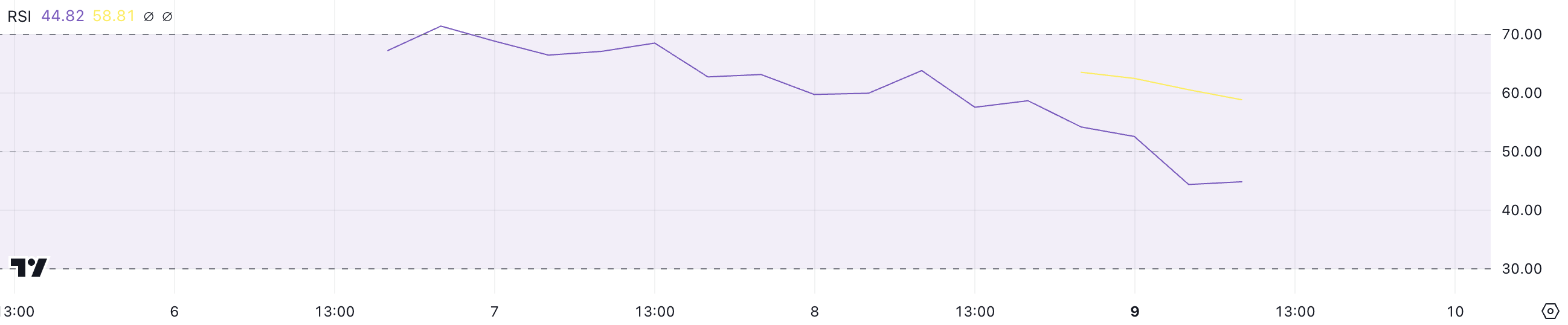

As an analyst with over a decade of experience in the crypto market, I have seen countless price surges and subsequent corrections, much like the one we are witnessing with Hyperliquid (HYPE). The RSI currently sitting at 44.8 suggests a neutral or slightly bearish sentiment, which aligns with my observation that momentum is waning in this asset.

The cost of Hyperliquid (HYPE) skyrocketed by 60% after a massive airdrop valued at $1 billion, distributing 310 million HYPE tokens to various users. This significant increase was then followed by a temporary phase where the market showed signs of overbuying, as evident from its Relative Strength Index (RSI) exceeding 70.

Nevertheless, the initial surge fizzled out, causing the RSI to dip to 44.8, indicating a neutral or slightly negative trend. Although net inflows have been inconsistent, peaking at $181 million on November 29, HYPE’s value continues to struggle under pressure due to recent decreases in both net flows and price points.

HYPE RSI Is Currently Neutral

After its airdrop, HYPE RSI briefly surged above 70, indicating that the asset was overbought.

However, this momentum didn’t last, and the RSI started to decline. It is currently sitting at 44.8, suggesting a neutral or slightly bearish sentiment.

The Relative Strength Index (RSI) is a tool used for analyzing financial markets that shows how quickly and in what direction prices are moving. It has a scale from zero to hundred.

A Reading on the Relative Strength Index (RSI) of 44.8 for HYPE indicates that it’s neither overbought nor oversold at the moment. This could mean that HYPE’s price might stay steady or experience slight decreases in the short term if its momentum keeps declining, as the RSI below 30 signals oversold conditions and above 70 suggests overbought status.

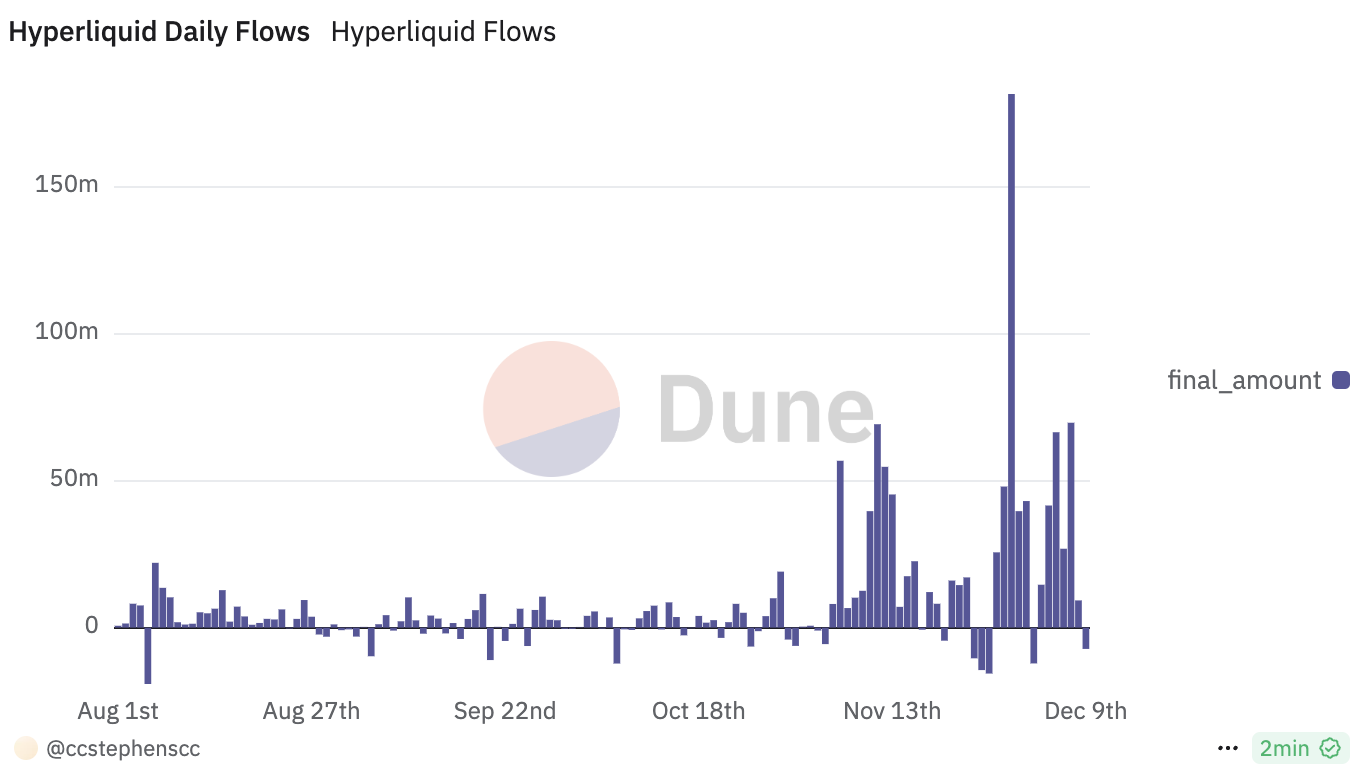

Hyperliquid Flows Reached An All-Time High On November 29

On November 29, the Hyperliquid net flows chart hit a record peak of over $181 million, marking a substantial increase. However, it decreased to $66 million by December 5, followed by a slight uptick to $69 million on December 7.

On the 8th of December, there was a significant decrease in net flows to $9 million, and as of now, they’re roughly at about negative $7 million.

In simpler terms, net flows represent the contrast between the overall incoming and outgoing funds for an asset or investment over a specific timeframe. When more money is coming in compared to going out, it’s referred to as positive net flows. Conversely, negative net flows mean that there are more exits than entries.

Although overall there’s still more money coming in than going out, the sudden decrease in net gains to negative figures might hint at dwindling investor trust or a change in market opinion. This decline may suggest possible price volatility or pressure towards decreasing prices in the near future, as withdrawals exceed deposits, potentially indicating a shift in market sentiment.

HYPE Price Prediction: Can HYPE Go Below $10 In December?

Following the airdrop, the value of HYPE noticeably skyrocketed, peaking at $14.99 on December 7th. After this spike, there was a phase of steady leveling off, during which the price remained relatively stable. Subsequently, the price started to gradually decrease.

The market seems to be in a state of uncertainty, with a slight downward momentum taking hold.

Should HYPE regain its previous bullish energy, there’s a possibility it might surge once more, aiming to surpass resistance points around $15. This could pave the way for additional growth, with the next objective being $16. This upward trend may persist as decentralized exchange platforms that operate perpetually remain popular.

Should the present weakening trend persist and intensify, the HYPE price might be challenged at its initial significant support point of $11.29. If this support fails to hold, the price could keep falling, possibly reaching $10.44, indicating a more pronounced bearish movement.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2024-12-09 19:40