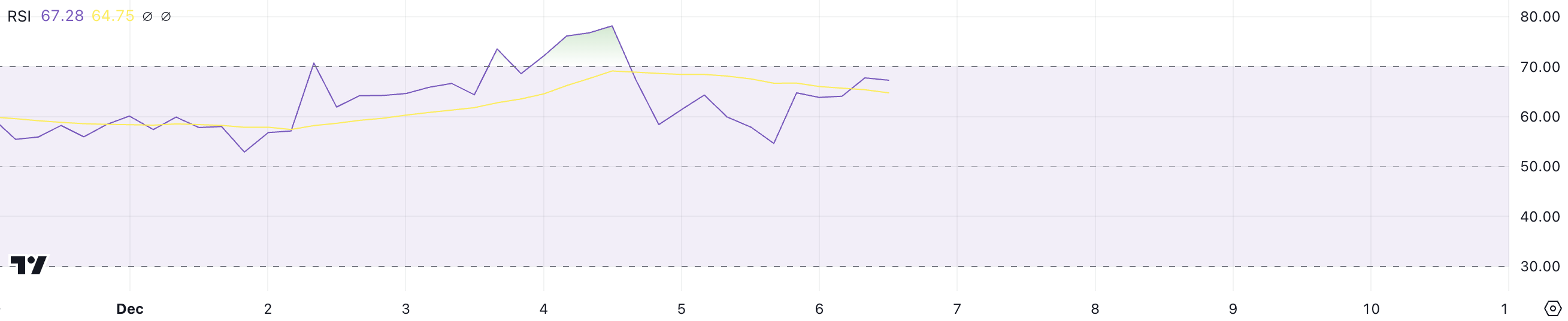

As a seasoned analyst with over two decades of experience in the crypto market, I’ve seen trends ebb and flow like the tides. While Uniswap’s RSI reading of 67 indicates it’s approaching overbought territory, it hasn’t yet sounded the alarm for an immediate correction. This is akin to a stock market bull seeing a red candle but knowing it’s just a brief pause before the market continues its upward trajectory.

Uniswap’s (UNI) value has experienced significant increase, surpassing a market capitalization of $10 billion and climbing by 80.44% in the last month. At present, UNI is moving towards overbought territory, as indicated by its RSI score of 67, but there’s still potential for further growth before suggesting an imminent adjustment.

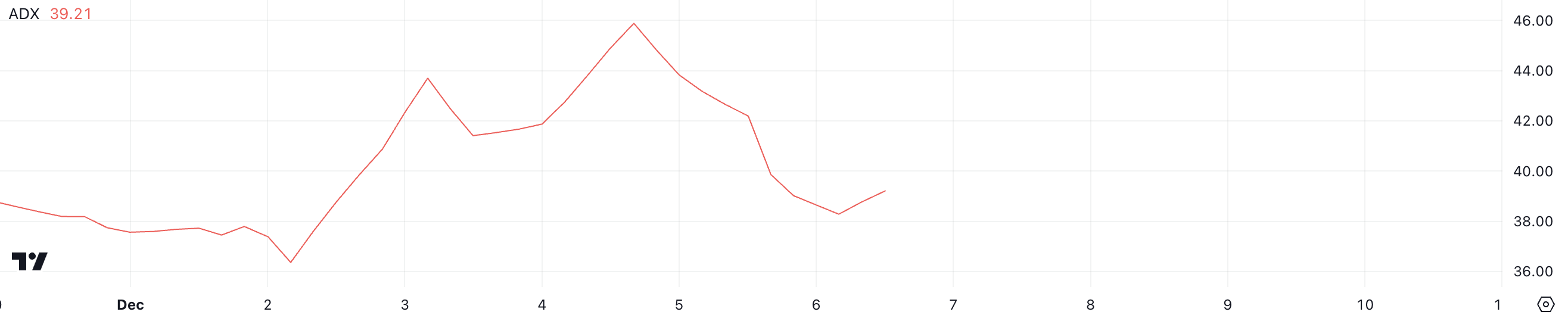

Although the Average Directional Index (ADX) has decreased slightly from 46 to 39, UNI still exhibits a robust upward trend as its trend strength exceeds 25. If this positive trajectory persists, UNI might challenge the resistance at $17.39, possibly even reaching $20 – a level not seen since 2021 and marking a new high for the digital asset.

UNI RSI Is Still Below Overbought Zone

The current Relative Strength Index (RSI) of Uniswap is around 67, indicating it’s getting close to being overbought, however, it hasn’t crossed over the 70 threshold just yet.

Values of Relative Strength Index (RSI) higher than 70 usually indicate that an asset may be overbought, yet UNI, currently standing at 67, appears to have some potential for further growth without triggering a swift reversal or correction.

The Relative Strength Index (RSI) is a tool that gauges the rate of price increase or decrease using a scale ranging from 0 to 100. A reading over 70 signifies overbought status, while a value under 30 indicates oversold status in the market.

Due to UNI Relative Strength Index (RSI) consistently being above 70 during recent price surges, its current reading of 67 indicates that there may be more room for growth before a possible downturn.

Uniswap ADX Shows the Current Uptrend Is Strong

As a crypto investor, I noticed that the Trend Strength of UNI, as indicated by its ADX, has slightly diminished over the past couple of days. Yesterday, it was at 46, but today it’s down to 39, hinting at a potential weakening in the momentum.

As an analyst, I’m observing a downturn that seems to indicate a slowdown in the momentum of UNI. However, it’s crucial to note that the Average Directional Index (ADX) continues to stay above 25. This suggests that UNI’s price is still part of a robust trend, even though we’re currently experiencing a pullback.

The Average Directional Index (ADX) determines a trend’s intensity, where figures surpassing 25 point to a robust trend, while numbers falling beneath 20 imply a weak or non-existent trend.

With an ADX of 39 for UNI, it’s clear the asset is still experiencing a robust upward trajectory. However, the recent dip hints at a possible reduction in speed, potentially signaling a temporary pause before additional growth resumes. In other words, despite the drop, UNI’s bullish trend appears to be holding strong, but there might be a short-term consolidation period coming up.

UNI Price Prediction: Can It Rise Back to $20 After 3 Years?

Should the upward trend persist, it’s possible that the UNI price might challenge the resistance level of around $17.39. If successful, it could continue climbing towards a new high of approximately $20, reaching its peak value since the year 2021.

This suggests a robust and sustained upward trend for Uniswap’s price, pointing towards substantial potential increases.

As an analyst, I’m observing a potential reversal in the current trend for Uniswap. Should this happen, the first support level we might see is around $13.5. If this level doesn’t manage to keep prices stable, there’s a possibility that the price could slide further down, potentially reaching $12.4. This suggests a bearish outlook for Uniswap unless the trend recovers its strength.

Read More

2024-12-07 00:43