As a seasoned crypto investor with a knack for navigating the volatile digital asset market, I find myself intrigued by Monero’s recent performance. Despite the minimal 2% increase, the positive funding rate and growing optimism suggest that XMR might be on its way back to the top.

In my analysis, I’ve noticed that Monero (XMR) has taken the lead among the top 100 cryptocurrencies in the past day. This advancement is quite interesting given the broader market’s sideways trend, where most altcoins have either consolidated or seen a decline, following their double-digit gains from last week.

At present, the 45th most valued cryptocurrency is being traded at $201.75 with a minimal growth of 2%. Is it likely that its price will escalate further?

Monero Increases Slightly, but Traders Stay Bullish

Last week, BeInCrypto’s daily assessment of the leading altcoins with the highest gains consistently experienced double-digit increases. However, owing to a lack of significant buying interest, today’s scenario is different, with Monero (XMR) emerging as the best-performing altcoin.

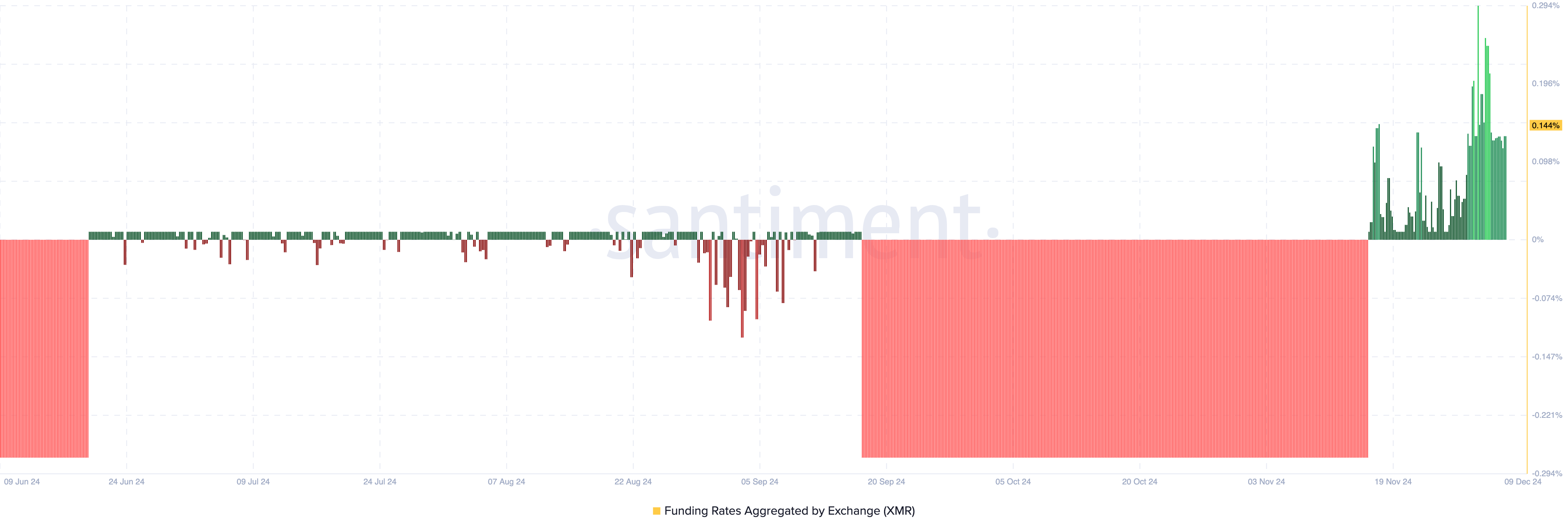

It seems that traders are anticipating a rise in XMR’s price based on the recent uptick in the funding rate, which represents the fee they pay for maintaining their positions in the derivatives market.

As a crypto investor, when I see positive readings, it suggests that long positions are earning a premium from short positions, keeping their bets open. This broader context implies a bullish outlook. Conversely, when funding is negative, shorts are paying the premium to longs, indicating a bearish sentiment.

According to information from Santiment, Monero’s funding rate stands at 0.14%. This suggests that a majority of trading positions are leaning towards a bullish outlook. If this trend continues, it’s probable that the price of XMR will increase because of the growing interest in the derivatives market.

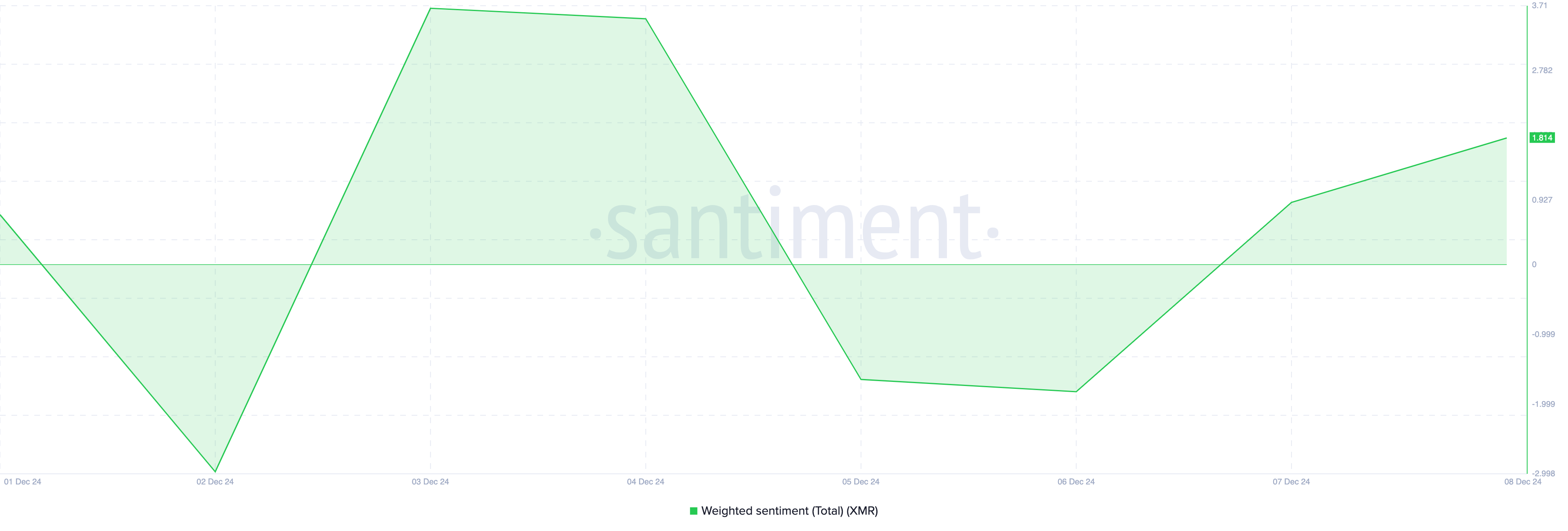

Additionally, the Weighted Sentiment, a tool used to gauge the market’s feelings towards a particular cryptocurrency, has moved into the positive territory. This suggests that the majority of discussions surrounding this digital asset are optimistic and favorable, often indicating a bullish trend.

On the contrary, a pessimistic interpretation implies that the general feeling towards the asset is negative or downbeat. However, since XMR has a positive sentiment reading, it indicates that increasing enthusiasm might boost the desire for this cryptocurrency.

XMR Price Prediction: Back to the Top?

According to the daily graph, there seems to be a correlation with an increase in XMR price, mainly due to the Bull-Bear Power (BBP). The BBP quantifies the power of bulls against the power of bears.

When the Big Bodied candlestick pattern (BBP) grows larger, it signifies that the bulls are dominating the market, potentially causing an upward trend in the price. On the flip side, a decrease in this indicator suggests the bears have the advantage, possibly leading to a decline in the price. A closer inspection of the Monero (XMR) chart reveals that it recently experienced a descent from its peak of $222.44.

If bullish forces are dominant, the altcoin’s downward trend could potentially be reversed. Should this prediction prove accurate, the token’s price could soar to approximately $227.48, or even surpass it. Conversely, if Monero (XMR) cannot maintain its current support at $201.30, a drop in value might occur, potentially leading to $186.64 and losing its position among the top-performing altcoins.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-09 14:28