As a seasoned crypto investor with a knack for spotting opportunities and a penchant for navigating regulatory waters, I find this recent NYDFS approval for Ripple‘s stablecoin, RLUSD, to be an exciting development. With my years of experience and a keen eye for potential market movers, I can’t help but see the potential in RLUSD, especially with its backing by U.S. dollar deposits, treasury bonds, and other cash equivalents.

The approval from the New York Department of Financial Services (NYDFS) was granted following a prolonged review period. Ripple, aiming to obtain the regulator’s approval for its stablecoin, took various measures to expedite the process. Among these actions were the acquisition of Standard Custody & Trust Company, a company that operates under an NYDFS limited-purpose charter.

Initially, Ripple unveiled its plans for the RLUSD stablecoin back in April, positioning it as a rival to established major stablecoins. The value of RLUSD will be tied directly to the U.S. dollar and supported by U.S. dollar deposits, short-term U.S. treasury bonds, and other liquid assets. As per comments from Ripple officials, the market value of RLUSD could grow substantially in the forthcoming years, with a focus on attracting institutional investors as its primary user base.

The latest approval indicates that RLUSD, a stablecoin developed by RLSDU, is now fully adhering to New York’s regulatory standards. Although Ripple has yet to announce a specific launch date for RLUSD, representatives from the company hinted that its release could occur imminently. Garlinghouse emphasized that any official launch dates and related updates would only be communicated by Ripple, and he advised market participants to be vigilant about unofficial information or tokens not supported by the company.

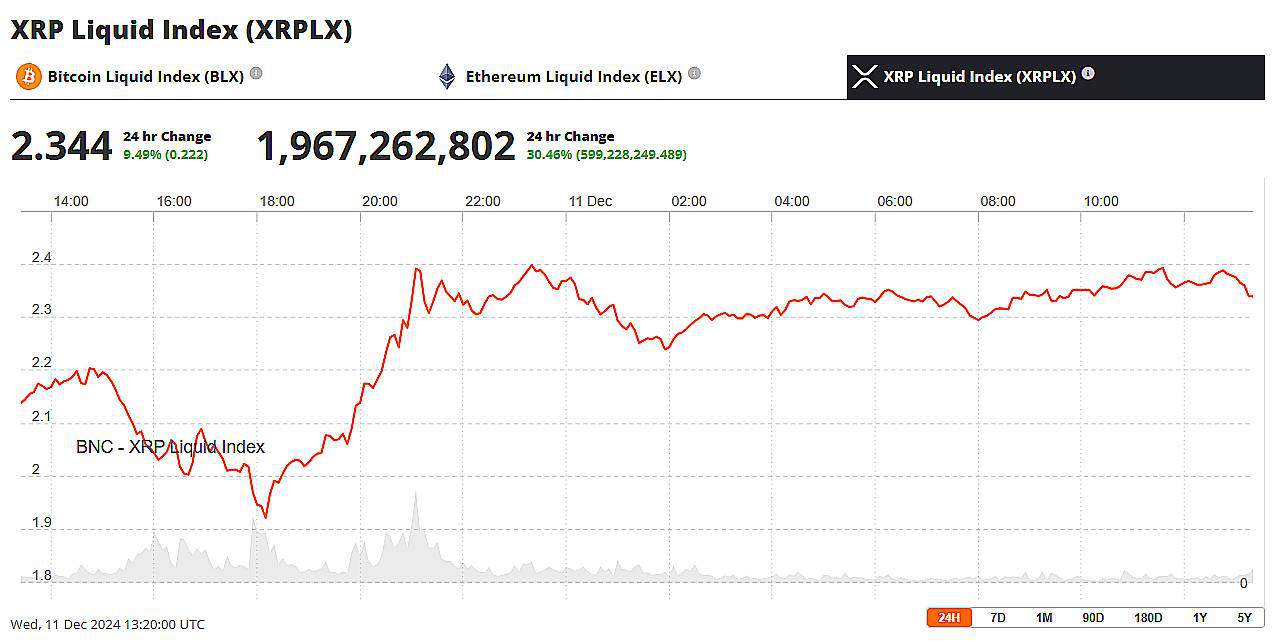

Before the announcement was made, XRP had dropped below the $2 price point, reaching its lowest point during the day at $1.91. However, once Garlinghouse confirmed the NYDFS approval, XRP bounced back and peaked to a daily high of $2.41.

Initially, there was a significant jump in XRP’s value, exceeding 26% from its lowest point during the day. Subsequently, XRP experienced a minor dip to $2.34, yet this didn’t deter daily trading volume, which surged past 12%, reaching an impressive $24.4 billion. The market data suggested that if XRP continued on this trajectory, it could soon overtake Tether (USDT) in terms of market capitalization, thus enabling XRP to reclaim its place among the top three cryptocurrencies by market cap.

Ripple has announced that it has worked with leading cryptocurrency trading platforms in anticipation of the launch of RLUSD. These include Uphold, Bitstamp, CoinMENA, Bullish, MoonPay, Bitso, and Independent Reserve. The company aims to make RLUSD accessible on additional exchanges and market players as time goes by.

Starting from August, RLUSD conducted its beta testing on both the XRP Ledger and Ethereum networks. Ripple officials have hinted that this stablecoin might be used alongside XRP to strengthen their payment solutions and cross-border transaction services. Some experts predict that the mainnet launch of RLUSD may occur before the year’s end, but Ripple has not yet announced a definitive timeline for its release.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-11 16:42