As a seasoned researcher with years of experience observing and analyzing the ever-evolving crypto landscape, I find myself intrigued by Solana’s recent price fluctuations. While it’s true that SOL has experienced a significant pullback after reaching its all-time high, the resilience shown by its active investor base is truly remarkable.

Recently, the value of Solana (SOL) has seen substantial ups and downs, peaking at a record high (all-time high, ATH) of $264. However, following this peak, there was a significant drop which has sparked worry among investors about potential adjustments or corrections.

On the other hand, supporters of SOL cryptocurrency maintain a positive outlook on its potential expansion, bolstered by continuous network activity and a generally bullish market atmosphere.

Solana Investors Are Active

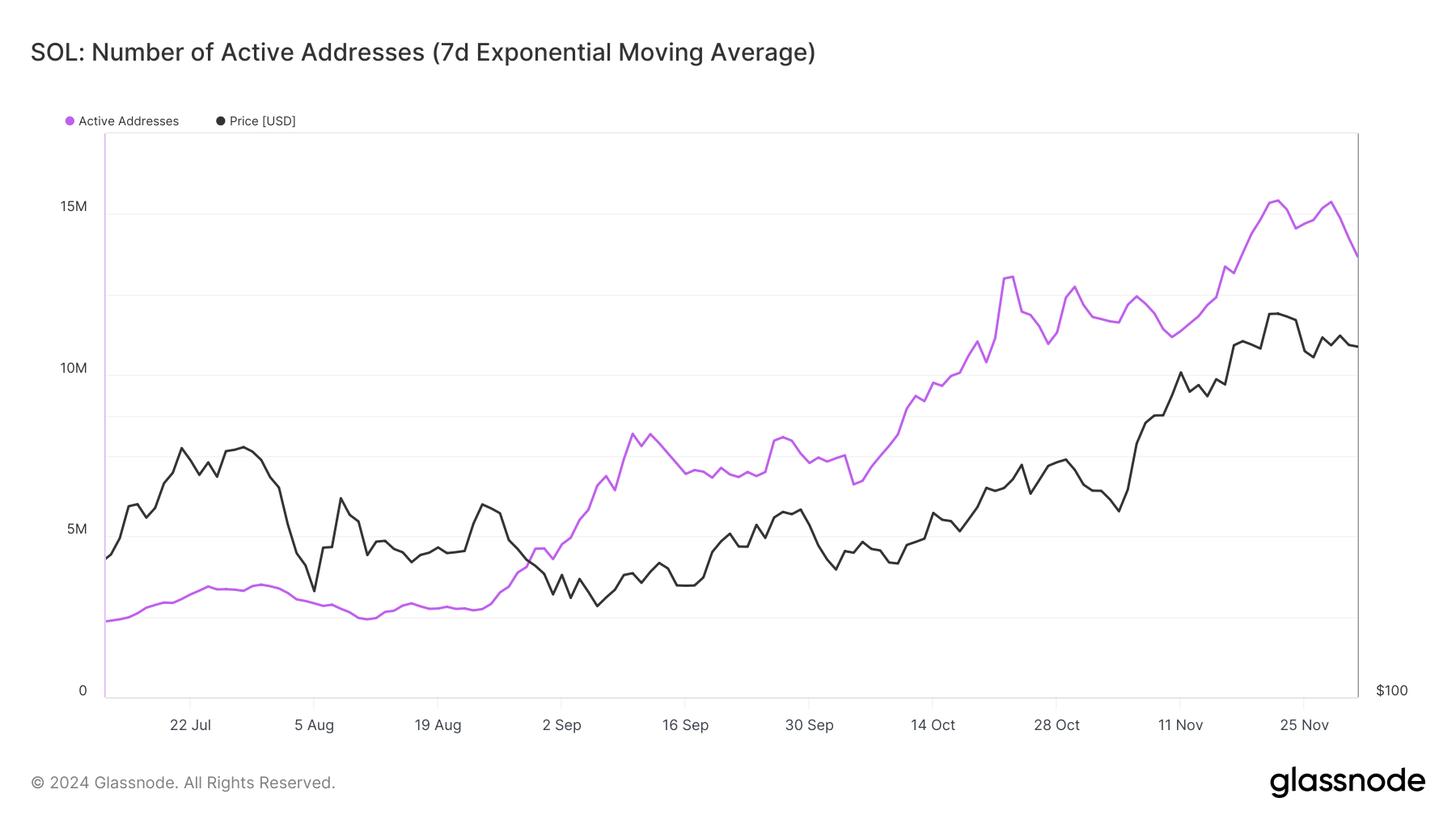

Even though there’s been a decrease in Solana’s value recently, the number of active addresses hasn’t dropped significantly. The high level of involvement indicates continuous demand and enthusiasm among investors, implying that cryptocurrency remains an area of interest with strong market potential. This consistent engagement is a favorable sign for Solana’s future price trend.

The bustling investor engagement on the Solana platform underscores the robustness of its user community. Persistent participation in the network has been instrumental in preserving the price trend, despite unfavorable market situations. This sustained activity implies that the recent ups and downs in SOL’s price have not discouraged investors, thereby ensuring the altcoin’s continuous upward trend remains unbroken.

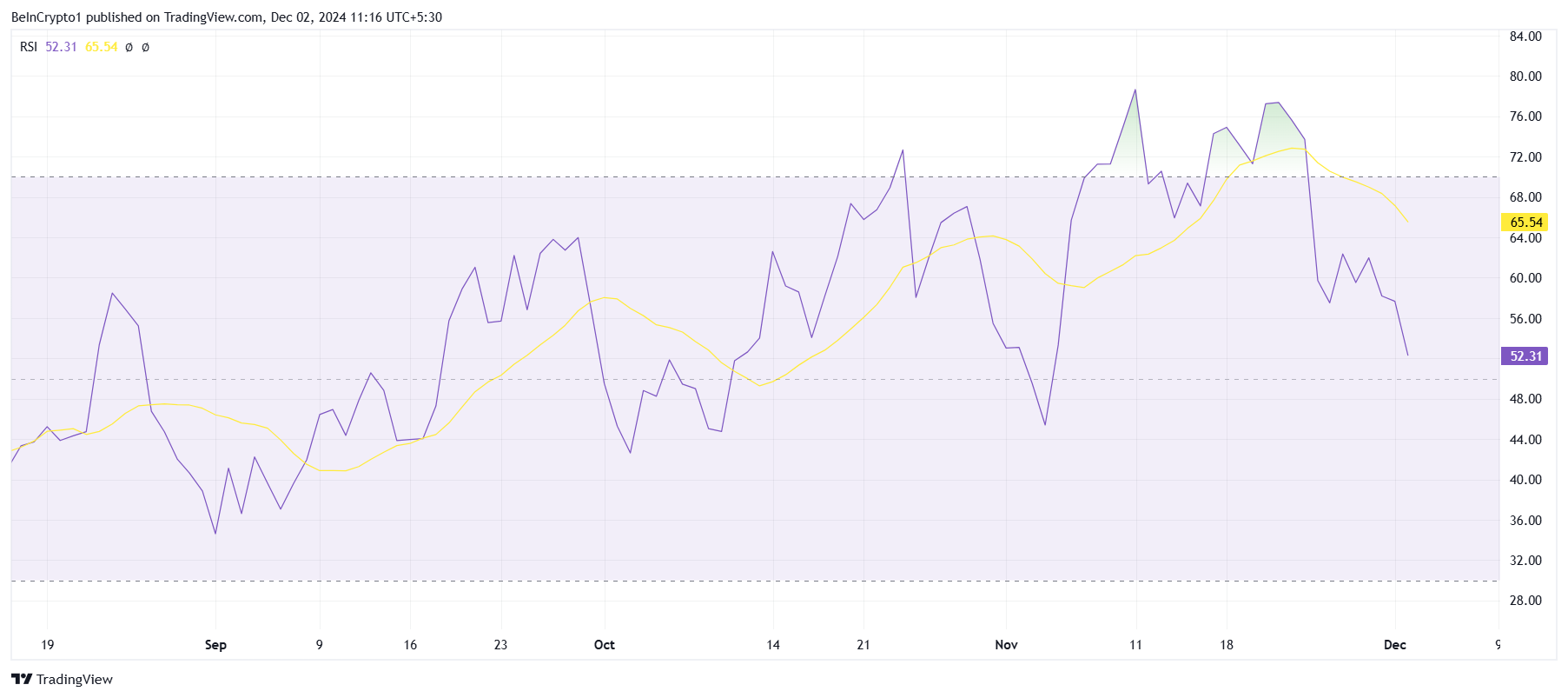

Looking at the technical analysis, Solana’s Relative Strength Index (RSI) is currently higher than the 50.0 neutral mark, suggesting it’s holding strong amidst recent downward trends. Maintaining this position above the neutral line suggests that there’s still some power behind the bullish movement. As long as the RSI stays above the neutral level, there’s a chance of a prolonged uptrend continuing.

If the Relative Strength Index (RSI) falls below 50, there might be an increase in bearish trends, possibly causing a decrease in Solana’s price. This level is significant for traders keeping tabs on SOL’s overall trend direction. Maintaining this equilibrium will be essential for Solana to keep its bullish momentum in the short term.

SOL Price Prediction: Preventing Corrections

At present, Solana’s value stands at approximately $228, having experienced a decline driven by its former rank as the fourth largest cryptocurrency being overtaken by XRP. Despite this setback, it continues to hold above the significant support threshold of $221.

Historically, this price point has demonstrated significant strength, acting both as a floor for support and a ceiling for resistance. Maintaining its position above this level keeps the optimistic perspective on Solana’s cryptocurrency alive.

As an analyst, I find it rather improbable that Solana (SOL) will drop below the $221 support. However, should such a scenario unfold, it could potentially drive SOL’s price down to around $201. A breakthrough of this level might suggest more significant losses, undermine investor confidence, and instigate broader market corrections for the altcoin.

If Solana manages to rebound from the $221 support level, it may aim for the resistance at $245. Overcoming this resistance could challenge the current bearish sentiment, possibly propelling the digital currency back towards its all-time high (ATH) of $264. This bullish movement would underscore Solana’s robust position among top cryptocurrencies in the market.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2024-12-02 09:59