As an analyst with years of experience navigating the volatile world of cryptocurrencies, I have seen my fair share of market fluctuations and trends. The recent accumulation of Bitcoin at the $96,000 to $100,000 range is a sight that brings both excitement and caution.

Over the last fortnight, Bitcoin’s price movement has been relatively stable. However, it’s worth noting that this period has also included one of the largest accumulations of Bitcoin in recent times.

The amassed sum, worth approximately $23 billion, has played a significant role in keeping Bitcoin’s value above the crucial $96,000 mark.

Bitcoin Investors Are Optimistic

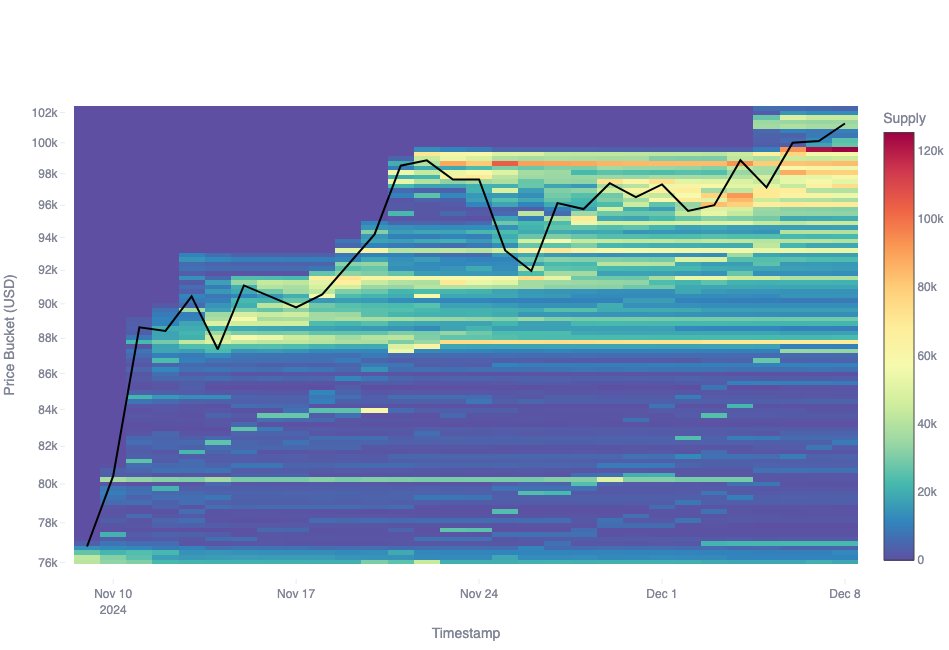

The Cost Basis Distribution (CBD) offers valuable insights into the prevailing mood of the Bitcoin market. It’s been found that the most significant amassing area is around $99,559, where approximately 125,000 Bitcoins were purchased just under the $100,000 threshold.

Over the past fortnight, there’s been considerable build-up within the price range of $96,000 to $98,000, with approximately 120,000 Bitcoin being amassed. This indicates that the region between $96,000 and $100,000 could now be a pivotal support area for Bitcoin, preventing the price from dropping below $96,000.

Bitcoin’s current position is holding above a significant area, indicating robust faith from investors, despite market turbulence. With major accumulation areas primarily found around the $96,000 to $100,000 bracket, these price points have grown even more crucial in the present context.

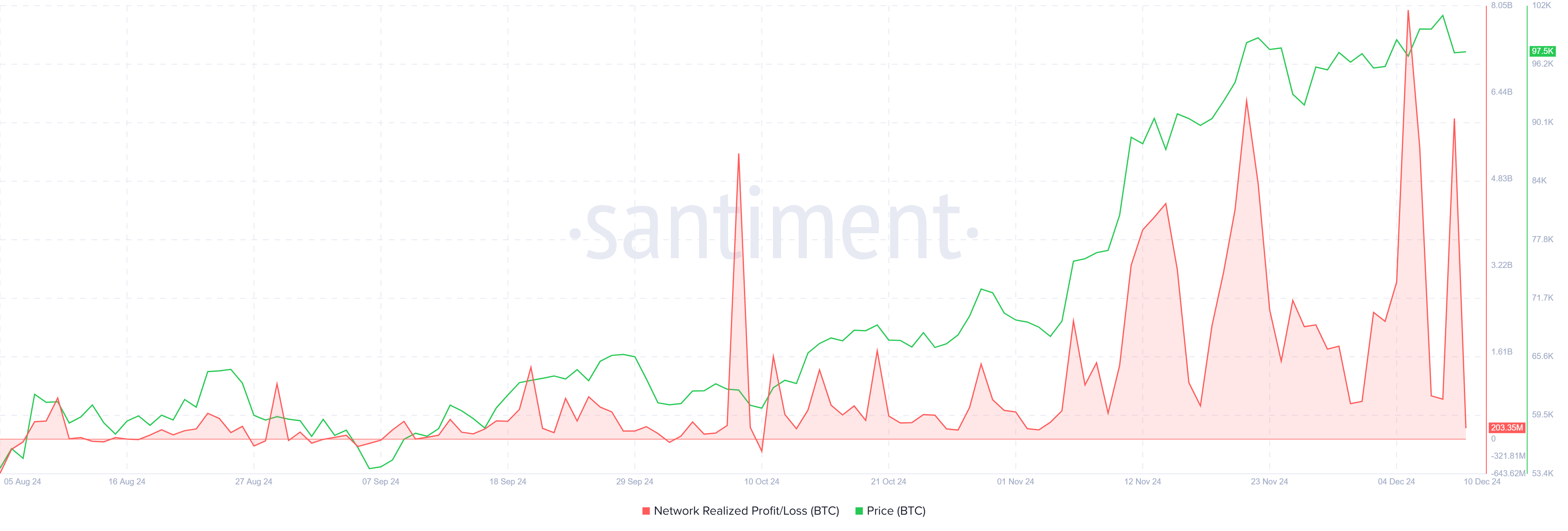

Examining the overall trend of the crypto market, it’s clear that investors are actively involved with Bitcoin. Even though there is an increase in holdings, frequent surges in profits indicate that traders are still cashing out during growth phases. This underscores the persisting volatility in the market, as profit-taking actions could potentially impede Bitcoin from maintaining its upward trend.

These significant increases in realized profits indicate a thriving market environment, yet they simultaneously underscore the hurdles that Bitcoin must overcome to sustain positive trends. As investors cash out their gains, they might trigger temporary market drops; however, such actions are typical within the standard market rhythm.

BTC Price Prediction: Breaking Out

As a researcher, I’m observing that the price of Bitcoin is holding steady around the $96,000 support zone following an unsuccessful breakthrough at $100,000. The substantial accumulation of Bitcoin within the $96,000 to $100,000 band has established a robust foundation that could potentially ward off any major downturns. If Bitcoin manages to maintain this range, it might make another effort to reach $100,000 again.

Bitcoin might encounter hurdles at the $100,000 mark since it hasn’t been able to establish solid ground above this value so far. If the cost doesn’t manage to exceed this significant barrier, the cryptocurrency may find itself stuck in a holding pattern, with possible price oscillations between $96,000 and $100,000.

Should Bitcoin surpass and maintain itself above $100,000, it might resume its upward trajectory. This action could trigger a push towards the next significant resistance point, potentially bringing Bitcoin nearer to its peak values from before. The accumulation happening at these prices indicates that investor belief is robust, which could fuel further price advancements in the future.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

2024-12-10 16:43