As a seasoned analyst with over two decades of experience in traditional financial markets, I have seen firsthand how market events can shape the trajectory of investments. After diving into Keyrock’s latest research on token unlocks and their impact on the cryptocurrency market, I am convinced that these seemingly mundane events are indeed critical market drivers.

Unscheduled token releases play a pivotal role in shaping the crypto market. They can lead to price fluctuations, increased volatility, or even foster ecosystem expansion. A recent study by Keyrock, a prominent player in the cryptocurrency market, delves into the effects of token unlocks on the market.

The study demonstrates that token releases, while consistent, can bring about substantial effects. Utilizing this knowledge allows cryptocurrency market players to handle such occurrences more tactfully, turning possible disturbances into prospective advantages instead.

Keyrock Research Unveils Insights on Token Unlocks

As a researcher delving into this fascinating field, I’ve recently analyzed over 16,000 token unlock occurrences, shedding light on their significant impact on market dynamics. The insights gleaned from this study prove invaluable for both traders and investors alike. Each week, an impressive $600 million worth of tokens flood the market through these unlocks. Remarkably, despite their recurring nature, the market’s response to these events tends to be consistent across the board.

It’s crucial nowadays for traders to grasp the concept of trading schedules, as it plays a vital role in making accurate decisions about when to enter and exit the market.

As stated by Keyrock, approximately 90% of token unlocks tend to exert downward pressure on prices. This holds true regardless of whether the tokens are large or small, cryptocurrencies or otherwise, and who their recipients are. It’s worth noting that price changes can start happening even before the scheduled unlock date, as it appears that some members of the community may anticipate these events and act accordingly. Moreover, larger unlocks intensify this impact, leading to steeper price decreases (up to 2.4 times more severe) and a rise in market volatility.

It’s worth mentioning that token release events, often called unlock events, usually adhere to predefined timetables detailed in vesting tables. These timetables may vary from one large release (also known as cliff unlocks) to a steady flow of monthly distributions (linear unlocks). Keyrock’s findings group these events based on their size, revealing that while smaller releases might not have a significant individual impact, they can collectively lead to price suppression over time.

- Nano (<0.1%) and Micro Unlocks (0.1%-0.5%): Minimal impact.

- Small (0.5%-1%) and Medium Unlocks (1%-5%): Capable of influencing market sentiment.

- Large (5%-10%) and Huge Unlocks (>10%): Significant events with high market impact.

As a researcher studying market dynamics, I’ve observed that the magnitude of an unlock significantly impacts its relevance for traders. Overwhelmingly large token unlocks, while initially causing disruption, tend to distribute their influence over time. This distribution results in a more drawn-out process of price recovery, as opposed to a swift rebound.

Other than just its size, the kind of entity that receives the unfastened tokens plays a substantial role in shaping price movements. Understanding the profile of the recipient who unlocks these tokens is essential for predicting their potential influence on the market. Keyrock has categorized five main groups in this regard.

Team Unlocks

These actions cause significant harm, leading to average decreases in price of up to 25%. Selling without coordination among team members and a failure to employ strategic tactics to mitigate market effects can make things worse. These tokens are frequently sold rapidly to meet financial requirements, which leads to sudden drops in price.

“Team unlocks exemplify how lack of planning can amplify market disruption,” the report noted.

Consequently, traders might want to steer clear of opening new positions during these unlock phases, or for that matter, during the prolonged periods of distribution that typically occur afterward.

Investor Unlocks

Through skillful management and careful execution, the results were tactfully moderated, thanks to sophisticated hedging and liquidation techniques. It’s worth noting that when an investor releases their holdings, the market response tends to be more predictable and controlled than when a whole team does so.

Initially backers, many hailing from Venture Capital (VC) realms, utilize sophisticated tactics like Over-the-Counter (OTC) trades, derivatives, and options to lessen the influence of token sales. This approach minimizes quick selling and maintains a well-structured market environment.

Keyrock’s findings suggest that if project teams implement comparable strategies, they could substantially lessen the adverse effects associated with token unlocks.

Keyrock noted that with careful strategy and execution, turning obstacles into chances becomes a possibility instead of a burden.

Ecosystem Development Unlocks

Distinctively beneficial, these frequently lead to price hikes (by an average of +1.18%) by either infusing liquidity or encouraging the expansion of the ecosystem. These tokens are usually employed for infrastructural advancements, fostering sustained growth within the ecosystem over time.

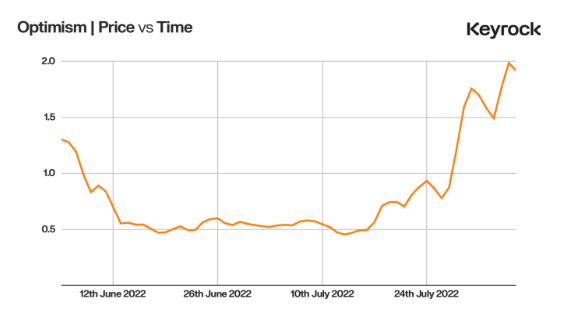

Keyrock illustrates an instance where Optimism (OP) distributed $36 million worth of tokens to 24 separate initiatives, as a strategic move after a significant release in June 2022. This tactic not only helped stabilize the market but also encouraged growth within the network.

Keyrock stated that aligning unlock strategies with the development of the ecosystem can function more effectively as stimulants, rather than causing disruptions.

Community and Burn Unlocks

Transactions involving community or publicly distributed tokens sometimes show a blend of effects, as many are kept or traded, which generally results in modest price fluctuations. Conversely, burn unlocks are seldom seen and thus not considered in the given analysis.

Key Takeaways: Patterns and Strategies Around Unlocks

Simultaneously, two common factors often contribute to the lowering of pre-token unlock prices. The first one is retail foresight, where traders choose to sell ahead to avert dilution, thus continuing to push down the prices. Secondly, there’s institutional hedging, where knowledgeable holders take steps to fix prices in advance, intending to minimize their influence on unlock days.

After being released from lockup, prices usually become steady within a fortnight as the market mechanisms adapt. For ecosystems, this stability brings along visible advantages for development, such as the case with projects like Optimism, which strategically employed token unlocks to finance their ecosystem’s growth.

The research noted that Optimism’s approach post its aggressive June 2022 release offers a classic illustration of how thoughtfully structured ecosystem releases can foster both short-term benefits and long-term progress. Initially, there was a selloff, but Optimism showcased the impact of linking releases with strategic incentives, transforming a sudden increase in supply into a platform for expansion.

eyrock’s study underscores the significance of keeping tabs on release timetables and learning about user habits for traders. The timing is vital in trading. Exiting investments approximately 30 days before significant releases and re-entering around 14 days afterward may help minimize risks and maximize returns. For projects, thoughtfully designing unlock schedules and tactics like staggered distributions and liquidity assistance can lessen market turbulence and align with long-term growth goals.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

2024-12-06 17:47