As a seasoned crypto investor with a decade of experience under my belt, I’ve witnessed the rollercoaster ride that Bitcoin has been since its inception. The current surge in retail demand for BTC is undeniably reminiscent of the fervor we saw back in May 2020, but this time around, it seems to be more intense. While institutional and whale investments have traditionally driven Bitcoin’s price movements, the growing influence of retail investors cannot be ignored.

Investors who typically shop for stocks are strongly re-emerging in the Bitcoin market, and their current interest exceeds what was observed in May 2020. This renewed enthusiasm for Bitcoin is significant because it’s aiming at a challenging milestone of $100,000 per coin, a price level that has been hard to achieve so far.

However, could the resurgence of retail interest in Bitcoin propel it to unprecedented levels? This study delves into its possible effects on the price based on on-chain data.

Bitcoin Now Carries Everyone Along

Historically, Bitcoin’s value tends to rise when there is increased interest from retail buyers. However, it’s the large-scale investors (whales) and institutions that have been primarily responsible for fueling the recent price surge.

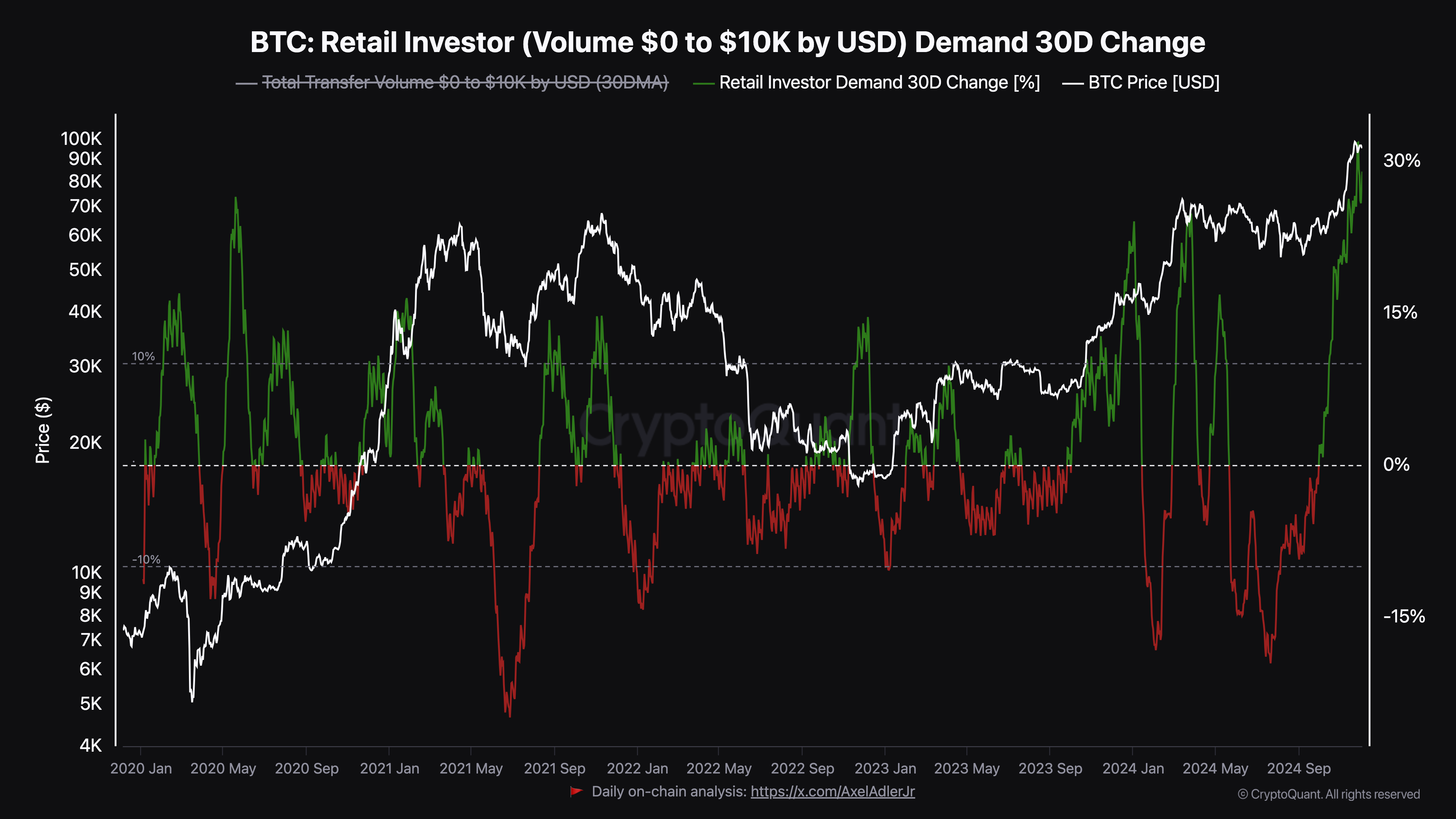

Yet, as per CryptoQuant’s analysis, there seems to be a potential shift in this trend. The data from the 30-day retail investor demand indicator, which monitors the movement of volumes below $10,000 into Bitcoin, indicates a notable change, hinting at an increasing impact from retail investors.

Currently, the value stands at a record high of $27.15, not seen for more than four years. Back then, when it was last close to this level, Bitcoin’s price skyrocketed from $9,500 to an astonishing $37,000 within just half a year.

If historical patterns repeat themselves, Bitcoin (BTC) might escalate and exceed $100,000 in a short period of time. Yet, Darkfost – an anonymous analyst on CryptoQuant – has suggested that this rapid surge towards $100,000 may not occur immediately.

Based on the expert’s viewpoint, an increase in Bitcoin demand among retail investors might indicate a temporary peak or plateau. In a recent article, Darkfost proposed that Bitcoin may experience a period of consolidation before resuming its upward trend.

The analyst predicts that Bitcoin could stay within a certain price range, experiencing small adjustments, before surging past the significant level of 100,000. This jump could spark renewed interest among individual investors, possibly leading to an excited buying spree in the market.

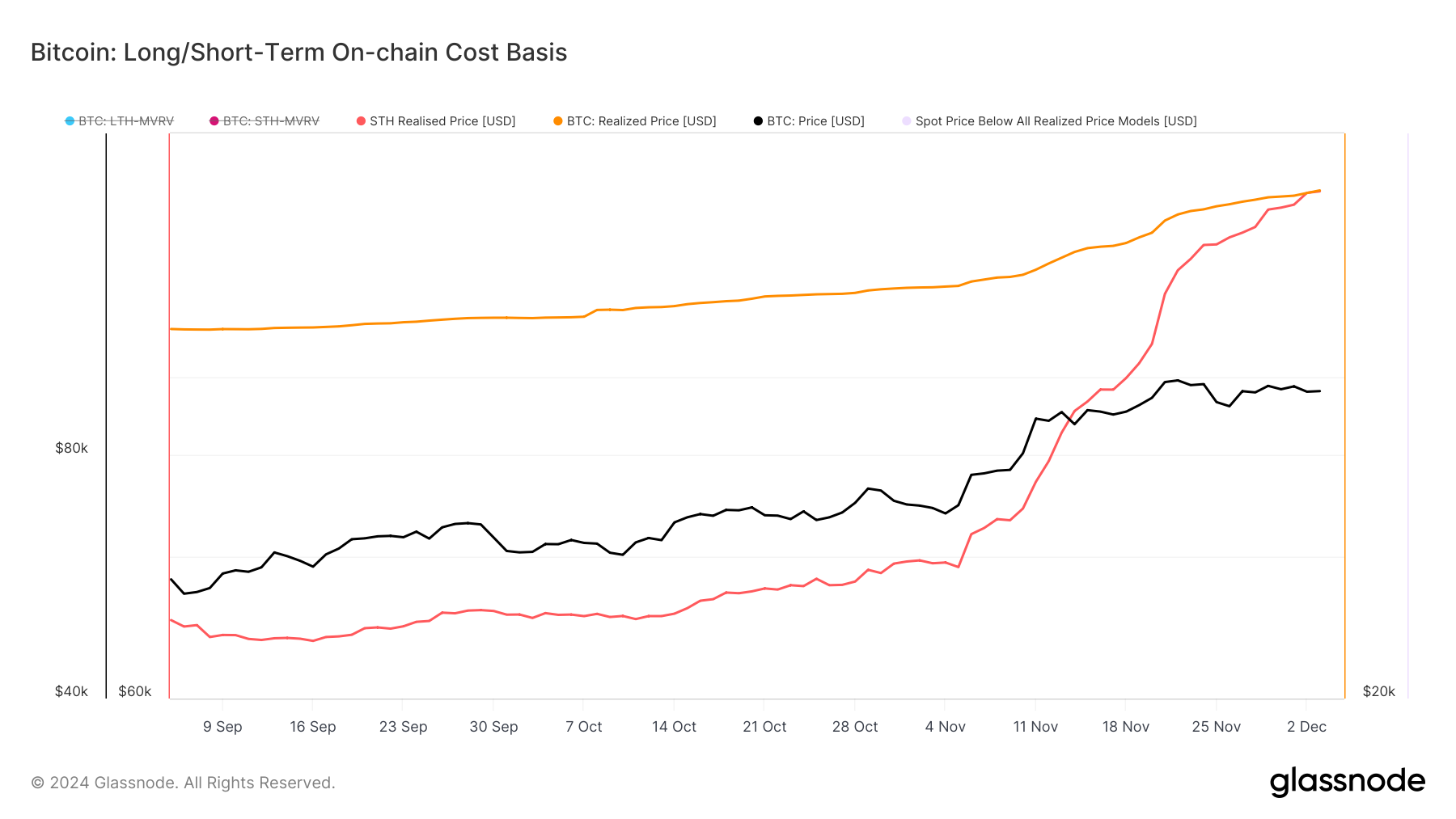

Additionally, data from Glassnode indicates that the average on-chain purchase price for Bitcoin over the short term is approximately $77,675.

Generally speaking, if the actual price of Bitcoin exceeds its market value, it’s a sign of a bearish trend. But since Bitcoin is currently trading over $96,000, this indicates a bullish trend for the coin, suggesting that its price could rise further.

BTC Price Prediction: $110,000 Possible in the Short Term

On its weekly chart, Bitcoin has developed a ‘bull flag’ pattern. This pattern, which suggests a bullish outlook, consists of two substantial upward movements followed by a short period of sideways movement or consolidation.

As I analyze the market trends, I notice a distinct pattern unfolding. Initially, there’s a swift, near-vertical price surge that resembles the staff of a flagpole. This is followed by a retreat or pullback in prices, which forms two trendlines running parallel to each other, thus shaping the ‘flag.’

Given that BTC has broken free from its established pattern, there’s a strong possibility that the coin’s value may surge in the immediate future. If this trend holds, Bitcoin’s price could quickly reach approximately $100,274. In an extremely optimistic outlook, it might even exceed $110,000.

Should the appetite for Bitcoin among individual investors wane, my projection of its surge may not materialize. In such a scenario, the price could potentially dip down to around $90,275.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2024-12-04 15:31