As a seasoned researcher with a keen interest in the intricacies of the crypto market and its correlation with US macroeconomic data, I can confidently say that this week promises to be a rollercoaster ride for Bitcoin enthusiasts. The US CPI, Initial Jobless Claims, and PPI are three key economic indicators that could significantly influence the sentiment and volatility of the Bitcoin price.

This week, Bitcoin (BTC) traders should keep an eye on three key U.S. economic indicators that could sway Bitcoin’s momentum and potentially trigger market turbulence. The focus is heightened due to the substantial impact of American macroeconomic data on both Bitcoin and the broader crypto market this year, following a relatively quiet stretch in 2024.

Currently, the value of Bitcoin is nearly at $100,000, fluctuating around $99,000 over the weekend.

3 US Economic Data That Could Influence Bitcoin Price This Week

This upcoming week is shaping up to be quite dynamic, as several key U.S. economic indicators are anticipated to significantly impact the fluctuations in Bitcoin and other digital currencies.

US CPI

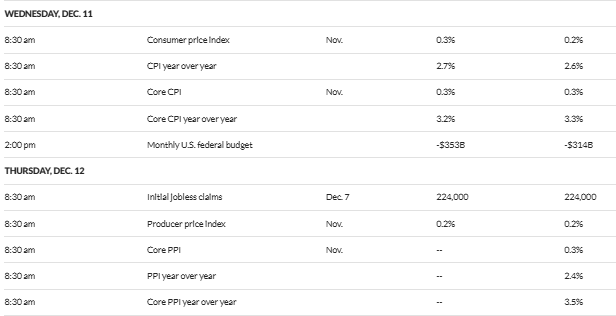

This week, one of the most significant economic indicators for the United States is the Consumer Price Index (CPI). It’s scheduled for release on Wednesday, December 11, at 8:30 A.M. Eastern Time. The US Bureau of Labor Statistics (BLS) publishes this data, which monitors how much prices for consumer goods and services change every month, providing insight into the country’s inflation trends over time.

In the recently published Consumer Price Index (CPI) report from the United States, it was disclosed that inflation had increased to 2.6%. This number remained consistent with September’s figure when it came to monthly changes, but it signified an increase for the first time after eight consecutive months of stability in annual terms.

As a researcher, I’ve observed a growing curiosity about the potential tightening by the Federal Reserve (Fed). Yet, the institutional interest in Bitcoin has significantly boosted its value, making it clear that this digital pioneer remains attractive as a store of value. This increased appeal, in turn, fuels demand for it, reinforcing its position in the financial landscape.

Economists predict an average growth of 0.3% in prices from one month to the next, which is higher than the 0.2% increase experienced in September. The general agreement among analysts on Wall Street is a 2.7% rise overall.

This coming Wednesday, all attention will shift towards the Labor Department, as they release the latest U.S. inflation figures. Besides the primary data points, the core Consumer Price Index (CPI) inflation rate will be particularly significant this week. This figure provides a more reliable gauge of inflation trends since it excludes volatile food and energy prices from the calculation.

The rate at which the essential cost of living changes significantly and unpredictably from one month to another, often not linked to consumer desire, is what makes Core Consumer Price Index (CPI) inflation crucial. Predictions indicate that in November, the Core CPI might increase by 3.3% compared to the same month last year. If this forecast holds true, it would signify the fourth consecutive month with a 3.3% reading.

Meanwhile, monthly core price increases are expected at 0.3%, also in line with the October gain.

Because it’s not controlled by any central authority and there’s a limit on how many Bitcoins can be created, it’s often seen as a protective investment during periods of inflation. On a Wednesday note, Bitcoin might gain value if the Consumer Price Index (CPI) and Core CPI in the U.S. show an upward trend.

In simpler terms, when people think inflation is making regular money less valuable, such as the U.S. dollar, they might consider digital assets like Bitcoin as a safer place for their funds because it’s seen as a reliable way to preserve value. If more investors choose Bitcoin, its demand could increase, possibly causing the price of Bitcoin to rise.

Initial Jobless Claims

On Thursday, we’ll get a look at the latest unemployment claims data from the United States, which covers the period ending on December 7. This information will offer valuable insights about the current state of the job market and the broader economy.

Generally speaking, when there are many people filing for unemployment benefits (high jobless claims), it usually signals economic hardship and instability. Conversely, when fewer people are seeking unemployment benefits (low jobless claims), it often indicates a robust labor market and economic security.

The number of unemployment insurance applications for the week ending November 30 reached 224,000. This figure surpassed the initial forecast of 215,000 and also exceeded the previous week’s total, which was initially reported as 215,000 but has now been adjusted to 213,000.

Based on Bureau of Labor Statistics figures, it appears that the U.S. job market showed a slight improvement in November, with the unemployment rate increasing to 4.2%.

In November, the United States saw a growth of 227,000 jobs outside farms, a rebound from the slowdown in job creation observed in October. This increase occurred despite the ongoing Boeing strike and the aftermath of Hurricane Milton.

According to recent employment figures, it appears that the labor market is continuing to thrive. Following a dip in job growth during October due to inclement weather and strikes, there was a significant rebound in November with robust job creation and upward adjustments. On average, the economy has added approximately 173,000 jobs over the past three months, as Senior Economist Elise Gould from the Economic Policy Institute explained.

Unusually high unemployment benefits requests on Thursday might fuel a pessimistic market atmosphere and ambiguity. As a result, investors may opt to invest in secure assets such as gold or Bitcoin due to their perceived safety. The growing interest in Bitcoin as a means of wealth preservation could theoretically boost its value.

Just as persistently high unemployment figures might hint at a decline in consumer spending and overall economic activity, this trend could lead central banks to adopt expansionary monetary policies. This move might stir worries about inflation and currency depreciation, causing investors to seek refuge in alternative investments such as Bitcoin to safeguard their assets.

US PPI

Furthermore, this coming Thursday, the Bureau of Labor Statistics (BLS) is set to publish the Producer Price Index (PPI). This index provides an insight into wholesale price inflation. Essentially, it calculates the typical change in the costs that domestic manufacturers charge for their products over a given period.

This week’s Consumer Price Index (CPI) and Producer Price Index (PPI) figures will play a crucial role in deciding the Federal Reserve’s interest rate for this month. The insights gained from these indices will be vital in shaping the Fed’s strategy, as they represent key steps in their policy readjustment process. It’s important to mention that this week’s data is the last inflation-related information before the December meeting of the Federal Reserve.

Everyone is eagerly waiting for the release of Consumer Price Index (CPI) and Producer Price Index (PPI) inflation figures, as investors are optimistic that these numbers might justify another quarter-point reduction in interest rates, according to The Kobeissi Letter.

Currently, according to BeInCrypto’s data, the markets are experiencing a dip. At present, one Bitcoin is being traded for approximately $99,147, representing a 0.68% decrease in value.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-12-09 08:50