the majority of user traffic. Concurrently, platforms like Upbit and Robinhood focus on niche markets and new investors.

When it comes to investing in cryptocurrencies, retail investors often choose the most convenient option. Listing a coin across all major platforms guarantees widespread visibility and streamlines the purchasing process for newcomers, as he emphasized.

Besides their accessibility, Deutscher pointed out that several altcoins listed on CEXs have a more advantageous risk-to-reward (R/R) ratio. Although they might not exhibit the high volatility of smaller, blockchain-based tokens, these altcoins often present substantial growth opportunities, potentially offering gains up to 5-10 times the investment. He also recommended investors to be on the lookout for upcoming listings, as they can provide exclusive chances.

As a researcher, I’ve observed that new listings on significant exchanges can serve as a catalyst, sparking price activity. For instance, digital coins such as MOG and MEW, which have recently gained high-profile listings, demonstrate how increased accessibility can fuel interest in these assets.

German recommends investors seeking a competitive advantage to delve more profoundly into projects by engaging in community talks and keeping track of announcements for signs of possible upcoming listings.

Pay attention to updates from Project AMAs (Ask Me Anything sessions) and consider joining their Telegram and Discord communities. By gathering as much info as possible about upcoming exchange listings, you’ll increase your chances of getting an early start,” is one way to paraphrase the original statement.

With more retail investors expressing an interest in cryptocurrency, Deutscher’s analysis provides a guide for navigating this stage of the market trend. By emphasizing ease of use, strong foundations, and catalysts driven by community engagement, the chosen altcoins could potentially yield substantial returns. However, it is crucial for traders and investors to independently verify their findings as well.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-12-12 16:08