As a seasoned analyst with over two decades of experience in the tech and finance industries, I’ve witnessed the rise and fall of countless market trends. The current state of Bitcoin mining is undeniably intriguing, given its unique mix of technological complexity, financial volatility, and regulatory uncertainty.

The total value of publicly-listed Bitcoin mining companies currently stands around $39.09 billion. Among these, Marathon Digital Holdings holds the largest market capitalization at about $8.71 billion, followed closely by Core Scientific with a market cap of $5.02 billion. Riot Blockchain and CleanSpark come in third and fourth respectively, with market caps of $4.06 billion and $3.90 billion.

Rising Mining Difficulty

The complexity involved in mining a new Bitcoin block, known as the mining difficulty, has been consistently rising. As of November 29, 2024, this level stands at an impressive 102.29 trillion. Predictions suggest that it may increase by 2.04% during the next adjustment.

As a researcher, I’ve observed that for the fifth time in a row, we’re witnessing an uptick. This surge seems to be driven by heightened competition among miners and a strong fortification of our network security measures.

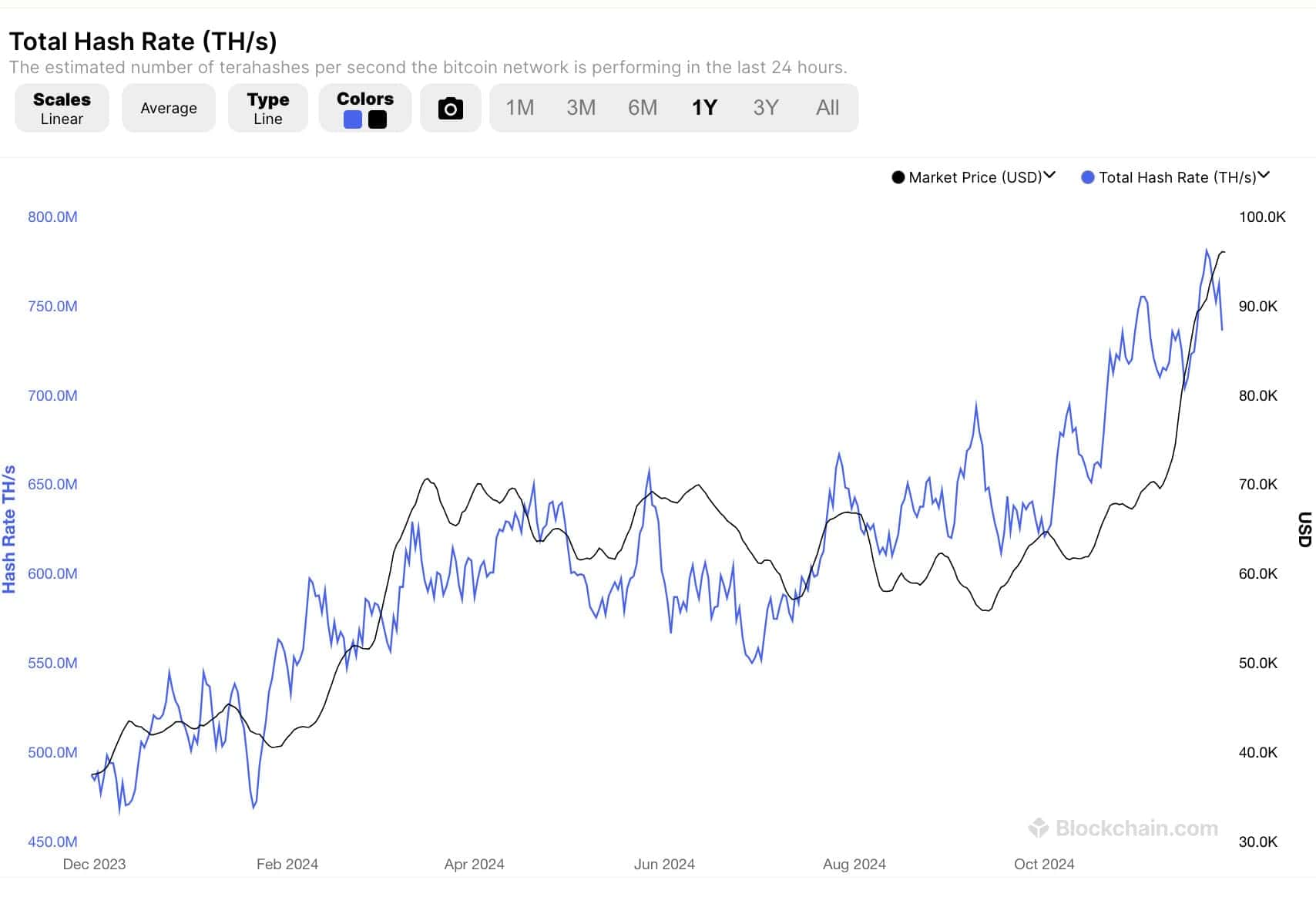

Hashrate Trends

For more than a month now, the combined computational strength used in mining has persistently surpassed 700 quintillion hashes per second (or 700 EH/s).

This continuous high hash rate emphasizes the increasing dedication of resources towards Bitcoin mining, which in turn influences the increases in mining complexity.

Implications for Miners

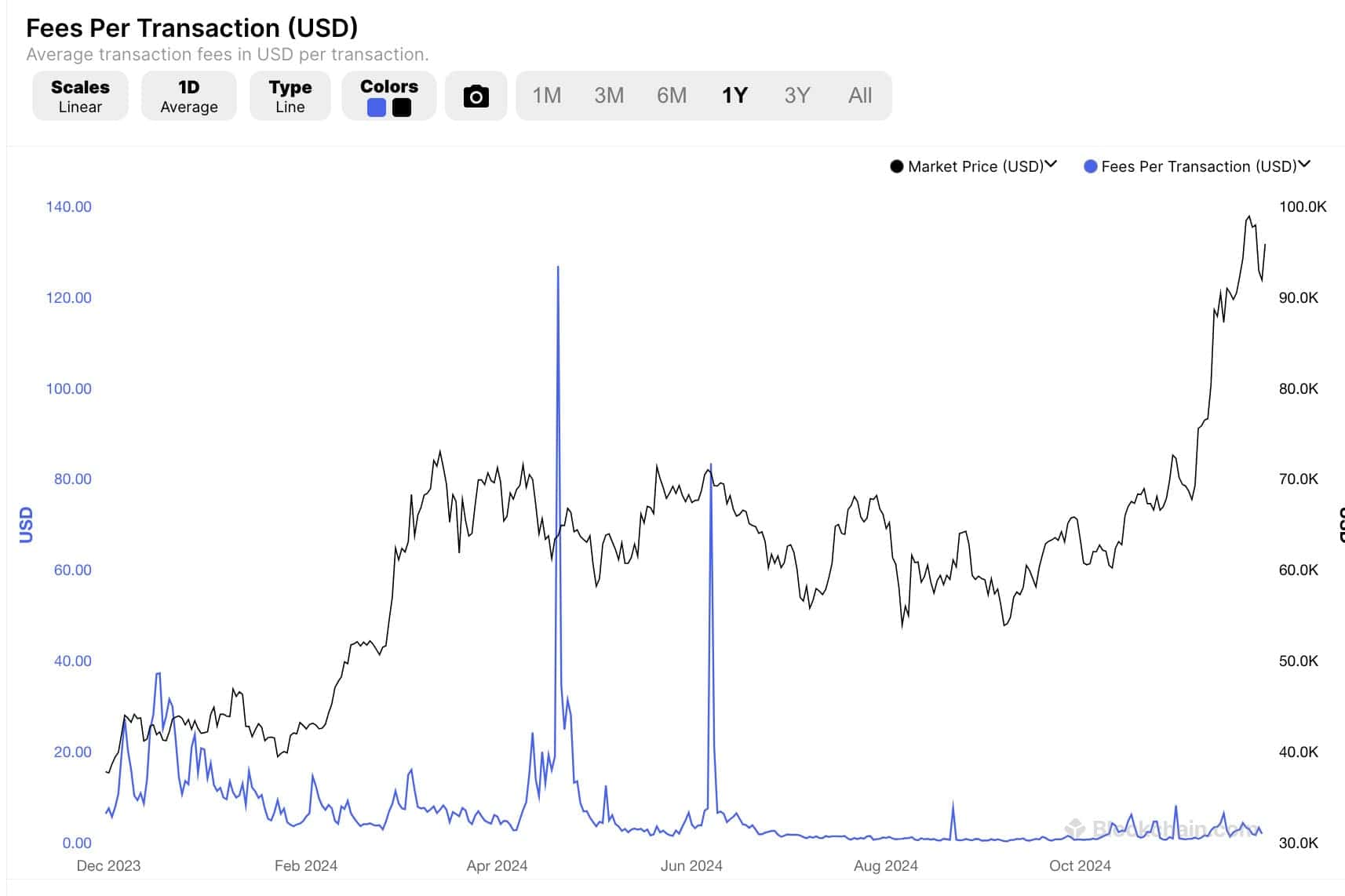

The rise in Bitcoin’s price and the increase in mining difficulty poses a complex situation for miners. On one hand, higher Bitcoin prices could boost potential earnings; however, the growing complexity necessitates more sophisticated equipment and increased energy usage, resulting in higher operational costs. To remain profitable in this cutthroat environment, miners must consistently invest in efficient technology solutions. The main hurdle for Bitcoin miners currently is generating revenue. During the halving event in April, the block rewards, which are earned by confirming transactions on the Bitcoin blockchain, were reduced by 50%. At that time, their combined market capitalization was approximately $20 billion. Today, only 450 new bitcoins are created daily. Meanwhile, transaction fees—an essential secondary income for miners—are at record lows, amounting to just 10 BTC (approximately $946,000) on November 27.

Investors considering Bitcoin mining companies need to be aware of the sector’s volatility. The profitability of these firms is strongly linked to the performance of the Bitcoin market and changes in mining difficulty. Moreover, regulatory updates and energy expenses significantly influence the industry’s trends. Miners must navigate a complex environment requiring constant adjustment to technological innovations and market fluctuations.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Are Lady Gaga’s Ever-Changing Wedding Plans Suiting Fiancé Dizzy? Here’s What’s Happening

2024-11-29 15:02