As a seasoned analyst with over two decades of market experience under my belt, I’ve seen countless bull and bear runs, and the current situation with Aptos (APT) is one that demands careful attention. The sudden plunge in its market cap from $8.25 billion to $6.36 billion in just five days is a stark reminder of the volatile nature of the crypto market.

On December 6th, the market capitalization of Aptos (APT) was close to 8.25 billion dollars. Currently, it has dropped significantly to around 6.36 billion dollars, losing approximately 2 billion dollars over the past five days.

This steep drop in value seems to align with the build-up of excitement about the impending release of APT tokens, which could lead to considerable price fluctuations due to its potential impact.

Aptos Loses a Lot with Supply Shock Coming

The value of Aptos exceeded 8 billion dollars on the stock market as its price climbed up to $15.25. To clarify, the market capitalization is determined by multiplying the price with the total number of circulating coins in circulation. Consequently, when the price surges, so does the market cap.

If a cryptocurrency’s price remains stable while more tokens are circulating, its market capitalization increases. For Aptos, the reduction in market capitalization may be due to the broader market downturn, causing many altcoins to dip since their high points from last week.

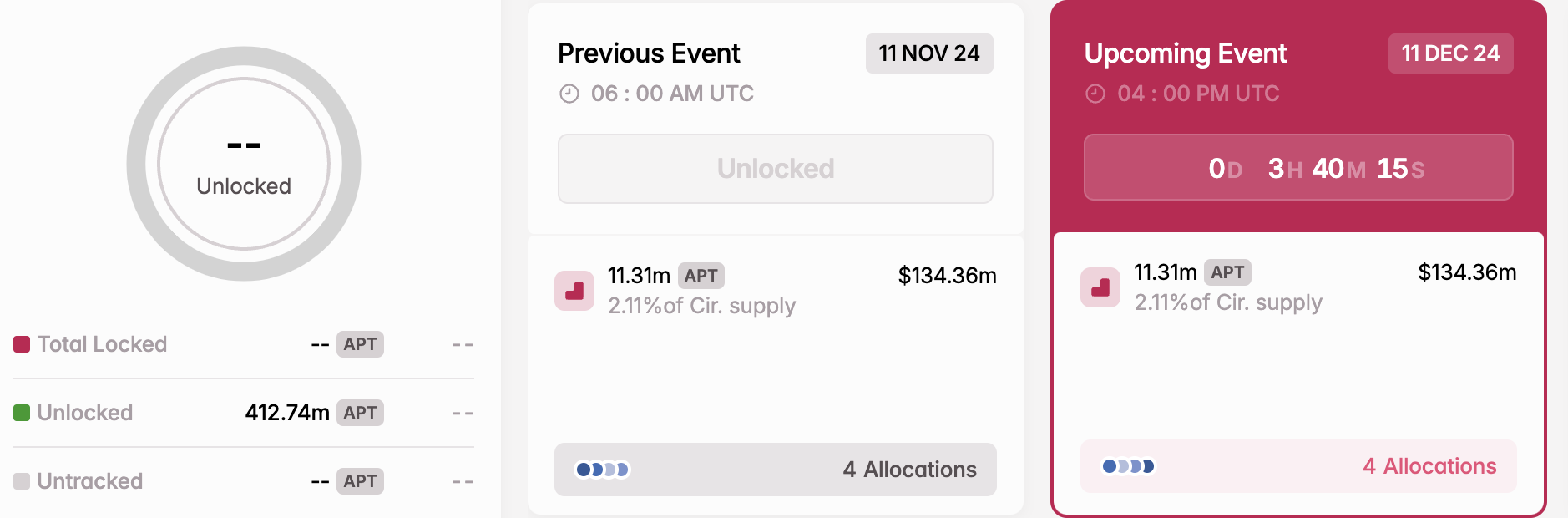

Additionally, the potential drop in value might be connected to today’s scheduled token unlock. Essentially, this involves making available for circulation cryptocurrency tokens that were previously locked away, usually according to a vesting plan or promotional scheme.

This system is vital in the cryptocurrency sector as it oversees a balanced and tactical distribution of tokens to regulate circulation and maintain market equilibrium. As per Tokenomist (formerly known as Token Unlocks), Aptos will disburse 2.11% of its entire token supply, which amounts to $134.47 million, today.

Upon activation, this occurrence may trigger significant market fluctuations regarding APT. Moreover, should purchasing demand fail to offset the impending surge in supply, there’s a possibility that the Aptos’ price could experience a decline as well.

APT Price Prediction: Token to Slide Below $10

Recently, Aptos was seen trading within a rising triangle structure, which is usually a sign of a potential continued uptrend. But, at present, the price of this altcoin has significantly fallen below the triangle’s neckline, signifying that the anticipated bullish breakout may no longer hold true.

In simpler terms, the Cumulative Volume Delta (CVD) has now moved into a range that suggests more sells are happening compared to buys. Essentially, the CVD calculates the gap between the number of shares bought and sold, so a positive value means more purchases, while a negative one implies more sales.

Conversely, if it’s a negative trend, it suggests increased selling pressure, as observed with APT. This scenario might lead to a short-term decrease in Aptos price to around $9.65. However, should demand significantly increase, this decrease may not occur, and the value could instead soar up to $15.33.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-11 16:18