As a seasoned researcher with years of experience analyzing cryptocurrency markets and their underlying technical indicators, I find myself both impressed and cautiously optimistic about the recent surge in XRP prices. With my finger on the pulse of the crypto world, I’ve seen bull runs come and go, and this one certainly has me intrigued.

As a crypto investor, I’ve been thrilled to see XRP (Ripple) soaring to heights not seen in six years, setting fresh records in its ecosystem. Over the last month, it has rocketed an astonishing 450%, making it one of the top-performing digital currencies currently available on the market. The optimism surrounding this coin is palpable!

The remarkable price action comes as technical indicators suggest strong bullish momentum, though some metrics hint at potential consolidation ahead.

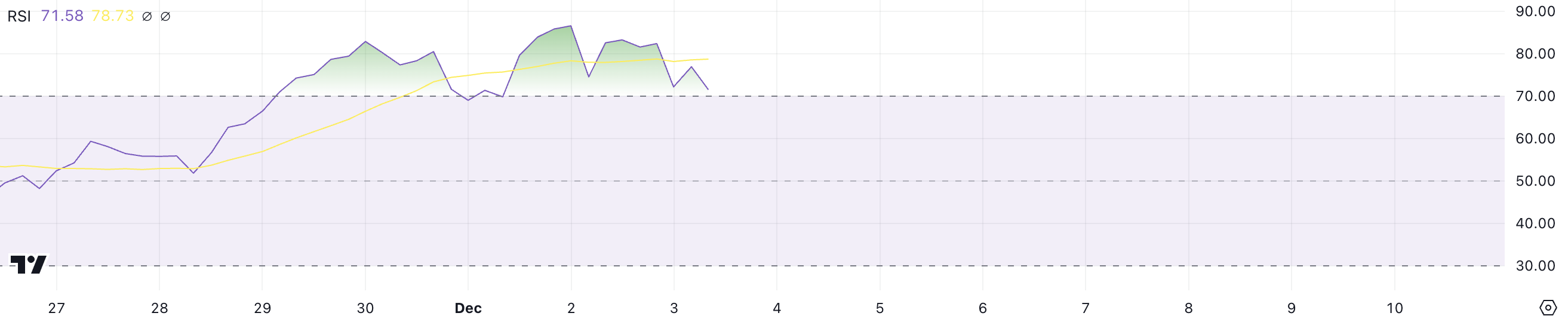

XRP RSI Is Still Above 70

For XRP, its Relative Strength Index (RSI) has remained above 70, indicating an overbought state, since late November. It peaked around 90 before dropping slightly to 71.5 more recently. This prolonged overbought condition corresponds with a notable rise in the price of Ripple, suggesting robust bullish energy that’s been controlling the market for quite some time.

The Relative Strength Index (RSI) functions as a tool for gauging momentum, quantifying the rate and intensity of price fluctuations between 0 and 100. A reading higher than 70 generally signals an overbought market, while a figure below 30 often indicates a market oversold condition.

As XRP’s Relative Strength Index (RSI) hovers around 71.5, indicating it’s in overbought territory, its steady decrease from peak levels close to 90 might imply that the demand is gradually lessening. Yet, this doesn’t automatically mean an immediate change in the upward trend, as assets can sustain overbought status during robust bull markets.

A drop in the RSI could indicate a possible period of stabilization or a steady progression in growth, rather than marking the absolute conclusion of the ongoing upward trend.

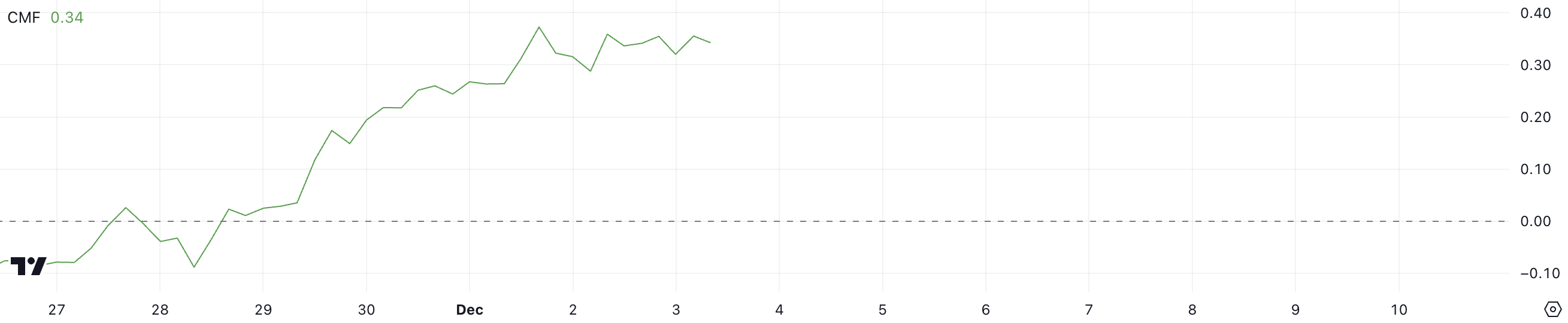

Ripple CMF Has Been Positive For Four Days

The Chaikin Money Flow (CMF) for the price of Ripple consistently shows a robust positive value around 0.34, sustaining its bullish trend that began on November 29.

The CMF is a volume-weighted average of accumulation/distribution over a specified period, typically 20 days, that helps measure buying and selling pressure. Values above zero indicate net buying pressure, while negative values suggest selling pressure.

The Ripple (XRP) currently has a Composite Money Flow (CMF) reading of 0.34, signifying strong buying activity and institutional involvement, contributing to the ongoing upward trend. This high, positive CMF value implies that the majority of trading is happening at prices above the previous period’s levels, bolstering optimistic market sentiment.

While the CMF remains significantly positive, it supports the continuation of the uptrend.

XRP Price Prediction: Can It Rise To $3 In December?

The XRP Exponential Moving Averages show a robust bullish pattern, as the quicker averages are situated above the slower ones, while the price remains well above the shortest average. As the bull market persists, XRP approaches a substantial psychological and historical hurdle at $3.00.

Additionally, the current record high of $3.18 serves as a significant barrier for further growth, potentially offering an opportunity for a 18.5% increase in the value of XRP from its present price level.

However, the uptrend carries downside risks that traders should consider. Key support levels have formed at $2.29 and $1.88, marking potential pullback targets if momentum wanes.

A correction to these levels would represent a significant retracement of up to 32% for XRP price, though such pullbacks are common even within sustained bull trends.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- ANDOR Recasts a Major STAR WARS Character for Season 2

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

- Clair Obscur: Expedition 33 – Grandis Fashionist answers

2024-12-03 19:35