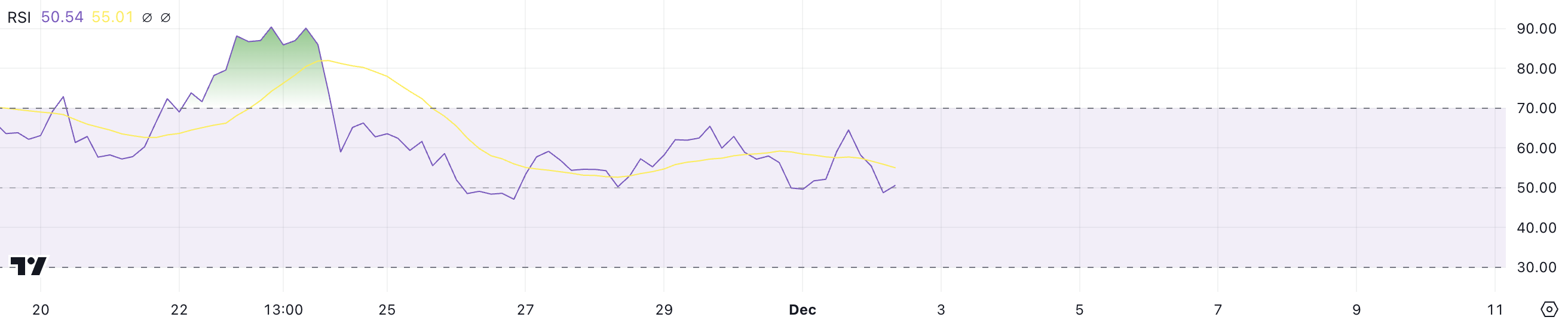

As a seasoned crypto investor with scars from more than a few market cycles etched into my calloused fingers, I can’t help but feel a mix of anticipation and caution when it comes to Stellar (XLM) right now. The 459% surge in the last 30 days is undeniably impressive, but the RSI cooling down to 50.5 indicates that the market might be taking a breather after the overbought conditions in late November.

In the past 30 days, the price of Stellar (XLM) has soared by an impressive 459%, drawing considerable market focus. However, following this rally, the Relative Strength Index (RSI) has dropped to 50.5, signaling a neutral momentum shift after a brief spell of overbought conditions towards the end of November.

Currently, XLM is encountering significant resistance levels at approximately $0.53 and $0.56. Despite exhibiting bullish trends in its Exponential Moving Averages (EMA), the short-term momentum seems to be slightly weakening. Additionally, the Ichimoku Cloud indicates a possible change in market sentiment.

XLM RSI Is In the Neutral Zone

As an analyst, I’m observing that the Stellar Relative Strength Index (RSI) has dipped to approximately 50.5 today, a significant drop from yesterday’s 64. Interestingly, for the past four days, from November 21 to November 24, the RSI consistently remained above 70. This period saw Stellar’s price reaching its highest point since May 2021.

During this time, the market showed a significant surge due to robust bullish power, which later cooled down.

The Relative Strength Index (RSI) gauges how quickly prices are rising or falling, helping to determine if an asset is more likely to be overbought or oversold. A RSI score above 70 usually signals overbought status and a potential decrease in price, while a score below 30 often points to oversold conditions where the price might increase again.

currently, the Relative Strength Index (RSI) of XLM stands at approximately 50.5. This suggests a more equitable position, where forces of purchase and sale are evenly matched. Such a situation might imply that the price is stabilizing, waiting for additional market signals to dictate its upcoming direction.

Stellar Ichimoku Cloud Shows the Current Sentiment Could Be Shifting

The Stellar’s Ichimoku Cloud diagram suggests that the current price movement is close to the cloud, which could mean an impending examination of its underlying support level.

The main section, colored green and red, indicates a mostly neutral to slightly optimistic trajectory. Although the cloud appears rather level, it still provides support near the $0.50 price point. The blue line (Tenkan-sen) is positioned beneath the red line (Kijun-sen), implying a temporary decrease in short-term momentum strength.

As a crypto investor, I find myself optimistic when XLM maintains its position above the cloud. This bullish trend could potentially lead to a recovery and a movement toward the supportive levels of the Tenkan-sen and Kijun-sen lines.

However, a breakdown below the cloud could signal a bearish shift, with price likely retesting lower support zones. The cloud’s flat nature suggests indecision in the market, so traders may look for a breakout or breakdown as the next clear signal.

XLM Price Prediction: Can It Reach $0.7 In December?

Right now, the price of XLM is encountering two potential resistance levels at approximately $0.53 and $0.56. However, its Exponential Moving Averages (EMA) are indicating a bullish trend as the short-term averages are above the long-term ones.

In simpler terms, the price of Stellar has fallen under its short-term moving average, indicating a possible decrease in short-term bullish momentum. This hints that the current upward trend might be losing strength, and if it doesn’t bounce back soon, there could be more declines to come.

If Stellar’s (XLM) upward momentum gains more power and manages to surpass its current resistance points, it might challenge the price point of $0.638 once again. With a strong push, it could potentially advance towards $0.65 or even reach as high as $0.7, returning to levels not seen since 2021.

Conversely, the Ichimoku Cloud and Exponential Moving Average (EMA) patterns suggest potential indications of a trend flip. Should this predicted downward movement occur, the XLM price could encounter resistance around $0.41, representing a substantial correction from its present position.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-03 00:57