As a seasoned crypto investor with over a decade of market experience under my belt, I find myself watching the current market developments with a blend of caution and optimism. The recent liquidation events, totaling $1.7 billion, have shaken even the most hardened traders, but they are not entirely unexpected in such volatile markets.

On Monday, the value of total liquidations surpassed $1.7 billion as the price of Bitcoin (BTC) fell to a daily low of $94,150. This downward trend continued into Tuesday, with Bitcoin still struggling to break through the $97,000 mark at the current moment.

As cryptocurrency markets prepare themselves for an unpredictable week ahead, several crucial U.S. economic happenings are lined up on the schedule.

Total Crypto Liquidations Exceed $1.7 Billion

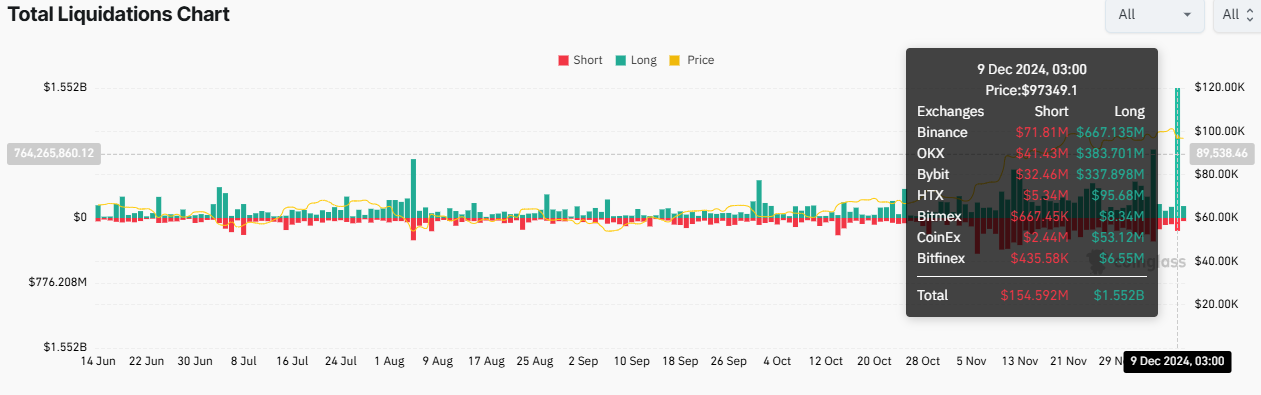

Based on Coinglass’s figures, around 583,530 traders experienced significant losses or exited the market within the past 24 hours. The overall liquidation amount surpassed $1.7 billion as a result. At least $1.552 billion of these losses were from long positions, whereas $154.59 million came from short positions.

After the recent adjustment in Bitcoin’s value, there were significant sell-offs (massive liquidations). At one point on Binance Exchange, the first and most recognized cryptocurrency dipped as low as $94,150.

As a researcher observing the recent liquidation event, I can’t help but notice the mixed emotions it has stirred among traders and investors. On one hand, there seems to be a sense of optimism about the market’s potential recovery. However, on the other, I find myself heeding the words of caution from a prominent user like Unipcs on platform X. The market remains a fascinating enigma, full of both hope and uncertainty.

The user stated that this was one of the biggest market sell-offs since 2021, which often signals a market low. Panic selling is not advisable at this point, but neither is reckless buying or overusing leverage. Instead, it might be wise to gradually increase positions in strong investments as we prepare for the next significant price surge.

Undeniably, it’s prudent to exercise caution given the potential effects of upcoming U.S. economic data releases in the coming days. As per BeInCrypto’s report, the U.S. Consumer Price Index (CPI), job figures, and Producer Price Index (PPI) might shape Bitcoin sentiment during this period. Essentially, these U.S. macroeconomic indicators will provide insight into the current status or condition of the American economy.

For certain individuals, these extensive sell-offs served as a “thorough cleaning,” eliminating all funding rates for altcoins. Essentially, this implies that many highly leveraged trading positions were forcibly liquidated because of the sudden drop in the market value.

Seth, a cryptocurrency analyst, humorously commented that all the funding rates for altcoins were completely cleared out, which he described as a beneficial and necessary market cleansing.

As a researcher, I find that the funding rate serves as a crucial mechanism for maintaining equilibrium between the perpetual futures market price and the spot market price on exchanges. When numerous leveraged positions are liquidated, it can trigger significant volatility and misalignments in market prices. In various scenarios, these disruptions often prompt the funding rate to adjust back towards neutral levels.

Experts think that these occurrences serve to remove excess borrowing, overzealous investors, and less robust participants from the market. This clears the path for a more robust and long-term price trend in the future by creating a market with fewer unstable elements. By eliminating overleveraged positions, the market may discover a more solid foundation for growth that is not influenced by excessive speculation.

As I write this, Bitcoin is being traded at approximately $96,682 according to BeInCrypto’s data, representing a decrease of nearly 3% from the opening of the Tuesday trading session.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Persona 5: The Phantom X Navigator Tier List

2024-12-10 09:45