As a seasoned researcher with over a decade of experience in the ever-evolving world of cryptocurrencies, I must say that the current state of Bitcoin (BTC) is intriguing, to say the least. The rollercoaster ride between $98,000 and $10,000 has been quite a spectacle, but it seems we might be in for a prolonged stay at the lower end of that range.

Over the past few days, Bitcoin (BTC) has experienced a significant decrease in demand from buyers, with its value fluctuating between $98,000 and $10,000. This decline in bullish energy could indicate that Bitcoin may not be prepared for its upcoming price increase.

Instead, it indicates that the price might continue to trade sideways unless something changes.

Bitcoin Accumulation Lowers

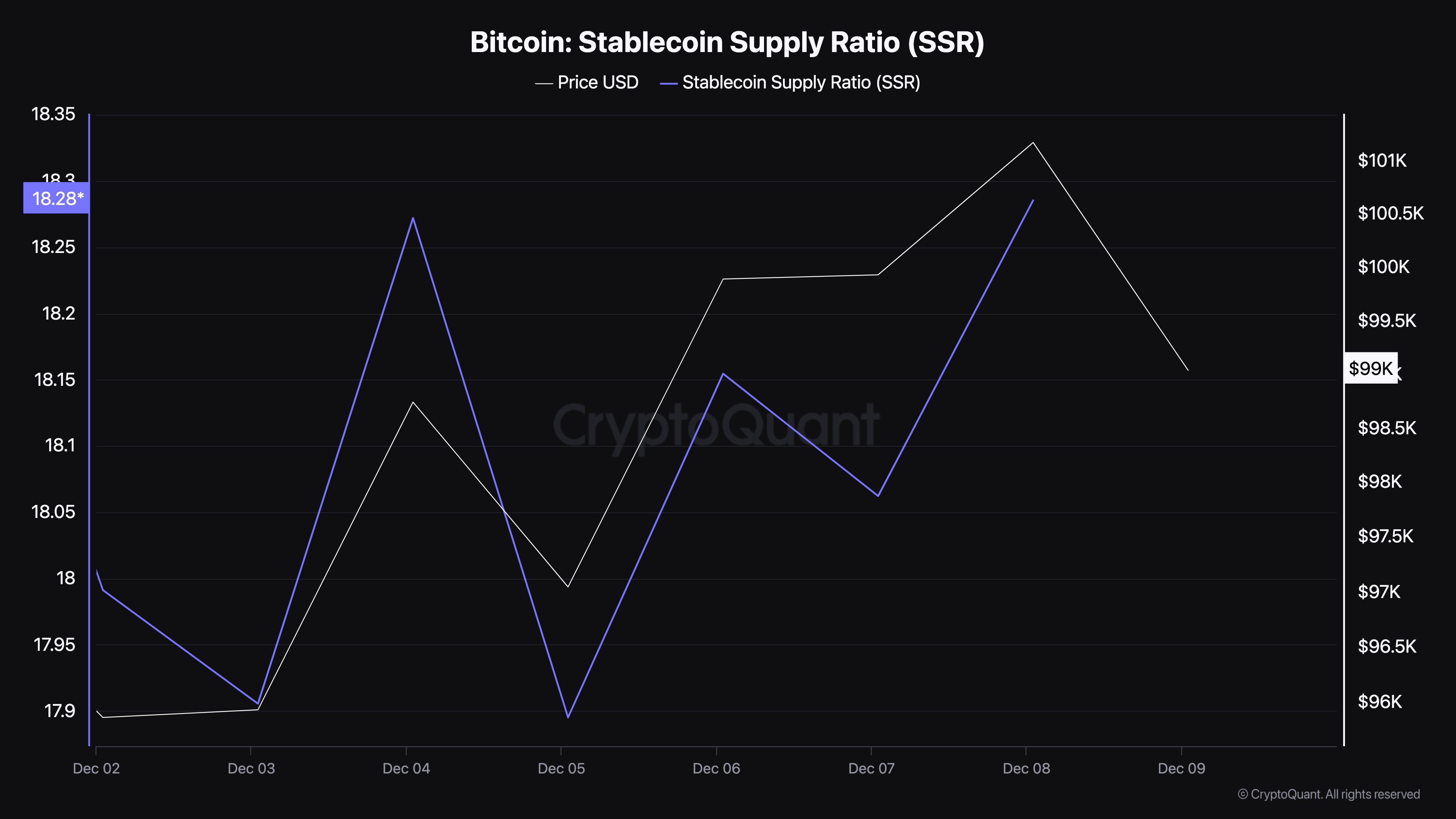

One indicator showing a decline in Bitcoin buying pressure is the Stablecoin Supply Ratio (SSR). The SSR measures the ratio of a cryptocurrency’s market capitalization to the aggregated market capitalization of all stablecoins in circulation.

A low Supply Stablecoin Ratio (SSR) implies stronger purchasing power from stablecoins since they are more abundant. This abundance of stablecoin liquidity could lead to a surge in prices if converted into cryptocurrencies. In contrast, a high SSR shows less available stablecoin liquidity compared to the market cap of the cryptocurrency, possibly suggesting reduced Bitcoin buying power or limited demand.

Based on CryptoQuant’s report, the Bitcoin Stacker Satoshi Ratio (SSR) has surged to 18.29. This suggests that buying strength is weakening, which could potentially lead to Bitcoin’s price staying below its record high of $103,900.

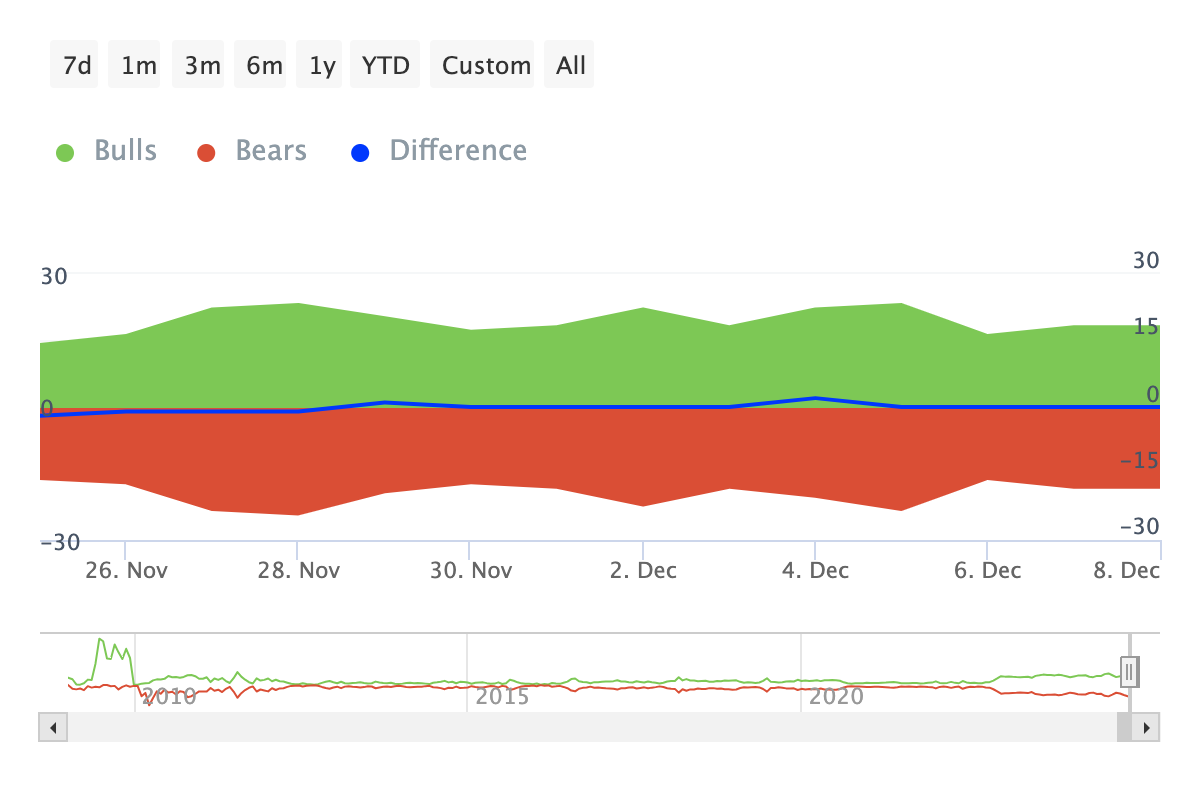

Another metric suggesting the same is the Bulls and Bears indicator. For context, bulls are addresses that bought at least 1% of the total trading volume within a specific period. Bears, on the flip side, are those who sold a similar amount.

In simpler terms, when the number of bullish investors (those who believe Bitcoin’s price will rise) outnumbers the bearish investors (those who expect a fall), the Bitcoin price usually goes up. But if more people are bearish, the price tends to go down. As per IntoTheBlock data, the number of bulls and bears in the last week has been roughly equal.

As a crypto investor, I’ve noticed that Bitcoin bulls seem reluctant to purchase additional coins, which could potentially lead to a prolonged consolidation in the price if this trend persists.

BTC Price Prediction: Further Decline Looms

On the daily graph, the Momentum Indicator known as Moving Average Convergence Divergence (MACD) has moved into the negative zone. This indicator gauges the speed at which a particular cryptocurrency is moving.

When the Moving Average Convergence Divergence (MACD) shows a positive value, it indicates a bullish momentum. But at present, the MACD is indicating bearish momentum, which could mean that Bitcoin’s price might not surge significantly in the near future. Moreover, the position of this indicator suggests a decrease in demand for Bitcoin, as the buying pressure seems to be dwindling.

Should conditions persist, the value of Bitcoin could potentially fall to around $90,623. On the other hand, if there’s a surge in demand and aggressive buying from bulls, the price could spike up to approximately $103,581.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2024-12-09 21:37