As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I find myself both intrigued and cautious about the recent moves by the US government regarding seized cryptocurrencies. Having lived through multiple market cycles, I’ve come to understand that the crypto market is highly sensitive to news and events, especially those involving significant players like FTX and Alameda Research.

On Wednesday, the U.S. authorities moved $33.6 million in cryptocurrency, previously confiscated from FTX and Alameda Research, into unidentified digital wallets.

Discussions around these transactions have sparked curiosity about their potential future, as questions arise regarding how their listing on exchanges might affect the market.

US Government Moves Funds Seized from FTX

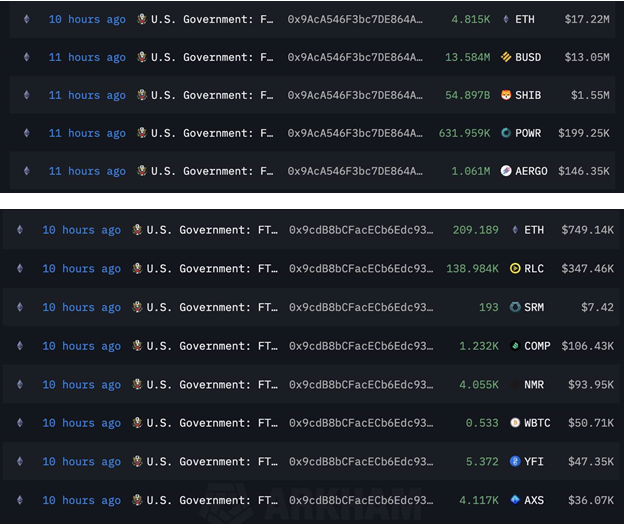

As reported by blockchain analysis firm Arkham, transactions carried out early Wednesday included approximately $18.17 million in ETH (5,024 ETH) and $13.58 million in Binance USD (BUSD). Moreover, smaller amounts of tokens like SHIB, AERGO, and WBTC were also moved by the government. These transfers were directed to unidentified wallets, however, on-chain data reveals that these addresses start with 0x9ac and 0x9cd.

Currently, Ethereum (ETH) is trading at its peak since May 2024, reaching $3,704, a fact observed in the present moment. This surge occurs during a robust comeback of the cryptocurrency market; however, there’s an undercurrent of worry that offloading these assets might cause substantial selling pressure, potentially disrupting token prices.

This development takes place amid increased examination of FTX’s involvement in political funding. Notably, Cameron Winklevoss has proposed an investigation into why American prosecutors chose not to pursue campaign finance charges against Sam Bankman-Fried (SBF). According to BeInCrypto’s report, he argued that such actions erode public faith in the justice system.

Sam Bankman-Fried (SBF) faced allegations of utilizing client funds for political contributions, sparking concerns about regulatory loopholes. On the other hand, FTX has presented an extensive restructuring blueprint designed to compensate creditors and revitalize their image. This plan, set to commence in January 2025, details a strategy to restore value for shareholders amidst hurdles resulting from FTX’s downfall.

In a related development, the U.S. government’s recent action coincides with a string of cryptocurrency transactions, such as the transfer of approximately 19,780 BTC from the Silk Road seizure to Coinbase Prime just recently. The government now holds roughly 198,109 BTC, valued at about $19.15 billion, that were seized in cryptocurrency-related criminal investigations over the past ten years.

Actions by the U.S. government recently suggest shifting strategies regarding handling confiscated cryptocurrencies, putting emphasis on issues of transparency and market influence. As discussions about regulations and corporate reorganizations persist, understanding how crypto markets intertwine with governance remains crucial.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2024-12-04 13:59