As a seasoned analyst with years of experience in the financial and regulatory sectors, I find this latest move by AUSTRAC to be a necessary step in addressing the growing issue of money laundering through cryptocurrency ATMs. My personal life experiences have taught me that when it comes to financial systems, especially those involving new technologies like cryptocurrencies, regulation is key to maintaining trust and ensuring the safety of users.

The Australian financial intelligence agency AUSTRAC has declared tighter monitoring of cryptocurrency Automated Teller Machines (ATMs). While they haven’t officially banned these machines, they plan to closely examine them to ensure adherence to the law.

AUSTRAC referred to this enforcement as the “initial measure” within their larger strategy aimed at combating cryptocurrency-related illegal activities.

AUSTRAC to Investigate Crypto ATMs for Enabling Money Laundering

On December 6, the Australian Transaction Reports and Analysis Centre (AUSTRAC) issued a press release, warning of an impending crackdown. The agency stated that scammers have exploited cryptocurrency Automated Teller Machines (ATMs) to facilitate illegal activities and transfer illicit funds. AUSTRAC considers these ATMs as prime conduits for money laundering and the perpetration of crypto-related crimes.

Crypto Automated Teller Machines (ATMs) offer a convenient method for criminals to launder money due to their widespread availability and ability to facilitate quick, untraceable transactions. It’s crucial that providers of these crypto ATMs take steps to minimize criminal activity associated with them. If they fail to meet these responsibilities, AUSTRAC will not hesitate to intervene,” stated AUSTRAC CEO Brendan Thomas.

Earlier last year, UK regulatory bodies took action against cryptocurrency ATMs, much like in 2022, due to allegations of money laundering. Similarly, Australian law enforcement agencies have been probing these crypto ATMs for quite some time. In one such instance in 2022, the NSW Police confiscated several cryptocurrency ATMs during a joint operation.

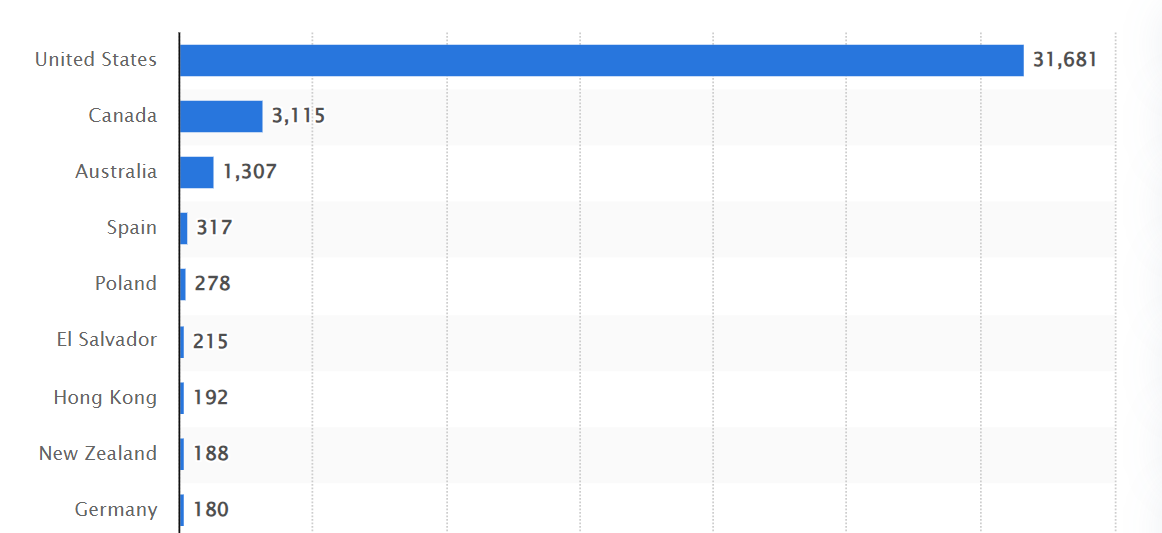

It’s been stated that just a handful of cryptocurrency companies manage most of the ATMs found in Australia. Given this concentration, it makes sense that AUSTRAC has the resources necessary to monitor any rule-breakers effectively. In fact, they’ve even created a dedicated team for precisely this reason.

The CEO of the organization referred to this action as “the initial move” signifying AUSTRAC’s commitment to limiting the illicit usage of cryptocurrencies within Australia. Meanwhile, it is worth noting that other government entities have independently been carrying out their respective operations.

Additionally, in August, ASIC, a financial regulatory body, took down approximately 600 cryptocurrency frauds, while in October, the police confiscated around $6.4 million from individuals involved in cryptocurrency-related crimes.

Essentially, AUSTRAC is ready to take strong actions. In his speech, Thomas expressed concerns about cryptocurrencies at various points, stating “As the use of cryptocurrencies grows, so does the potential for criminal misuse.” However, this enforcement action doesn’t involve any new limitations.

To maintain compliance, Australian crypto ATM operators must monitor transactions, perform KYC checks on all customers, report all withdrawals over $10,000, and more. Crypto ATM scams are very common, and Australia’s regulators constantly encourage users to report suspicious activity in crypto markets.

Read More

2024-12-06 23:51