As a seasoned analyst with over two decades of experience in the cryptocurrency market, I find the current Ethereum (ETH) situation intriguing. The 19% drop from its all-time high might be discouraging to some, but the rising MVRV and increased whale accumulation suggest a bullish sentiment that could propel ETH towards $4,000 for the first time since March 2024.

Currently, Ethereum (ETH) is 19% lower than its record peak, and there’s a strong possibility it could surpass $4,000 for the first time since March 2024. Positive indicators such as an increasing 7-day MVRV ratio and increased whale purchases suggest that optimism among Ethereum investors is on the rise.

Should Ether (ETH) surpass the $4,000 mark, there’s a possibility it may kick off an ascent aiming at its old peak of around $4,867. However, if this upward momentum wanes, it might lead to another attempt to re-establish critical support levels.

ETH 7D MVRV Shows Ethereum Price Could Rise More

7-day MVRV of Ethereum has surged to 6.1%, marking a substantial rise from 0.28% only two days prior. This steep uptick suggests that more and more short-term investors are realizing gains, which points towards increased market enthusiasm. It’s worth noting that when ETH’s 7-day MVRV nears these levels, it frequently signals a potential correction.

On some occasions, MVRV levels reached as high as 7% or 13%, yet substantial declines didn’t follow immediately. This indicates that the ongoing rally might still have additional potential for growth.

The MVR (Market Value to Realized Value) ratio compares an asset’s current market value against its realized value, offering insights into whether investors are currently in a profit or loss position. When the MVR is high, it often indicates the presence of unrealized profits, which might lead to increased selling due to profit-taking. Conversely, a lower MVR may indicate that an asset is undervalued.

As a crypto investor, I’m keeping a close eye on Ethereum (ETH), as its 7-day MVRV ratio is currently below 7%. This suggests there might be more room for price growth before a possible correction, assuming the bullish sentiment persists and heavy selling pressure doesn’t crop up prematurely.

Ethereum Whales Are Heavily Accumulating ETH

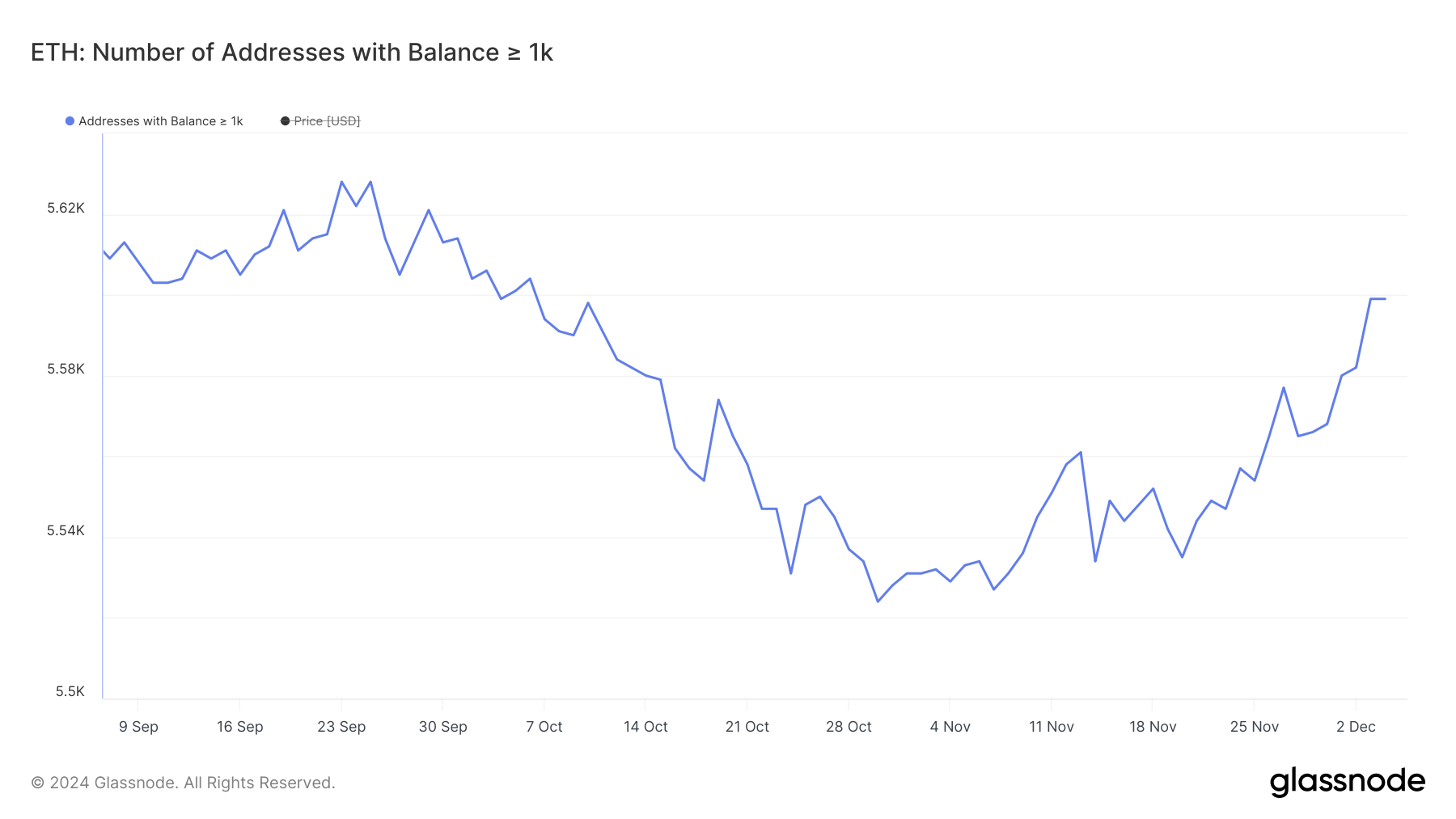

On October 30, the number of Ethereum wallets containing at least 1,000 ETH reached a three-month minimum of 5,524, but then shifted direction, indicating increased accumulation. By November 3, this figure had risen to 5,599 – its highest point since October 6.

As a seasoned investor with over two decades of experience in the crypto market, I have witnessed numerous market fluctuations and trends. The recent increase in Ethereum price seems to be indicating something significant – large investors, commonly known as “whales,” may be re-entering the market. This could potentially signal growing confidence in the Ethereum price among these experienced players. Based on my past observations, such a trend often precedes a sustained bull run. Therefore, I believe that this development is worth keeping a close eye on for potential investment opportunities.

Monitoring whale behavior is crucial since these massive entities frequently possess the ability to sway market patterns, given the immense amounts of trading they handle.

Lately, there’s been an increase in the number of wallets containing at least 1,000 Ether. This could signal a positive outlook among significant investors, potentially leading to additional price rises. If this trend persists, it might establish a solid base for continuous growth in the price of Ether.

ETH Price Prediction: A New All-Time High Soon?

According to Juan Pellicer, Senior Researcher at IntoTheBlock, the ongoing upward trend in Ethereum’s price can be seen through its EMA lines. If it successfully breaches the $4,000 mark, it might initiate a fresh spike. This potential surge could then push Ethereum towards testing its previous record high of approximately $4,800.

According to Pellicer’s statement to BeInCrypto, Ethereum is demonstrating a significant capacity to surpass the $4,000 mark. This prediction is bolstered by several key factors including massive institutional investments into Ethereum ETFs, large-scale whale accumulation, and growing interest in ETF products that facilitate staking. Furthermore, increasing layer 2 transaction volumes and escalating DeFi TVL (Total Value Locked) are indicators suggesting that Ethereum could potentially reach its previous high of $4,867 in the immediate future.

However, should the existing upward trend not be robust enough to push the ETH price beyond or maintain itself above $4,000, it may encounter resistance at support levels of approximately $3,688, $3,500, and potentially $3,255.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-05 17:44