As a seasoned researcher with a knack for deciphering market trends and a soft spot for Cardano, I must admit that the recent surge of ADA has been quite intriguing. The whale accumulation in November was a clear sign of confidence, but the stabilization since then suggests a more cautious approach – much like how my cat approaches a new toy after it’s lost its novelty.

Over just the past month, Cardano‘s (ADA) value has skyrocketed by an astonishing 265%, making it one of the top performers in the top 10 cryptocurrencies, trailing only Ripple (XRP) in terms of growth.

The buildup of whale holdings, which boosted confidence in November, has now settled down, indicating a more careful strategy among significant investors.

ADA Current Uptrend Appears To Be Fading Away

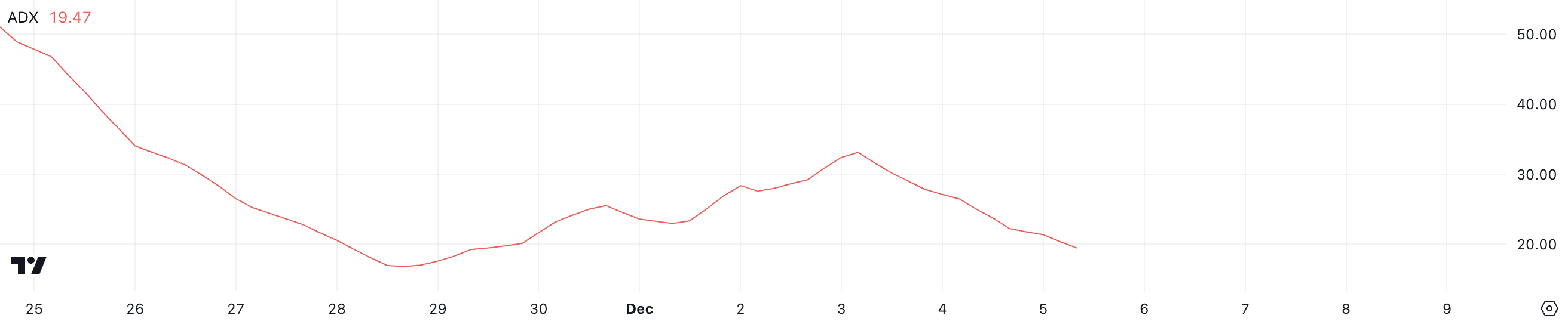

The ADX value for Cardano has decreased from 33 on December 3 to 19.4, suggesting a lessening strength in the trend. This drop implies that the momentum of ADA’s recent price increase might be weakening, although it continues to move upward overall. From December 1 to December 3, the price of ADA experienced a significant rise of nearly 27%. This surge corresponds with its ADX reaching 33.

In simpler terms, when the Average Directional Movement Index (ADX) is lower, it indicates that although the current trend persists, it may not have the same strength as before. This could be a sign of market consolidation or a deceleration in the rate of growth.

The Average Directional Index (ADX), which gauges the strength of a market trend, suggests a strong trend when its value exceeds 25. Conversely, values below 25 indicate a weak or consolidating market. In this case, the ADA ADX stands at 19.4, indicating a weakening trend despite the current uptrend, possibly suggesting that future growth might progress more slowly.

If purchasing activity picks up speed once more, there’s a chance that the ADX might increase again, bolstering the ongoing upward trend.

Cardano Whales Are Now Stable After Accumulating In November

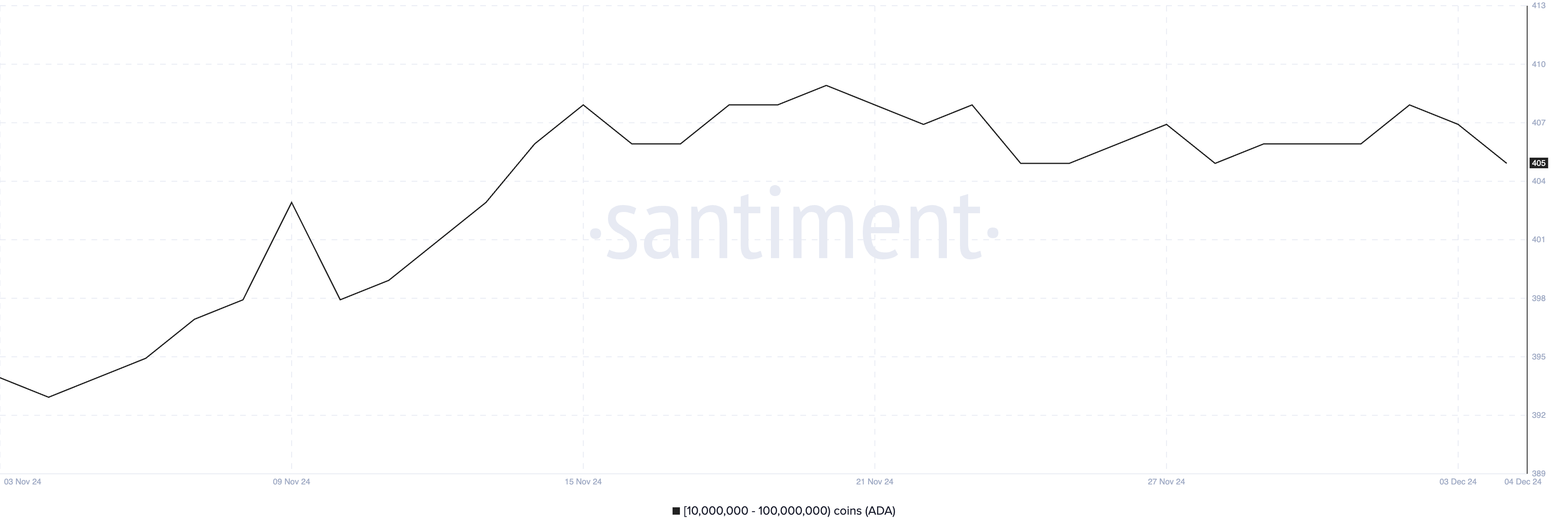

During the early days of November, there was a noticeable rise in the number of ADA addresses containing between 10 million and 100 million ADA. This figure grew from 393 on November 4th to 409 by November 20th.

During this timeframe, we’re witnessing a substantial increase, which suggests that ‘whales’ have been amassing a significant amount of Cardano. This accumulation seems to reflect a high level of faith in Cardano’s potential future success. Typically, such behavior precedes significant price changes because these large holders possess the power to significantly impact the market.

Starting from November 20th, the quantity of these whale wallets has remained relatively steady, fluctuating around 406. This consistency implies that although their earlier build-up may have slowed down, these significant investors seem to be holding onto their positions steadily.

Such steadiness might be suggesting a careful strategy among whales, hinting at their readiness to observe market signals more closely before executing any additional actions. Consequently, this cautious stance could prolong the period of stability for Cardano (ADA) in the current phase.

ADA Price Prediction: Can It Drop Below $1?

The cost of Cardano continues to climb, evident in its Moving Average (EMA) trajectory, where short-term averages persistently surpass the long-term ones. Nevertheless, indications from the ADX and increasing whale accumulation suggest that this upward trend may be slowing down.

If the demand for ADA continues to grow robustly, it might ascend to challenge the resistance at approximately $1.32. Should this upward trend persist, it could even reach the $1.40 mark, a price point last observed in 2022.

Should the current strength diminish and a downward trend takes hold, it’s possible that the Cardano price could revisit its closest support level at approximately $1.15.

If we can’t maintain this current position, it might lead to more significant adjustments, potentially causing the price to fall as low as $1.03, or even $0.87. This could equate to a potential decrease of approximately 27% from our present situation.

Read More

- ALEO PREDICTION. ALEO cryptocurrency

- MUFASA: THE LION KING Trailer Tells the Tale of Mufasa and Scar as Brothers

- ATH PREDICTION. ATH cryptocurrency

- Marvel Confirms ‘Avengers: Secret Wars’ as the End of the Multiverse Saga — Here’s What Could Be Next

- Solo Leveling Season 2: Check Out The Release Date, Streaming Details, Expected Plot And More

- Shangri-La Frontier: Sunraku To Challenge Ctarnidd

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Days Of Our Lives Spoilers: Xander’s Mother Arrives To Reveal a Secret That Threatens Theresa’s Plans

- Persona 5: The Phantom X Navigator Tier List

- POL PREDICTION. POL cryptocurrency

2024-12-05 21:51