As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, the recent tumble of Magic Eden’s ME token leaves me a bit disheartened but not entirely surprised. The 125 million token airdrop was a bold move, but its execution seemed to be a step too far, given the technical issues and complications in the claim process.

The price of ME, the token that powers the Magic Eden NFT marketplace, has declined 54% over the past 24 hours. This drop comes after the completion of its highly criticized 125 million token airdrop conducted on December 10.

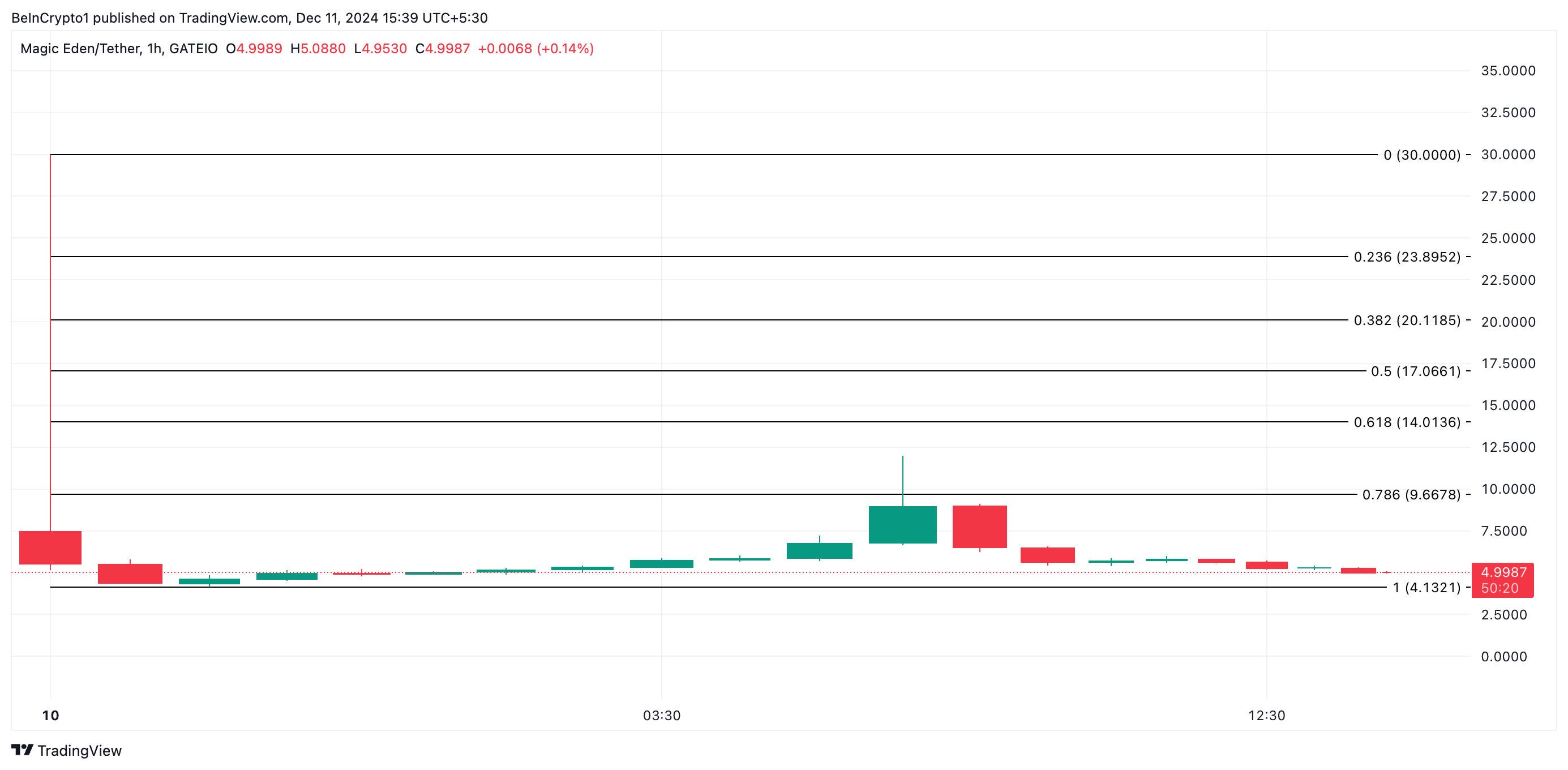

As of this writing, ME trades at $4.99 and is poised to extend this decline.

Magic Eden’s Token Faces Headwinds

On Tuesday, Magic Eden distributed 125 million ME tokens, which account for 12.5% of its total 1 billion token supply, through an airdrop. Immediately following the airdrop, the value of ME tokens skyrocketed, reaching $30 on some trading platforms.

Initially, the intricate claims procedure and technical glitches dismayed numerous customers, triggering a surge of sales which resulted in a 54% decrease in ME’s value within a day. Currently, ME is trading at $4.99.

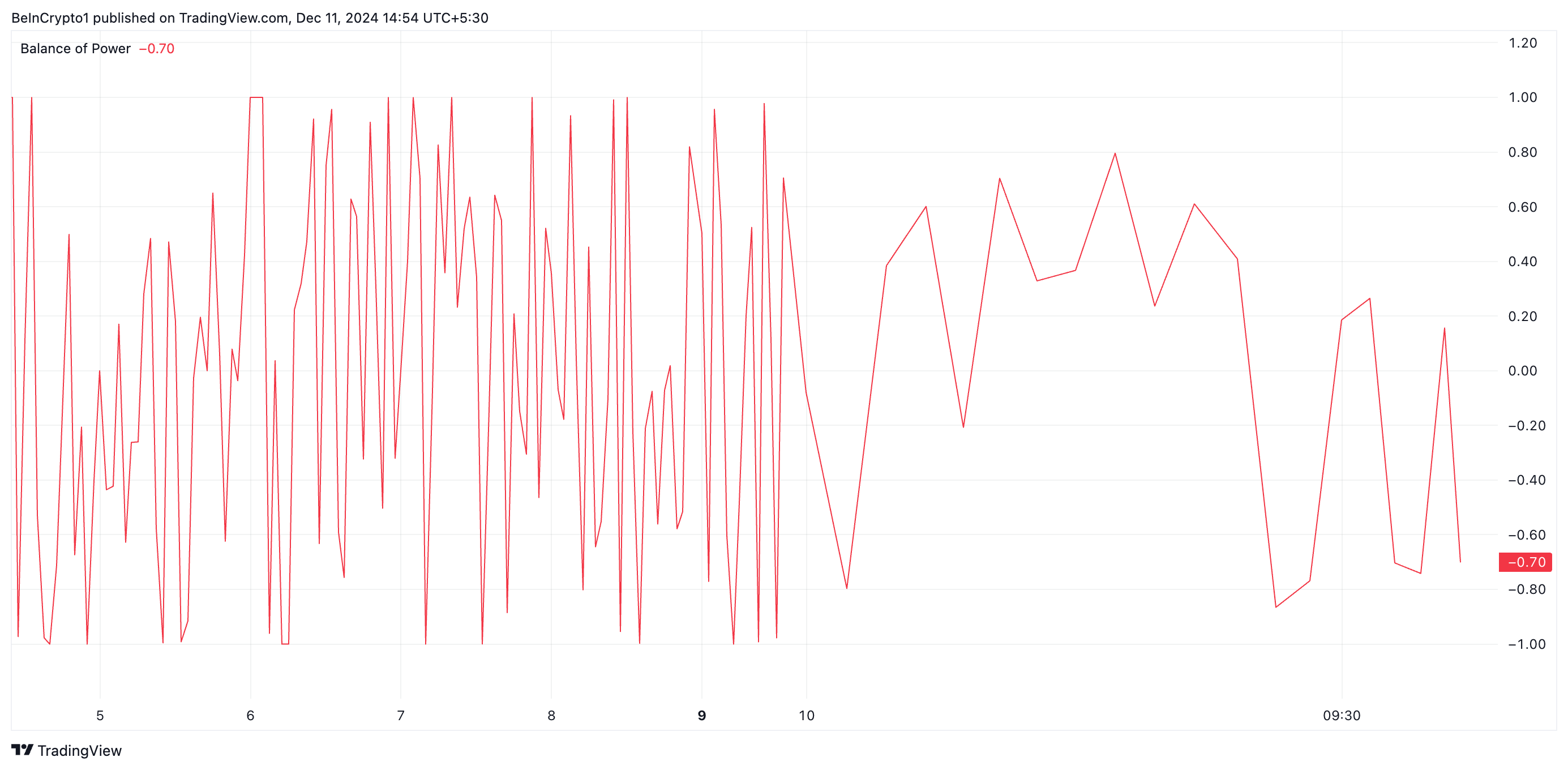

According to BeinCrypto’s analysis, the trend on the ME/USD one-hour chart suggests a rise in pessimism towards the altcoin. This negative sentiment is evident in the Balance of Power indicator, which currently stands at -0.70, indicating bearish dominance as reported now.

As a crypto investor, I find it helpful to keep an eye on the Balance of Power (BOP) indicator to gauge the struggle between buyers and sellers in the market. When this indicator shows a negative reading for a particular asset, it suggests that sellers have the upper hand, which can signal bearish sentiments or price pressure moving downwards.

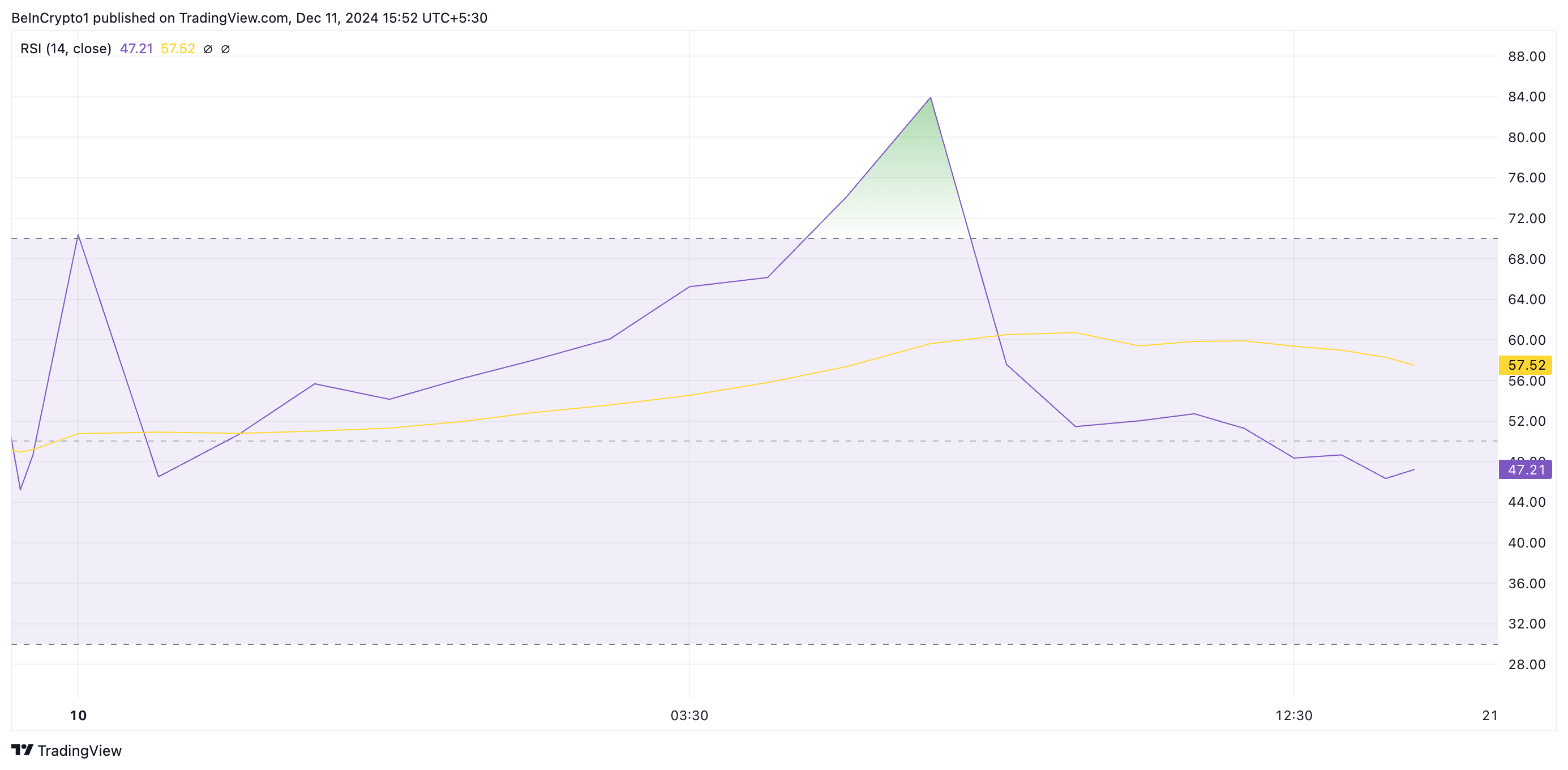

As a crypto investor, I’m seeing a bearish outlook that’s backed up by my own Relative Strength Index (RSI). Currently, it stands at 47.21, and it’s continuing to trend downwards, indicating potential weakness in the market.

The RSI (Relative Strength Index) tool evaluates whether an asset’s market conditions are excessively bought or sold. This index lies within the range of 0 to 100, where figures surpassing 70 hint that the asset is overbought and might need a correction.

As a crypto investor, I find it noteworthy when the asset’s RSI (Relative Strength Index) falls below 30. This suggests that the asset might be oversold and could potentially experience a rebound. The current reading of 47.21 indicates a growing selling pressure, with bearish sentiment gradually building up.

ME Price Prediction: Selloffs Put Token at Risk of Dropping to All-Time Low

As of now, ME is being traded at $4.99, just a bit higher than its record-low price of $4.13. If ME investors choose to keep selling, the price could drop to this level and potentially fall below it if the buyers are unable to maintain their position.

However, if demand for the Magic Eden token resurges, its price may correct and climb toward $9.66.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

2024-12-11 22:08