As a seasoned crypto investor with roots deeply planted since the early days of Satoshi’s whitepaper, I find Marathon Digital’s latest Bitcoin acquisition spree nothing short of exhilarating. The strategic maneuvers they’ve executed, coupled with the changing landscape of corporate adoption, paint a picture of an evolving and maturing market.

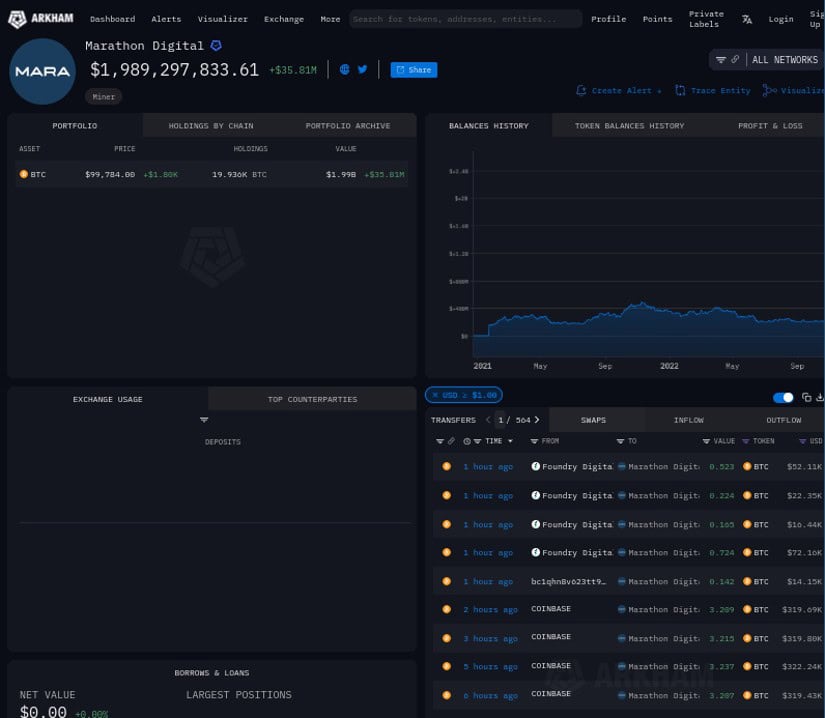

Recently, a company based in Nevada purchased an extra 1,300 Bitcoins, which is approximately $130.66 million according to current market values. This transaction followed another one of 1,423 Bitcoins worth around $139.5 million just a few days prior. With these consecutive purchases totaling over $270 million, Marathon Digital now ranks as the second-largest corporate Bitcoin holder globally, with MicroStrategy taking the lead due to its significant holdings according to industry data.

As an analyst, I’ve noticed a significant strategic move by Marathon, which comes at a time when the Bitcoin market is witnessing volatility but generally trending upward. In fact, it briefly broke through the $100,000 barrier and settled around $99,000. The company’s recent actions, as outlined in U.S. Securities and Exchange Commission filings, suggest a resolute approach to amass Bitcoin, even given its high valuations. Over the course of October and November, Marathon reportedly acquired over 6,400 Bitcoins at an average price approximately $95,000. This move underscores their faith in Bitcoin’s long-term potential.

Marathon’s aggressive stockpiling of Bitcoin comes after it successfully secured an $850 million convertible note offering, which carried no interest. The money obtained will be used for additional Bitcoin purchases. This financial strategy, along with the company’s ongoing buying spree, suggests a transformation in how traditional companies handle their finances. Initially considered a specialized asset, Bitcoin is rapidly morphing into a strategic reserve as corporations aim to broaden their holdings during times of economic flux and shifting investor preferences.

The expanding financial markets are driving this trend. Exchange-traded funds (ETFs) listed in the U.S., particularly those dealing with Bitcoin, have gained significant influence and attracted large institutional investments. Notable asset managers like BlackRock have made substantial investments in Bitcoin, contributing to its growing status as a viable alternative investment option for mainstream investors.

At the same time, increased whale activity – large-scale Bitcoin acquisitions by significant market figures – underscores strong institutional interest. Although there may be short-term price swings, data indicates that key stakeholders such as Marathon are prepared for long-term involvement with cryptocurrency. Additionally, political changes have played a role, with certain U.S. states and notable corporations publicly adopting Bitcoin as a reserve asset, which bolsters the credibility of corporate Bitcoin strategies.

As Bitcoin’s price rises and Marathon Digital expands, the market seems poised for growth, but analysts stay vigilant about short-term fluctuations. For example, miner holdings have shown instability, and recent decreases in total assets might suggest caution. However, many within the industry interpret these downturns as a normal part of the market’s cycle instead of a change in long-term outlook.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-07 14:49