As a seasoned analyst with years of experience in tracking cryptocurrency trends, I find myself intrigued by Helium (HNT)’s recent surge and subsequent pullback. While the 8% increase in 24 hours is certainly noteworthy, I can’t help but see the mixed signals that technical indicators are flashing.

The price of Helium (HNT) has increased by over 8% within the past day, garnering interest as it strives to recover its previous momentum. However, despite these temporary victories, technical signs point towards ambiguity regarding its upcoming direction.

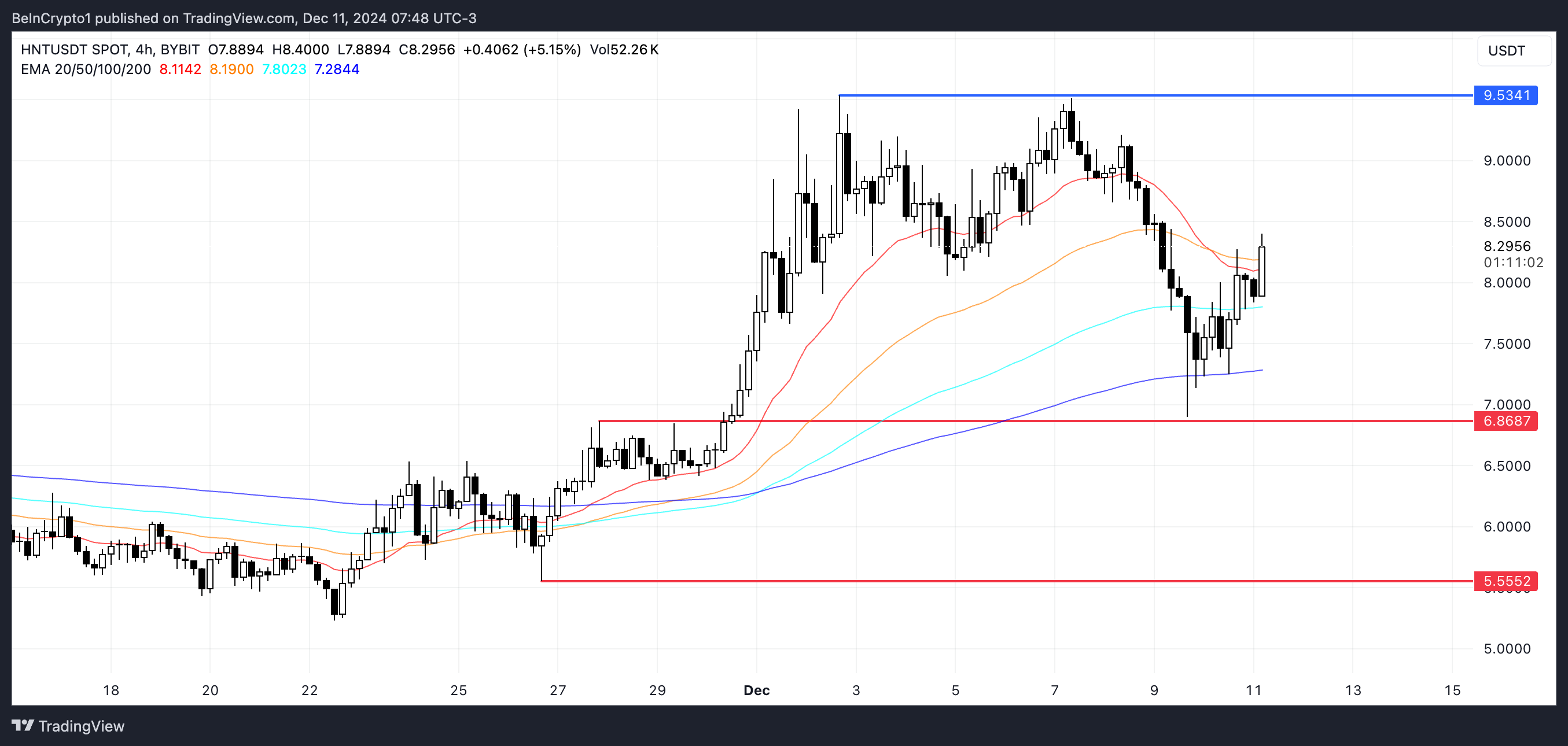

The ADX suggests the trend’s strength is diminishing, while the RSI indicates a standstill phase. Meanwhile, the EMA lines hint at an upcoming bullish encounter for HNT. This crucial juncture could lead HNT either to reach $9.53 or retest significant support around $6.86.

HNT Current Trend Is Losing Its Steam

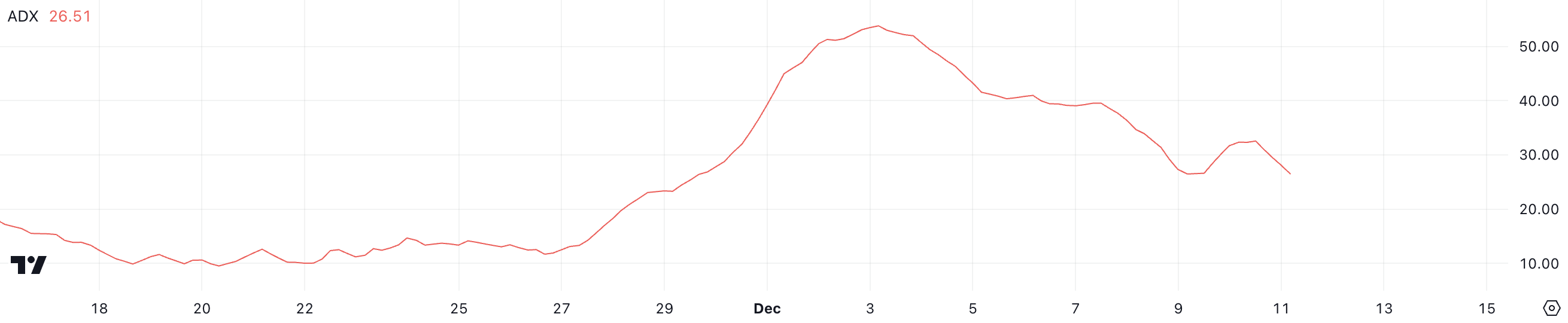

The Helium Average Directional Index (ADX) has experienced a considerable decrease, going from around 50 a week ago to 26.5 now. Over this period, its value surpassed $9, which is the first time it’s reached such heights since March 2024.

A decrease in ADX indicates a weakening of its recent upward movement, possibly suggesting a temporary halt or a slow-down in its progression.

As an analyst, I’d rephrase that as follows: In my analysis, the Average Directional Index (ADX) gauges the intensity of a market trend rather than its specific direction. A reading above 25 signifies a robust trend, while values below 20 imply either a weak or nonexistent trend in the market.

At 26.5, the HNT Average Directional Movement Index (ADX) slightly surpasses the robust trend boundary, suggesting that although the trend is still present, it’s starting to lose strength. For the HNT price to reclaim its upward trajectory, the ADX needs to increase significantly, demonstrating a resurgence of momentum and stronger purchasing enthusiasm.

Helium RSI Is Currently Neutral

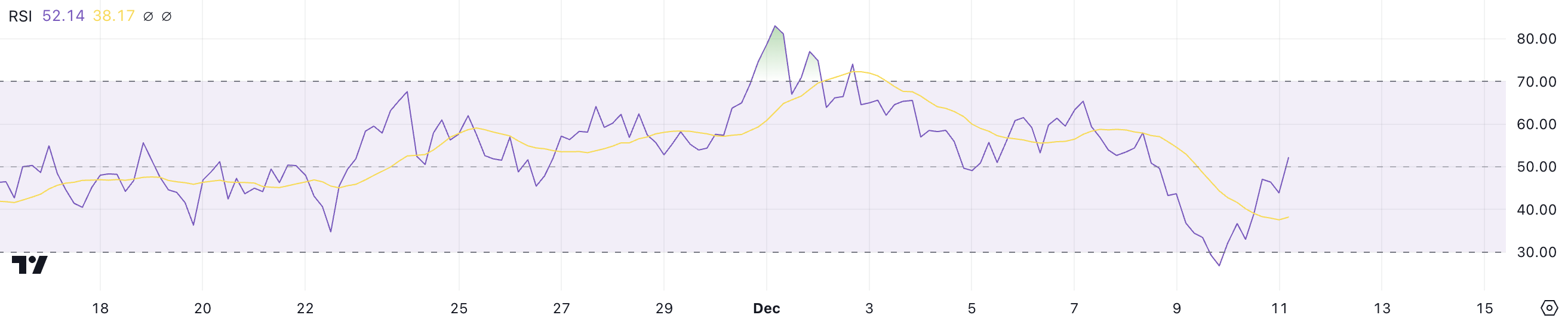

The Helium Network’s Relative Strength Index (RSI), which was previously around 70 in early December during a significant rise in its price, has now dropped down to 52. This decrease suggests that the buying momentum is less intense than it was when the market was overbought.

As the RSI hovers within its neutral range, it suggests a pause in market excitement after the recent surge. Notably, the RSI for HNT hit 28 on December 10, indicating that buying demand might be resurfacing again.

The Relative Strength Index (RSI) gauges the pace and size of price fluctuations, scoring between 0 and 100. A value exceeding 70 indicates an overbought state, which may hint at a possible reversal or adjustment. On the other hand, readings below 30 indicate an oversold situation, suggesting that prices could potentially rise again.

currently holding at a Relative Strength Index (RSI) of 52, the price of HNT indicates neither excessive buying nor selling, signifying it’s in a consolidation phase. To recommence its upward trend, the RSI should increase, indicating increased purchasing power. Conversely, if it dips below 50, that could imply weakening momentum continuing.

HNT Price Prediction: Can It Reach $9 Again?

The Helium Exponential Moving Averages (EMAs) are presenting conflicting indications. Lately, the shorter EMA has fallen under the longer one, suggesting a potential downtrend or bearish trend.

As I observe the market trends, it appears that the shortest Exponential Moving Average (EMA) has once again started an upward trajectory. If this trend continues and the EMA crosses back above its previous levels, it could signal a resurgence of bullish sentiment. This, in turn, might ignite a price increase as the Decentralized Physical Infrastructure (DePin) narrative gains momentum and attracts more attention.

Should a bullish crossover take place, the helium price may attempt to revisit the resistance level near $9.53. Nevertheless, the declining pattern shown by ADX calls for vigilance. If a bearish trend emerges as an alternative, the HNT price could challenge support at approximately $6.86.

Should that level not be sustained, there’s a chance the price might decrease more, potentially reaching $5.55. This suggests a potential drop of approximately 33%.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- PENGU PREDICTION. PENGU cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-11 21:17