As a seasoned crypto investor with over a decade of experience under my belt, I find this news about MicroStrategy potentially joining the Nasdaq 100 intriguing. Having closely followed the trajectory of Bitcoin and its associated companies, I’ve seen MicroStrategy make bold moves that have paid off handsomely for investors.

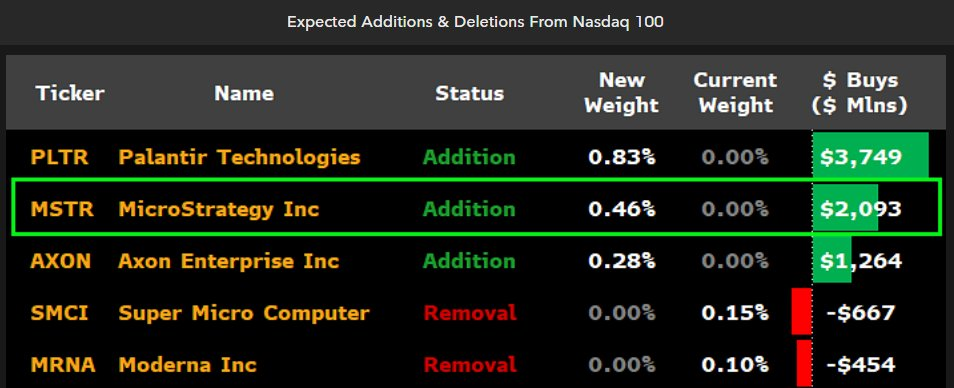

Based on the views of Eric Balchunas and James Seyffart, two well-regarded ETF analysts, it appears likely that MicroStrategy could soon become part of the Nasdaq 100 index. Despite being categorized as a tech company, MicroStrategy manages to bypass the rule that financial institutions are not eligible for inclusion in this index.

If this prediction comes true, it will take place this Friday for a listing on December 23.

MicroStrategy on Nasdaq 100?

Yesterday, Balchunas initially made this forecast through a social media post, suggesting that MicroStrategy might surpass Moderna, a company known for producing COVID-19 vaccines.

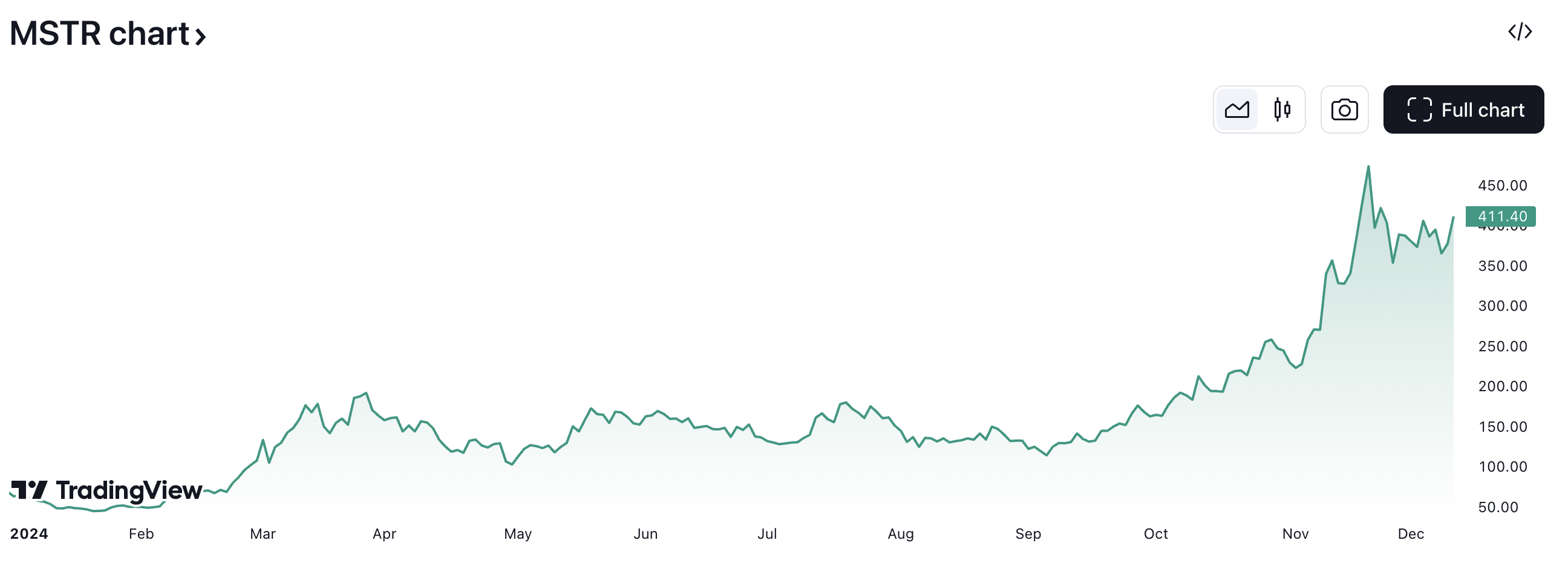

Due to its ongoing acquisitions of Bitcoins, MicroStrategy’s share price has significantly increased, positioning it among the leading 100 publicly-traded American corporations. Nevertheless, approval from NASDAQ is needed before it can be added to the list.

Over the past few years, Nasdaq – being a publicly-held corporation – has taken only a modest step into the realm of cryptocurrencies. Last year, the Securities and Exchange Commission (SEC) put a stop to its endeavors to establish a digital asset custody service. Since then, Nasdaq hasn’t openly mentioned any plans to reinitiate these efforts.

In August, BlackRock’s endeavors to introduce options trading for its Ethereum ETF were aided. On the other hand, Nasdaq hasn’t made many announcements regarding cryptocurrencies.

Simultaneously, James Seyffart agreed with Balchunas’ views in a subsequent post. He highlighted that Nasdaq doesn’t allow finance companies to be listed, and MicroStrategy might meet these technical requirements.

The future of the company is closely linked with that of Bitcoin, meaning its nature could be considered financial, despite being categorized as technology stock at present. Unfortunately, there’s no room for reconsideration until March.

Seyffart stated that these are the dates for ICB [Industry Classification Benchmark] reclassifications. If MicroStrategy hasn’t been reclassified as a financial stock yet during this process, he believes it should be included. However, the main risk for not getting included, in his opinion, is primarily due to the ongoing reclassification process.

As an analyst, I find myself in a unique position when it comes to MicroStrategy. Although it’s now recognized as one of the global titans in Bitcoin holdings, often referred to as a “Bitcoin whale,” it’s essential to remember that this company originated as a tech firm. Despite its substantial investments in Bitcoin, which have undeniably played a significant role in MicroStrategy’s impressive 500% growth on the stock market this year, it remains a technology stock in the eyes of Nasdaq.

Essentially, it’s important to note that this is a forecast, provided by two experienced ETF experts. Regardless, it’s crucial to keep in mind some significant dates. If MicroStrategy is indeed joining the Nasdaq 100, we should expect an announcement before the end of the current week.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- ATH PREDICTION. ATH cryptocurrency

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2024-12-12 02:16