As a researcher with extensive experience in the cryptocurrency market, I find this proposal by Jared Grey, the “Head Chef” at Sushi DAO, intriguing yet risky. Having closely observed the volatile nature of the crypto market and decentralized autonomous organizations (DAOs), I understand the need for diversification to ensure sustainability and growth. However, selling off all SUSHI tokens could potentially lead to a liquidation event that might have unforeseen consequences.

The group in charge of managing the Sushi Swap decentralized trading platform, known as Sushi DAO, has suggested a change in their treasury holdings. This proposal aims to shift the composition of Sushi’s treasury from being solely SUSHI tokens to a blend that includes stablecoins and various other assets.

This unofficial suggestion aims to gather opinions from the Decentralized Autonomous Organization (DAO) community, particularly regarding particular settings, prior to any formal voting process.

SUSHI Tokens Could Face Liquidation

The idea for this move originates from Jared Grey, who is in charge at Sushi as their top culinary expert. His plan involves offloading all of the exchange’s SUSHI tokens and utilizing the earnings to purchase additional assets. According to Gerry, this transaction would help minimize risks associated with platform volatility, boost liquidity, and potentially yield higher profits.

As the Sushi DAO progresses, it’s essential to maintain the longevity and expansion of our funds. The DAO keeps its funds in SUSHI tokens, which can lead to significant volatility and liquidity issues. This proposal suggests a method for expanding the variety of treasury assets to minimize risks and boost long-term resilience, as explained by Grey.

While the original purpose of this token was for governance, the DAO now functions according to distinct guidelines. The outcome of a governance vote determines whether the proposal is successful or not.

Should this plan be executed, the tokens in question would be progressively sold off. The earnings from these sales will then be used to amass a fresh treasury. Approximately 70% of the assets will consist of stablecoins, while 20% will be “blue chip” cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). The remaining 10% could potentially be DeFi tokens as well.

As a crypto investor, I find it noteworthy that the proposal outlines that any leftover emergency funds will be comprised of stablecoins. It’s worth mentioning that these digital assets will not only secure our current financial position but also cater to future strategic investments and operational costs associated with Sushi Swap.

To put it simply, this means that there are no more conditions requiring anyone to keep their SUSHI tokens. If this happens, it will mark a significant change in the policy.

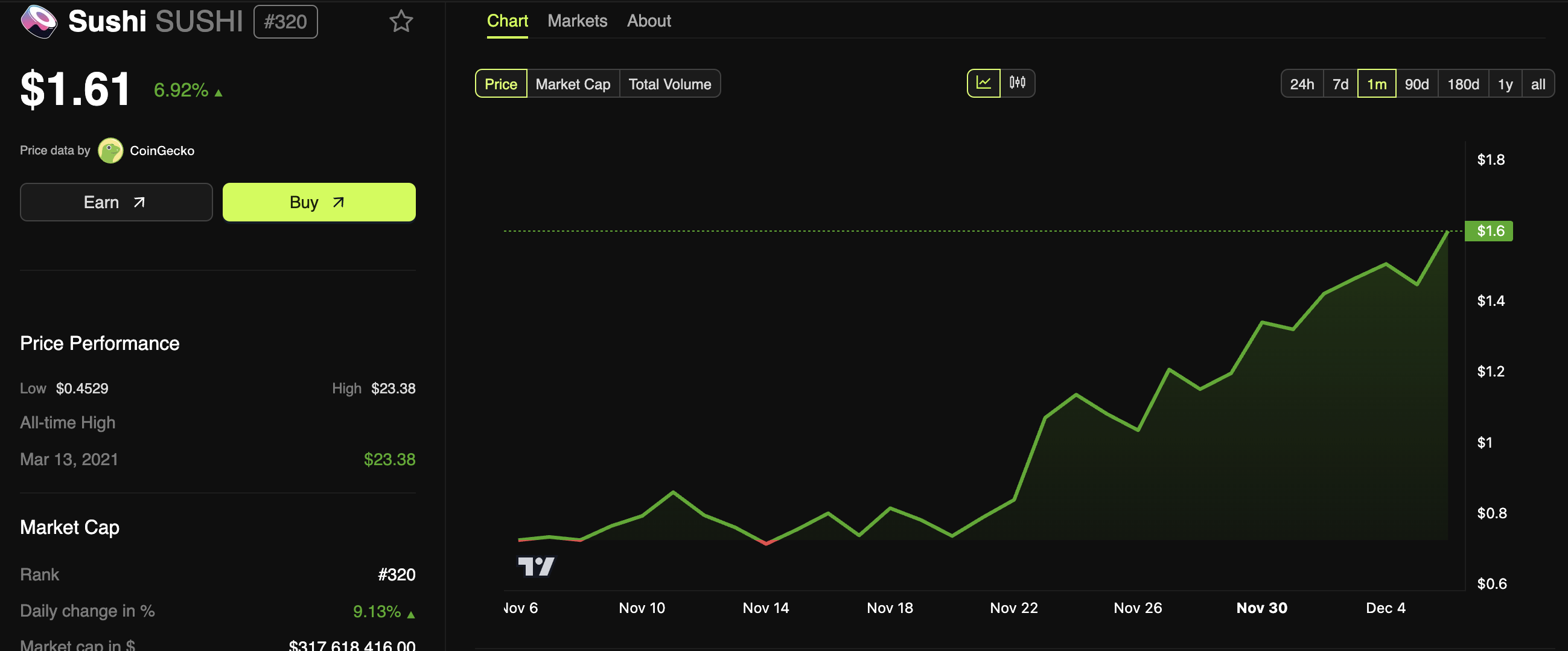

In April this year, Grey supported a debatable reorganization within Sushi DAO. Coincidentally, around the same period, the value of the SUSHI token dropped by almost 20%. However, it has since been on an upward trajectory, showing a significant increase of approximately 130% in the last month. Remarkably, this proposal hasn’t seemed to halt the positive trend.

Currently, it’s uncertain whether this policy will be successful. This initiative aims to gather community input to help shape a definitive community vote on governance matters.

As for certain factors such as the SUSHI liquidation rate and the integration of DeFi tokens, they haven’t been defined yet. Right now, these and other operational issues are being discussed within the Decentralized Autonomous Organization (DAO).

Read More

- ALEO PREDICTION. ALEO cryptocurrency

- Solo Leveling Season 2: Check Out The Release Date, Streaming Details, Expected Plot And More

- Who is Owen Cooper? All About Netflix’s Adolescence Star Taking Hollywood by Storm

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- How To Fix The First Berserker Khazan Controller Issues on PC

- ATH/USD

- Where to Stream Mickey 17? Everything You Need To Know About Robert Pattinson’s Sci-Fi Thriller

- General Hospital Spoilers: Will Kristina Let Blaze Pursue Her Career Dreams?

- COMP PREDICTION. COMP cryptocurrency

- Wall Street’s ‘Fear Index’ Jumps Over 25%, Hitting Its Highest Level Since March 2023

2024-12-07 00:17