As a seasoned researcher with years of experience in the ever-evolving crypto market, I find it both exhilarating and intriguing to witness Binance’s latest moves. The listing of Orca (ORCA) and Across Protocol (ACX) tokens, while not uncommon for this leading exchange, is always a significant event that can potentially set the stage for price fluctuations and market trends.

Binance is set to add support for trading Orca (ORCA) and Across Protocol (ACX), making available various options for spot trading these tokens.

The trading platform regularly adjusts the list of available tokens based on its regular assessment, aiming to maintain compliance with industry standards and uphold a top-tier quality.

Binance New Listings: ORCA and ACX

As per a recent announcement by Binance, you’ll be able to trade ORCA and ACX tokens starting from December 6 at 13:00 UTC, with the USDT stablecoin as the trading pair. After the listing, withdrawals will become available 24 hours later.

Binance announced the addition of new trading pairs: ACX/Tether and ORCA/Tether. Users are now able to deposit ACX and ORCA funds in anticipation of trading.

Remarkably, this list offers no charges for trades, allowing users to exchange tokens on the platform without having to worry about any transaction fees. Offering zero fees is one of the tactics that exchanges use to entice more people to join their platforms.

On Binance exchange, ORCA and ACX will receive a unique label called a seed tag. This is done as a precautionary measure due to their fresh entry into the market, which may expose them to above-average risks and potential for increased price volatility compared to established tokens.

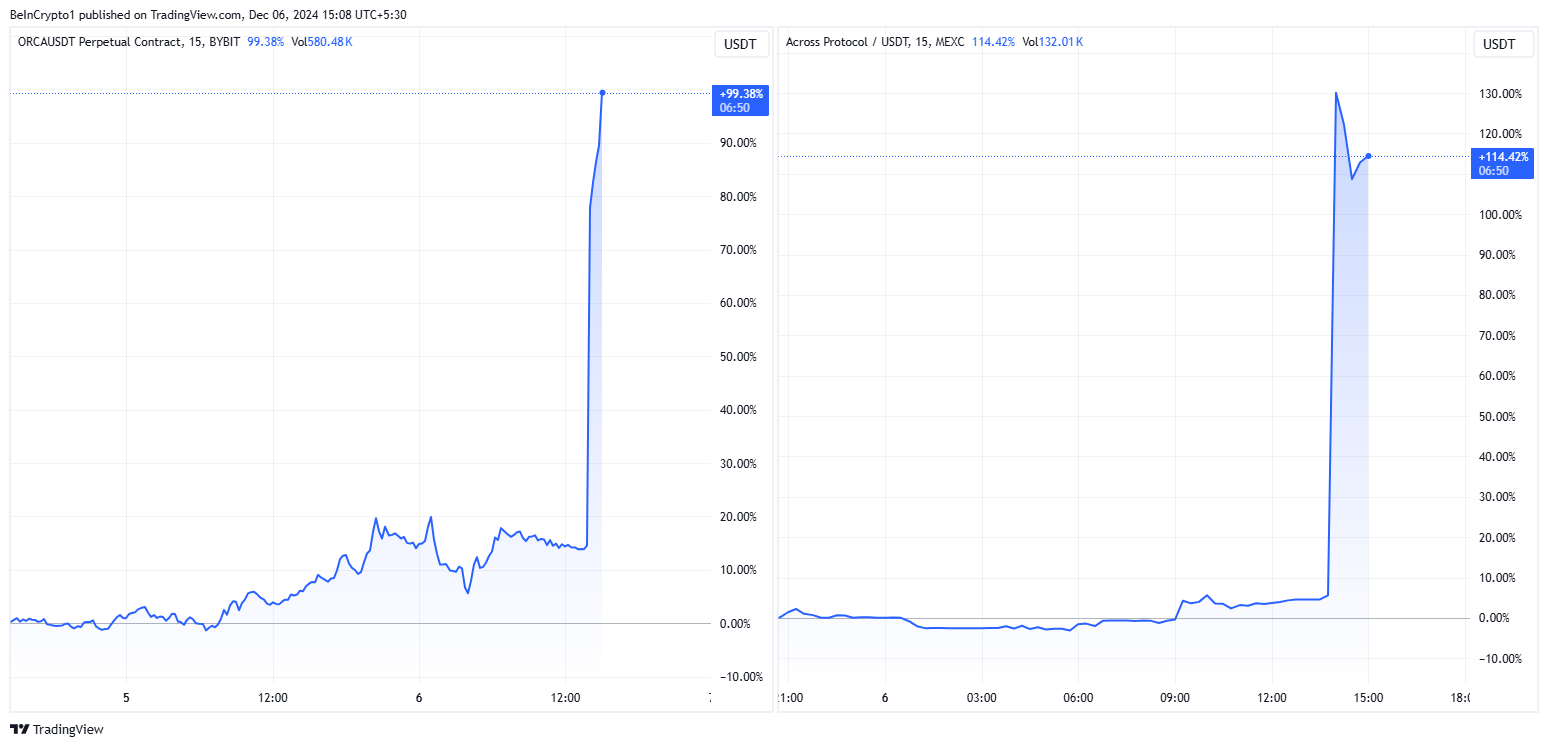

The ability to trade the recently mentioned pairings depends on your location or where you reside, as eligibility is determined by these factors. On the other hand, data from TradingView indicates that ORCA and ACX have experienced significant growth, with this surge starting after the announcement of their listing on Binance.

Binance to Delist MAVIA, OMG, BOND

In addition to the recent additions to Binance’s listings, the exchange with the highest trading volume has announced that it will terminate all perpetual contracts for Heroes of Mavia (MAVIA), OmiGo (OMG), and BarnBridge (BOND) as of December 16. This change means that these tokens will no longer be available for futures trading on that date.

On December 16, 2024 at 09:00 UTC, Binance Futures will close all open positions and perform an automatic settlement for the USDⓈ-M MAVIAUSDT, OMGUSDT, and BONDUSDT perpetual contracts. Following the settlement, these contracts will no longer be available for trading.

Binance advises users to wrap up any active trades before the removal deadline to avoid automatic payment processing. Moreover, the Binance Arbitrage Bot for Funding Rates will discontinue all arbitrage tactics and settle positions on the MAVIAUSDT, OMGUSDT, and BONDUSDT markets. Following delisting, these markets will no longer accommodate new arbitrage strategies.

Immediately following the announcement, the values of MAVIA, OMG, and BODND dropped. This decrease was anticipated because when tokens are delisted from major exchanges, it often leads to large-scale sell-offs. It’s worth mentioning that neither of these tokens can be traded on Binance in the spot market.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-06 14:32