As a researcher with a background in economics and a keen interest in cryptocurrencies, I find El Salvador’s Bitcoin policy shift fascinating. Having closely followed the global financial landscape for years, it’s clear that this move is not only strategic but also indicative of the evolving role of digital assets in the world economy.

As a crypto investor, I find myself reflecting on El Salvador’s decision to embrace Bitcoin as legal tender. Recently, it seems that they are considering scaling back their cryptocurrency policies in order to secure a $1.3 billion loan agreement with the International Monetary Fund (IMF).

The country made it compulsory for businesses to accept Bitcoin as a payment method in 2021.

El Salvador’s Bitcoin Policy to Shift Amid IMF Pressure

Based on Financial Times’ reports, the deal is anticipated to be concluded within a few weeks. This deal might reportedly eliminate the legal obligation for businesses to accept Bitcoin as a form of payment, instead making it an optional choice.

This transition could bring about a substantial modification in Bitcoin’s legal framework within the country. El Salvador and its President, Nayib Bukele, have often encountered criticism from global financial bodies such as the IMF.

Beyond the IMF loan, this deal might enable access to approximately $2 billion in funding from the World Bank and the Inter-American Development Bank within the upcoming years.

According to Travis Kling’s post on platform X, El Salvador recently discovered approximately 50 million ounces of gold valued at $131 billion based on current market prices. The President, Bukele, seems eager to immediately extract and sell this gold in order to invest the proceeds into Bitcoin.

In line with the terms of the loan, the Salvadoran administration is committed to enacting comprehensive financial adjustments. These involve narrowing the budget gap by 3.5% of the nation’s GDP over a three-year period, making expenditure reductions and tax hikes, and enhancing anti-corruption laws.

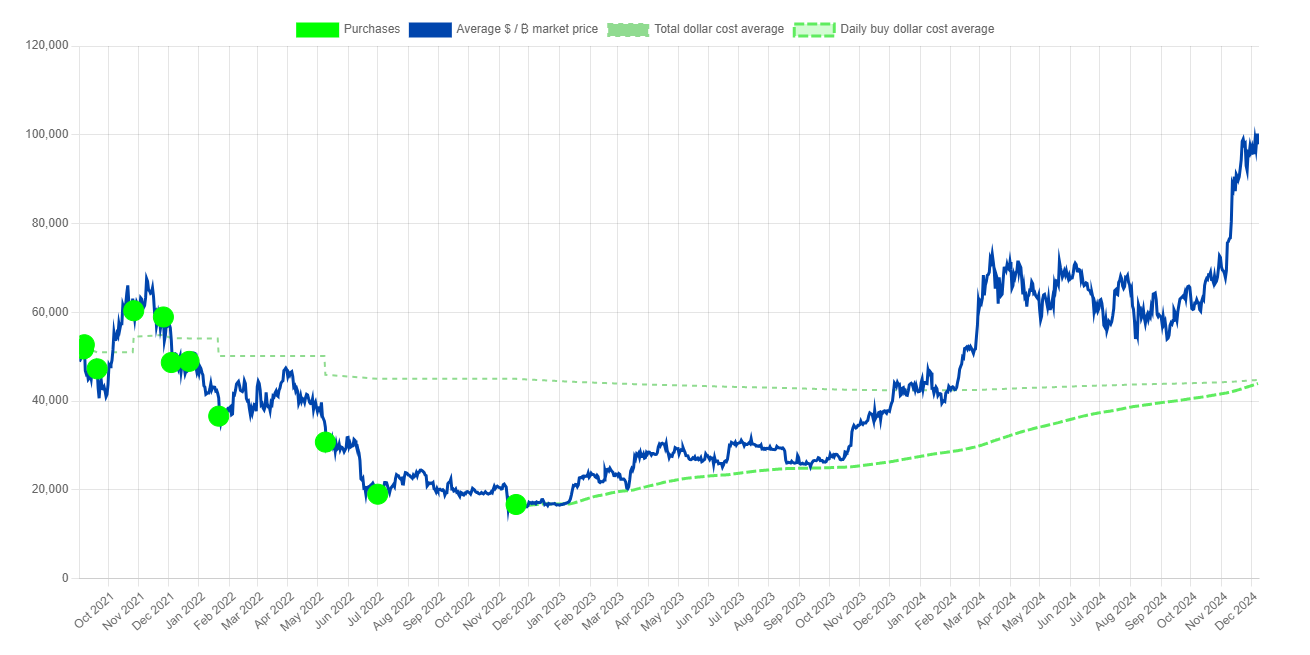

The nation intends to boost its financial savings from $11 billion to an estimated $15 billion. At present, El Salvador holds around $556.7 million worth of Bitcoin as a component of its reserves, enjoying a 118% increase in value that has yet to be realized.

Regardless of the IMF’s examination, Bukele’s administration has reaped substantial advantages from its Bitcoin investment. This year, BTC‘s record high allowed the nation to purchase back more debt and stimulate its economy. Additionally, El Salvador is planning to construct a Bitcoin city financed by government-issued Bitcoin bonds.

It’s possible that during Donald Trump’s forthcoming presidency, the U.S. could create a national Bitcoin reserve. Interestingly, just last month, Pennsylvania put forward a bill suggesting the allocation of state funds towards a Bitcoin reserve.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2024-12-09 21:36