As a seasoned analyst with over two decades of market observation under my belt, I find the current state of SUI to be a complex tapestry woven from both bullish and bearish threads. The 13% price drop is indeed concerning, but it’s important to remember that even the mightiest of mountains have their valleys.

Switzerland’s currency, the Swiss Franc (SUI), has seen a 13% decrease in value after an unsuccessful effort to establish a new record peak.

Regardless of an early boost that sparked hope among investors, the subsequent dip in the altcoin has brought about market ambiguity, prompting traders to pull back their backing. This change in attitude is fueling the coin’s erratic price fluctuations.

SUI Faces Challenges

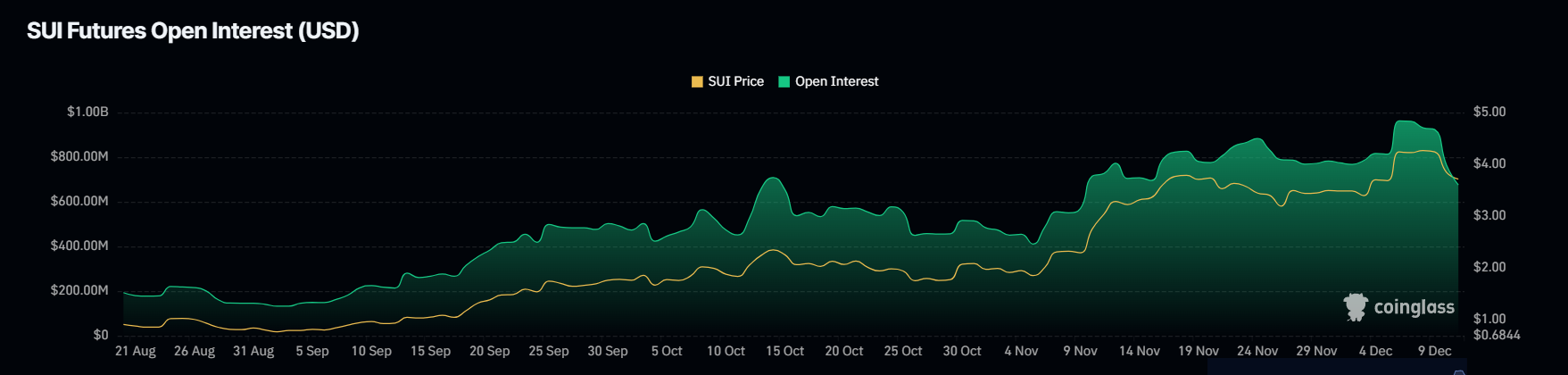

It appears that investor confidence in SUI has noticeably decreased, based on the substantial drop in Open Interest. This means that the total value of active positions for SUI futures contracts has dropped by approximately $248 million, going from $923 million to $675 million.

This significant drop suggests that a large number of investors are withdrawing their funds, mirroring growing apprehension about SUI’s future price trend. With trader faith waning, the possibility of additional downward movements becomes more likely.

It seems that technical indicators point towards a possible pause or stabilization phase in the near future. Investors are showing signs of reluctance to invest fully, as doubts about SUI’s capacity for a robust rebound linger. The absence of new investments only serves to strengthen this cautious market sentiment.

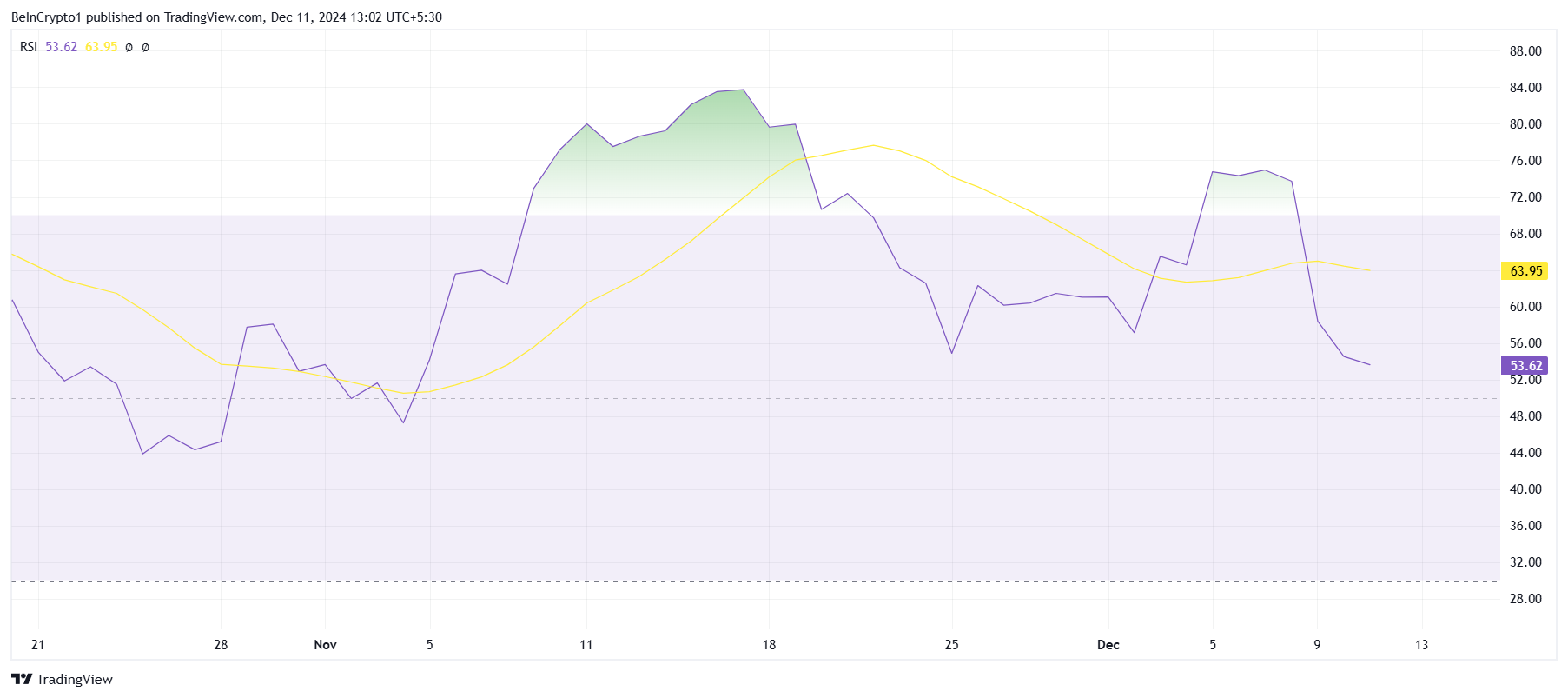

Although SUI’s price trends appear bearish, certain indicators suggest that the bullish energy hasn’t vanished completely. For instance, the Relative Strength Index (RSI) remains above the neutral line, suggesting that the asset isn’t excessively oversold. This could imply continued buying interest, but it also mirrors the market’s ambiguous sentiment, which is preventing a clear direction.

Currently, the RSI (Relative Strength Index) indicates mixed signals. While it hints at a potential recovery if purchasing power increases, the failure to surpass crucial resistance points might prolong SUI’s price decline, leading to sideways movement or further adjustments.

SUI Price Prediction: Finding Footing

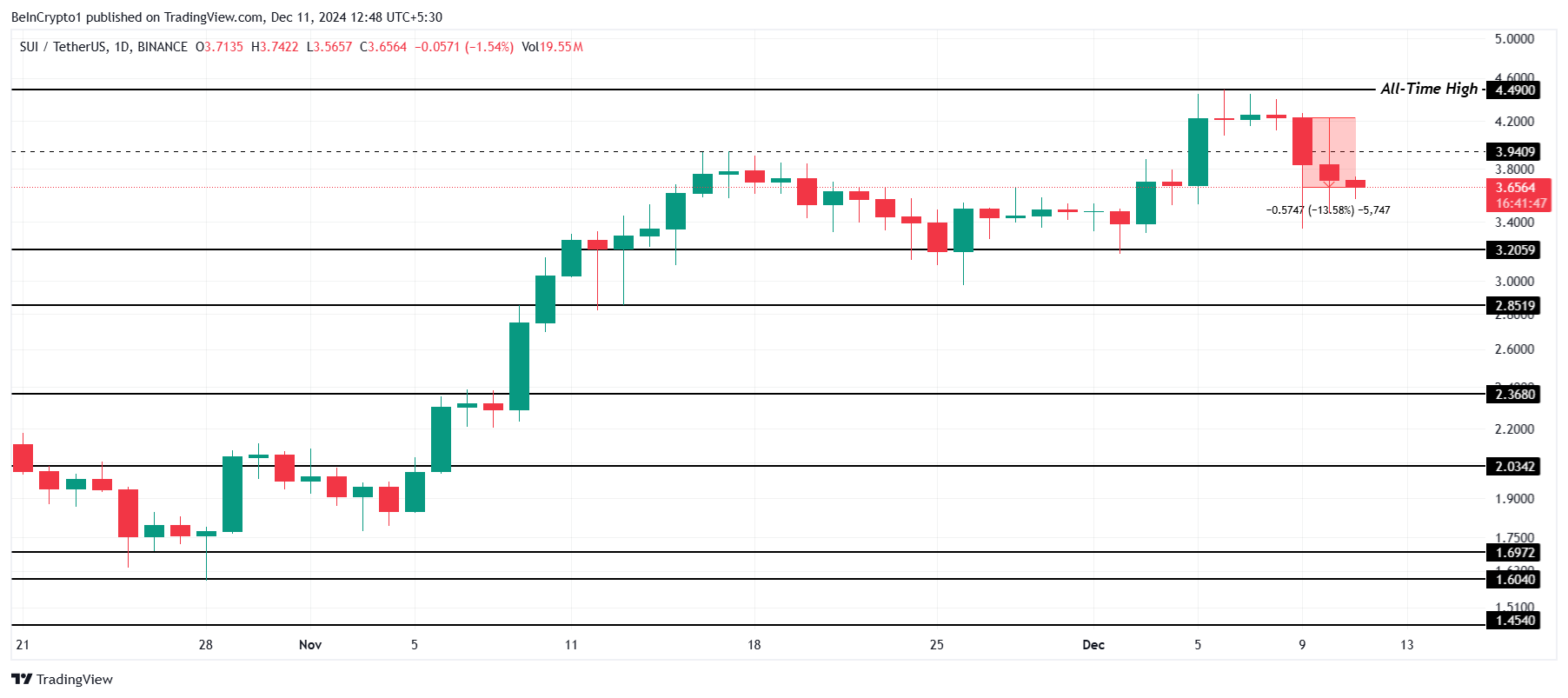

As a crypto investor, I’m observing a state of uncertainty with SUI right now, as it seems to be moving sideways. The technical indicators I’m tracking are sending mixed signals, which makes predicting the next move challenging. Despite the recent market turbulence, the price of this cryptocurrency is being held within its support and resistance levels. I, along with many other investors, am eagerly waiting for a breakout from these bounds. Once the price action settles down and we see a clear trend emerge, it could provide valuable insights into SUI’s future performance.

SUI has dropped by 13.5% over the last 48 hours, now trading at $3.65, not far from its all-time high of $4.49. The cryptocurrency appears poised to remain consolidated above the key support at $3.20. This consolidation could persist as traders await clearer market signals before making larger commitments.

As an analyst, if SUI manages to recover the $3.94 support, it’s likely we might see a surge towards its all-time high (ATH) of $4.49. This recovery would contradict the current bearish-neutral stance and offer a new, optimistic perspective. It’s crucial for investors to keep a close eye on this level, as a successful rebound could hint at a resumption of bullish trends.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Persona 5: The Phantom X Navigator Tier List

2024-12-11 12:10