As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles. The recent surge in Chainlink (LINK) has piqued my interest, as it aligns with broader market trends that suggest an altcoin rally is underway.

Over the past week, Chainlink’s (LINK) price surged by an impressive 36.55%, reaching its peak value since early January 2022. This growth aligns with a widespread uptrend in altcoins, causing many cryptocurrencies to recoup significant losses that had accumulated over the previous months.

Additionally, this examination points towards the possibility that LINK might still be rising, as various signs hint at a potential increase in its worth within the upcoming weeks.

Chainlink Bearish Sentiment Is Not Entirely Bad News

The recent Chainlink price rally has ensured that the altcoin now trades at $25. This milestone could be linked to rising buying pressure, especially from crypto whales.

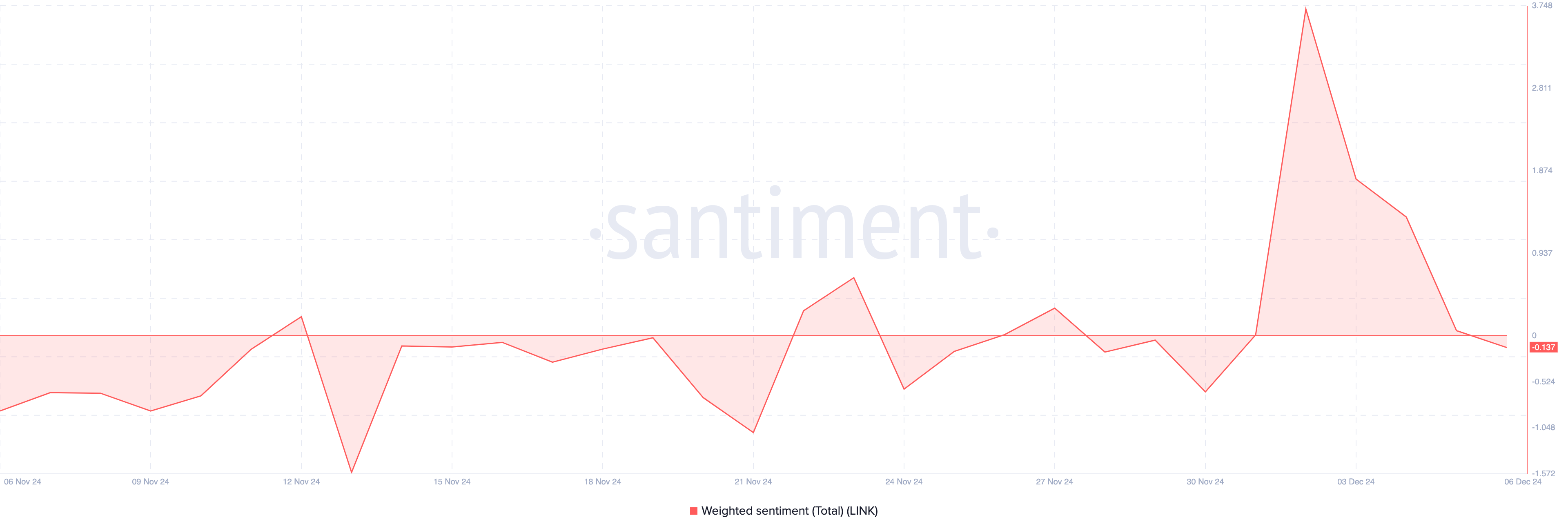

Meanwhile, based on Santiment’s analysis, it appears that retail investors are yet to jump aboard, implying that there might be more potential for LINK’s price to rise. A piece of evidence supporting this is the Weighted Sentiment.

Weighted Sentiment gauges the overall sentiment the public expresses towards a particular cryptocurrency. If the measurement shows negativity, this suggests that many online discussions revolve around a pessimistic view of the asset. Conversely, when the measurement is positive, it indicates that the majority of comments online are optimistic about the digital currency.

Currently, Chainlink’s Weighted Sentiment is situated within the negative range, suggesting that the Retail Fear of Missing Out (FOMO) hasn’t kicked in yet regarding the token. Typically, when prices rise and sentiment remains bearish, it indicates that the crypto may not have reached its maximum potential value.

According to a recent post by Santiment, they share the same viewpoint regarding LINK. They believe that low bullish sentiments among the public could be an advantageous situation for LINK.

The analysis from the on-chain platform indicates it’s promising that there’s minimal retail fear of missing out (FOMO) towards LINK. Since markets often move contrary to what the crowd anticipates, the skepticism among the crowd will actually contribute to the ongoing rally.

In addition, an analysis by BeInCrypto on the Holding Time metric of Chainlink’s coins shows an interesting pattern: the majority of LINK holders appear to be resisting the urge to sell their tokens. Normally, a decrease in holding time implies heightened selling activity as more coins are traded or disposed of.

In other words, the value measured by the specified metric for LINK is on the rise, indicating that investors have a growing sense of trust. This upward trend suggests a strong bullish sentiment among token holders, as they seem to prefer keeping their assets rather than selling them.

If sustained, such sentiment often lays a strong foundation for potential upward price momentum.

LINK Price Prediction: Time for $30 to Show

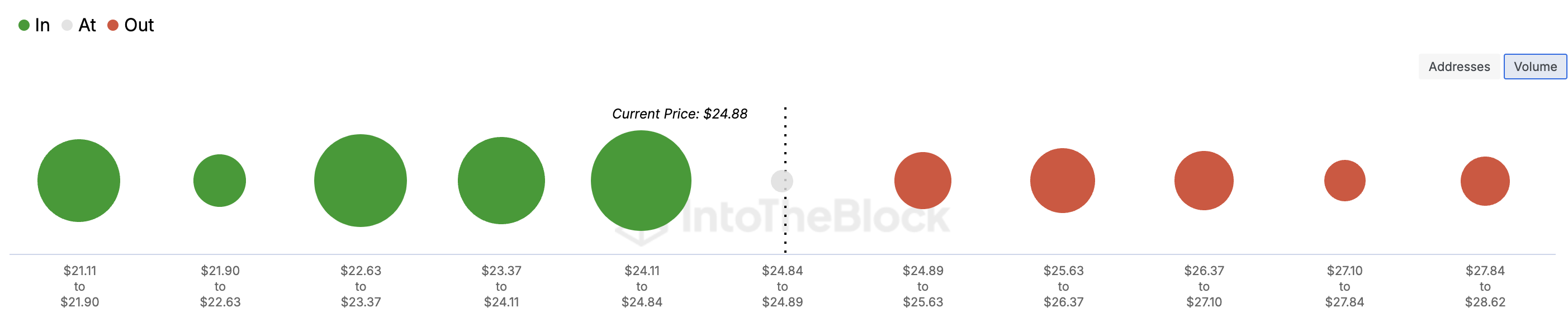

Looking at the on-chain data, it’s clear that approximately 79% of Chainlink’s LINK holders are currently enjoying a profit. This indicator not only pinpoints profitable accounts but also marks significant resistance and support levels for the token price, thanks to the volume of tokens being traded at these points.

At certain price ranges, larger groupings of tokens suggest more significant levels of either support or resistance. As per IntoTheBlock’s data, the number of “profitable” tokens falls heavily within the range of $22 to $25 compared to the number between $26 and $28. This suggests a robust support area that could potentially boost LINK’s price towards $30 in the near future.

As a crypto investor, I’m optimistic about Chainlink’s future, but it hinges on continued buying momentum. If selling pressure starts to dominate over purchasing activity, there’s a chance that Chainlink’s value might dip below the $20 mark. However, for now, it seems more likely that we’ll see an increase in Chainlink’s price.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-07 21:57